Negotiations for the Regional Comprehensive Economic Partnership (RCEP) are now at a “critical stage” with a conclusion “finally in sight,” Singaporean Prime Minister Lee Hsien Loong said last weekend.

Led by the Association of Southeast Asian Nations (ASEAN), RCEP is one of the most useful strategic opportunities for the 16 countries involved – ASEAN-10, India, China, Japan, South Korea, Australia and New Zealand – to realise an economically open and liberal Asia Pacific.

The mega trade deal, when completed, would be the largest of its kind in the world since the General Agreements on Tariffs and Trade (GATT) Uruguay Round in 1994 which saw the establishment of the World Trade Organisation (WTO). The RCEP encompasses 25 percent of the global gross domestic product (GDP), 45 percent of the world’s total population, 30 percent of global income and 30 percent of global trade.

"We are looking for that broad agreement, that milestone to be achieved, or what we call substantial conclusion,” Singapore’s Minister for Trade and Industry Chan Chun Sing said after chairing the 6th RCEP Ministerial Meeting.

“Just like climbing a mountain, as we go nearer and nearer to the summit, the climb can become steeper and more challenging,” Chan added.

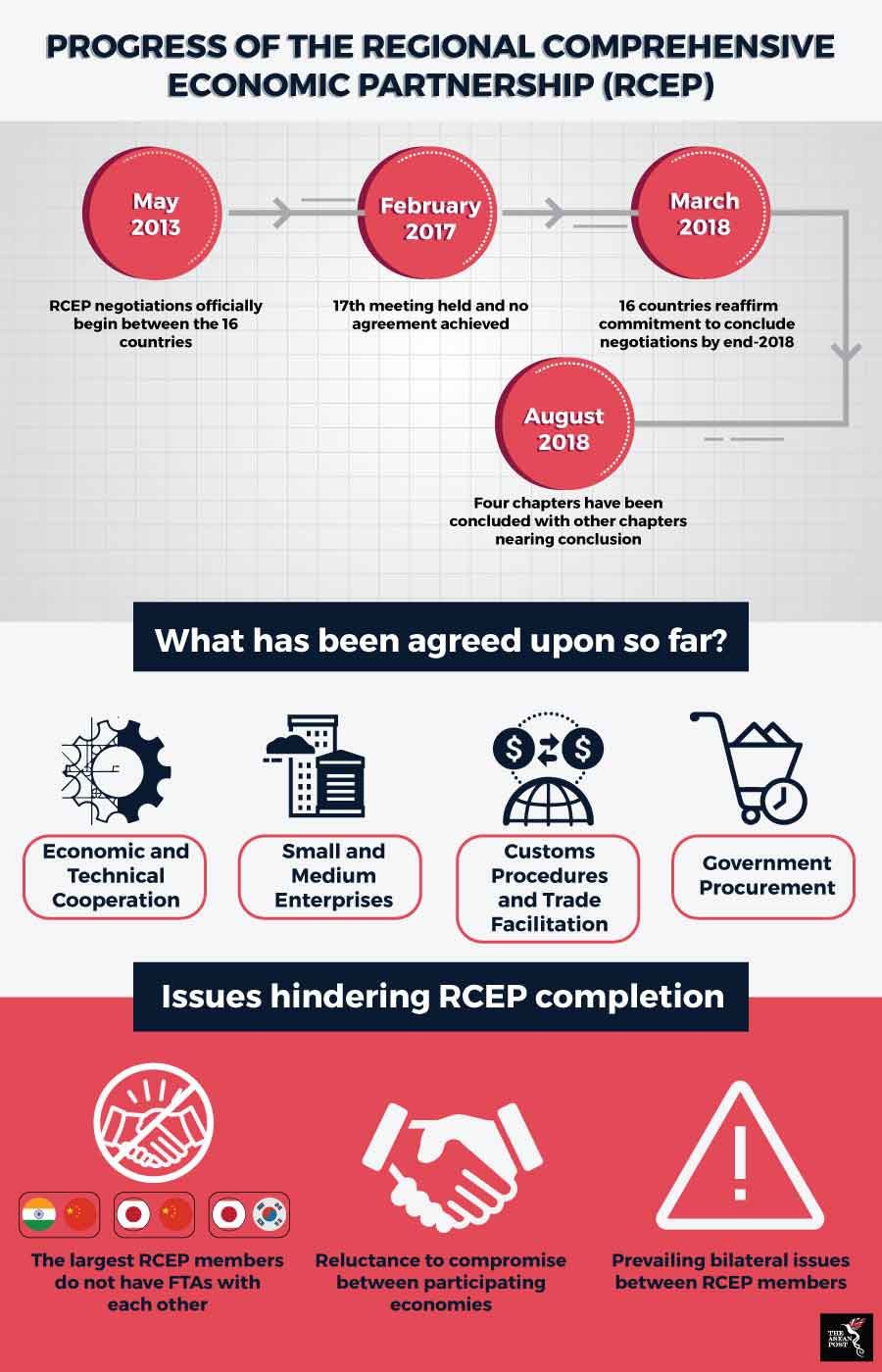

In a recent round of negotiations held in July, two additional chapters namely the chapters on Customs Procedures and Trade Facilitation and Government Procurement were concluded, bringing the total concluded chapters to date to four. In a joint statement, ministers from the 16 participating RCEP countries noted that the negotiations of other chapters are making good progress with some nearing conclusion. Leaders are now set to sign off on a broad agreement of the trade deal at the Singapore ASEAN Summit in November.

Source: Various sources

According to Sanchita Basu Das, Lead Researcher of Economic Affairs at Singapore based ISEAS – Yusof Ishak Institute, the trade agreement’s possible imminent conclusion showcases “high political willingness of the participating members”.

Nevertheless, she added that for negotiations to be concluded swiftly, countries must be “ready to make some compromises”.

“It looks unlikely that RCEP can deliver on a common tariff concession schedule for goods market access. Large trade deficit with China, lack of bilateral free trade agreements (FTAs) and upcoming national elections are looming concerns for countries to sign on a same set of market access condition,” she said.

“Hence, participating members need to reach some agreement on trade-offs and compromises,” Das added.

Global concerns

Amid the prevailing uncertainties of the global economic climate, the conclusion of RCEP could contribute towards mitigating some of the effects of the United States (US)-China trade tensions and the Trump administration’s overall protectionist undertones.

Although commonly misconstrued as the leader of the trade deal, China is seen as a heavy backer of RCEP which notably excludes the US. Under the Obama administration, the US had been leading another regional pact – the Trans-Pacific Partnership (TPP) – until President Trump abandoned it upon his election to the Oval Office.

With Washington apparently side-lining Southeast Asia from its geopolitical field of vision, Beijing will be keen to slide into a stronger position of influence which can be achieved by endorsing the ASEAN-led RCEP – essentially, giving free trade the thumbs up.

Das, who is an expert on regional economic integration opined that the RCEP could establish “an alternative trade path in the face of a possible full-fledged trade war with the US.”

“In case of a long-drawn trade war between the US and China, trade and investment rules in the RCEP agreement can facilitate reconfiguration and relocation of production lines from being more China- or US-centric to other RCEP members,” she explained.

RCEP is also perceived as a twin of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) – a slimmer version of the TPP signed by its remaining members after the US’ rescindment of the deal.

“As such, it needs to perform its role to deliver on an Asia-centric trading architecture, consolidating existing smaller deals and streamlining rules and regulations across borders,” Das concluded.

Compared to the TPP or the CPTPP, the RCEP is relatively modest, prescribing lower and more limited regulatory standards. As most of the 16 participating economies are developing nations, this represents an opportunity that’s too valuable to be passed up.

Related stories

Who is actually leading the RCEP?