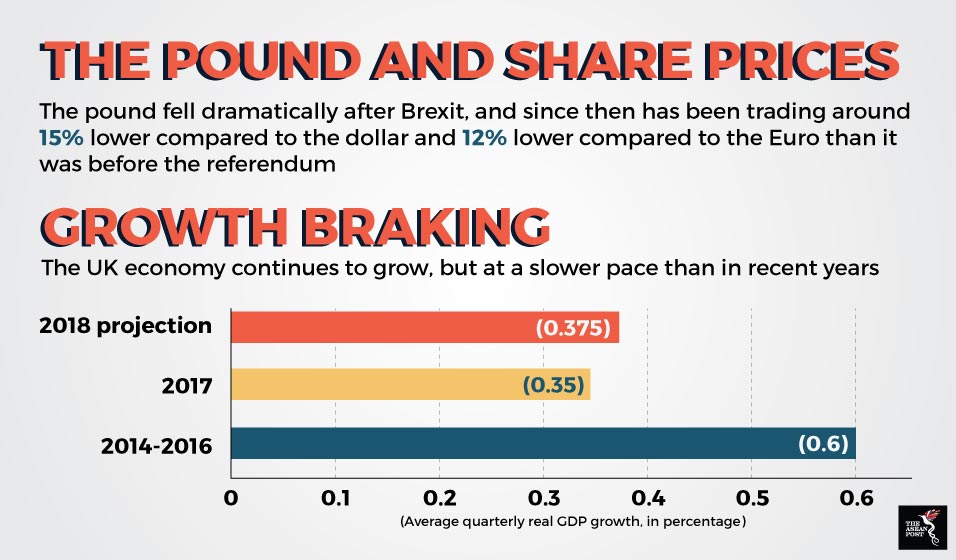

The United Kingdom’s (UK) decision to exit the European Union (EU) or Brexit as it is commonly known, is weighing on the economy, even as growth accelerates across the rest of the globe. The membership referendum that was agreed upon by the UK and the EU on 23 June, 2016 has left the Brits with reduced purchasing power as a weaker pound has caused prices to increase across the board. An incipient and almost crippling uncertainty about the future relationship with the EU has kept a number of business investments on hold. The question is, what does this mean for UK and ASEAN businesses as well as trade deals between the UK and ASEAN member states?

A total of 16.3 percent of foreign value added embodied in ASEAN exports originates from the EU. The European Commission states that the largest exporters to the EU in ASEAN is Vietnam, which amounts to more than €33 billion, and Malaysia at €22.2 billion. With regards to foreign direct investment (FDI) going into ASEAN, 16.7 percent of FDI comes from the EU, totalling more than US$19 billion, with one-third coming from the UK alone. This amount from the UK is quite substantial, implying a considerable dent to the channelling of funds to Southeast Asia, as a whole.

According to Aédán Mordercai and Phidel Vineles of the S. Rajaratnam School of International Studies (RSIS), a total of 16.3 percent of foreign value added embodied in ASEAN exports originates from the EU. The share of EU value added within exports is high, specifically in Brunei, Malaysia, and Singapore (all Commonwealth nations). Malaysia’s most significant export industry – electronics – owes almost 10 percent of its total gross export value to the EU. Elsewhere, the EU contributes 6.4 percent to the total exports of Thailand’ automobile industry, with it being the largest in the region. To add, 4.4 percent of Vietnam’s important textile export industry originates from the EU.

Source: Source: Haver Analytics, IMF October 2017 World Economic Outlook database

Post-Brexit push into ASEAN markets

The UK will be keen to develop a deeper relationship with ASEAN given that their attachment to Europe is now cast into doubt. Still cognisant of the fact that ASEAN is a big market with the potential to develop further, the UK still has eyes on the region that has a combined economy of US$2.6 trillion and a market of over 600 million people.

A Britain independent of the EU could possibly do away with the non-tariff barriers and other regulations that Asia and ASEAN currently contend with. An autonomous Britain should also be a more flexible negotiating partner rather than a bloc of 28, which must attain a signoff from each member state in order to ratify any decision made.

On the side of Southeast Asia, ASEAN could look to gain from Brexit, in the sense that the UK is in a relatively weaker position of negotiation without the heft of the EU’s internal market behind it. Based on a report by the Asian Development Bank (ADB), and the International Trade Centre (ITC Trademap), Vietnam and Thailand are the largest exporters from ASEAN to the UK, which amounted to US$4.8 billion and US$3.6 billion, respectively over the past four years. This point highlights the region’s dynamism and strength as it also has the capability to export and not only import from abroad.

The UK could also fall back on its strong ties with Singapore. A re-evaluation of the Trade and Investment Framework Agreements (TIFAs) could be beneficial for both parties. Meeting at least once a year, the senior-level conversations deal with issues such as market access, labour, the environment, as well as protection and enforcement of intellectual property rights.

Second, the two parties can agree upon the Bilateral Investment Treaty (BIT) programme with the basic aim of protecting foreign investments in countries where investor rights are not already protected through existing agreements. The encouragement of market oriented domestic policies and a support of international legal standards to back these objectives ought to be carried out as well.

The ripples from Britain’s decision to leave the EU has now turned into a wave. The effects are not only felt in the Occidental world but is now experienced in Africa and Asia too. It is thus imperative to maintain good ties with both, the EU and an independent Britain if ASEAN wishes to prosper along the lines of the ASEAN Economic Community Blueprint 2025.