In China, millions enter public transportation each day using smartphones, pay for breakfast with WeChat, and use an app to have lunch delivered hours later. They work at offices that leverage blockchain, Artificial Intelligence (AI), robotics, and cloud computing. They book restaurants for dinner over the internet and late-night shop on the train.

Much of this has been enabled by rising smartphone adoption. In 2017, Asia saw 319 million new mobile connections, compared with just 5 million new mobile connections in Europe over the same period. Smartphone access to the region’s high-speed 4G networks has enabled Asia’s consumers to go online even if they don’t have home broadband.

As this smartphone revolution transforms individuals, cultures, and societies, the changes ahead will continue being remarkable. Policymakers and businesses tasked with navigating the evolving digital ecosystem will also be increasingly challenged.

Understanding Asia’s fast-moving digital ecosystem

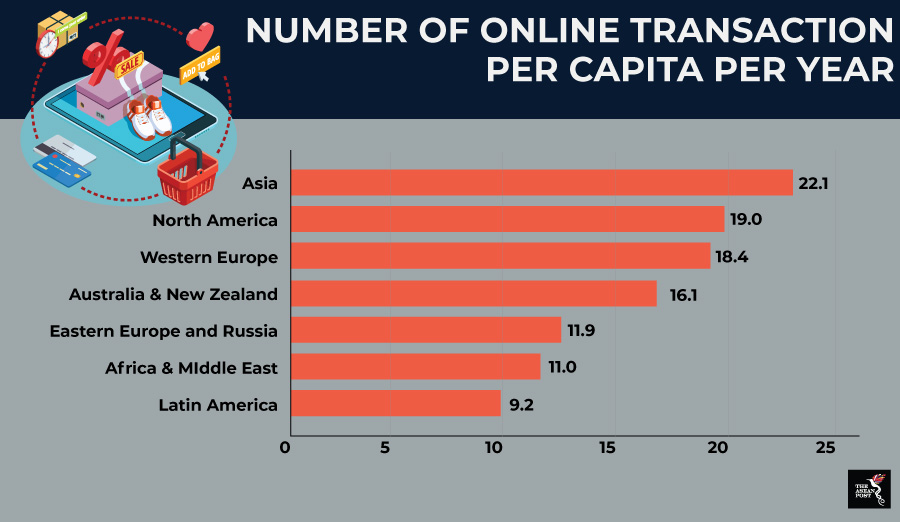

Asia’s consumers are particularly open to integrating technology into their lives compared with other markets. According to research firm Kantar TNS, in 2017, 77 percent of connected consumers in the Asia Pacific made their most recent purchase on a mobile, compared with 61 percent globally and 24 percent in Europe. Asia also leads the world in online payments, according to KPMG, with an average 22.1 transactions per person annually. This compares with 19 transactions per year for the average North American.

Capital flows from investors into the region suggest that Asia’s online commerce is just getting started. Tech in Asia reported that venture funding for Southeast Asian tech startups more than tripled in 2017 to nearly US$8 billion. These investments contributed to a surge in Southeast Asia’s digital economy - expected to grow from approximately US$50 billion in 2017 to US$240 billion by 2025.

As digitalisation expands in Asia, it dissolves the line between the physical and online worlds. A woman in India may see a pair of earphones advertised in a newspaper, purchase them online, and on social media later that night, post an image of herself using them. Separating the impact of her online and offline interactions during her day will be even more difficult in the future.

With rapid growth comes rising tensions

Asia’s rapid digital growth also places businesses and policymakers in the challenging position of needing to leverage the benefits digitalisation brings while learning how to mitigate its risks.

Companies must constantly seek new strategies that cut through the digital market noise. The cost of not doing so is growing as consumers become increasingly confused by all the choices online. This sentiment can make consumers reluctant to trust new businesses on the internet at a time when they are growing.

Also, Asia’s regulators and policymakers are focused on protecting consumers’ data while businesses need to leverage data—particularly as new technologies emerge or existing channels develop in different directions.

Government leaders are further promoting small and medium-sized enterprise (SME) growth in their economies and supporting large players that help SMEs access marketplaces. For example, Go-Jek, Line, or WeChat—digital platforms that aggregate a number of different services into one—help companies and partners better reach and serve consumers. However, in doing so, they also introduce an element of risk; these large platforms can hold disproportionate amounts of power and control across the internet.

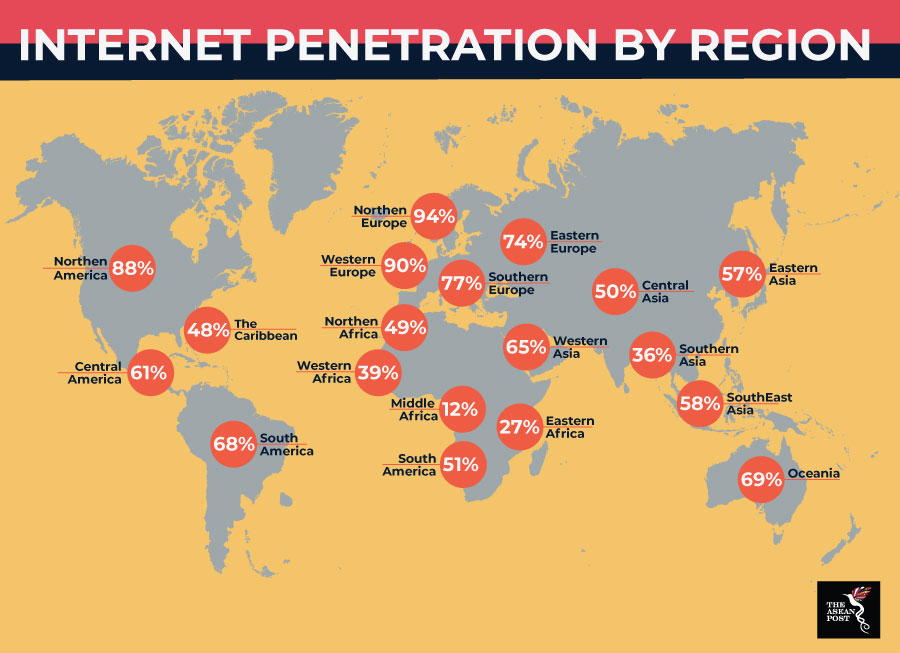

Uneven digital development is another concern - pockets of the population fall behind due to being digitally under-skilled or excluded. Across Southeast Asia, more than 40 percent of the population still lacks regular access to the internet. The widening gap between the digitally native and the digitally naïve will become more difficult to close in specific markets as the region advances.

Learning from other regions

As policymakers in the region look to address these issues without sacrificing growth, much attention is being paid to protecting and promoting the core asset rising out of digital development: consumer data. Asia is not alone in this point of focus. Governments around the world are creating legislation on who consumer data belongs to and how best to protect it.

Asia is in a unique position to observe and learn from regulations developing in other parts of the world. For example, the General Data Protection Regulation has brought harmonisation of data protection norms across Europe. It provides consumers in Europe control over their data and requires organisations to implement privacy by design in their product development process.

In contrast, data protection in Asia is increasingly marked by differences than commonalities. Consistency in defining the basic concepts of personal data and sensitive data and their treatment remains elusive. While some countries recognise the need for safe and enabling cross-border data transfers, others are intent on preventing data flow. This latter strategy impedes interconnectivity between markets, limits the ability for vital use of data for things like protection from fraud, and ends up introducing more risk than it reduces.

Reducing this legislative variance is an opportunity for the region’s policymakers. They can start by committing to treating data like all markets treat valuable assets— creating methods of exchange that engender trust through transparency, consumer choice and control, security, and responsible and fair use.

Consumers also require more education on the importance of protecting their data, and best practices for guarding their privacy online. This will help to foster digital inclusion, digital literacy, and next-generation technology skills to ensure Asia’s population continues to best use and enjoy technology’s benefits.

Finally, regulatory and operational strategies aiming to support cross-border e-commerce and data sharing can help ensure today’s digital markets’ full potential is realised across the region. For this reason, countries in Asia also benefit from taking a collaborative approach in developing their regulatory frameworks.

Rama Sridhar is the executive vice president of Digital and Emerging Partnerships and New Payment Flows at Mastercard

Related articles: