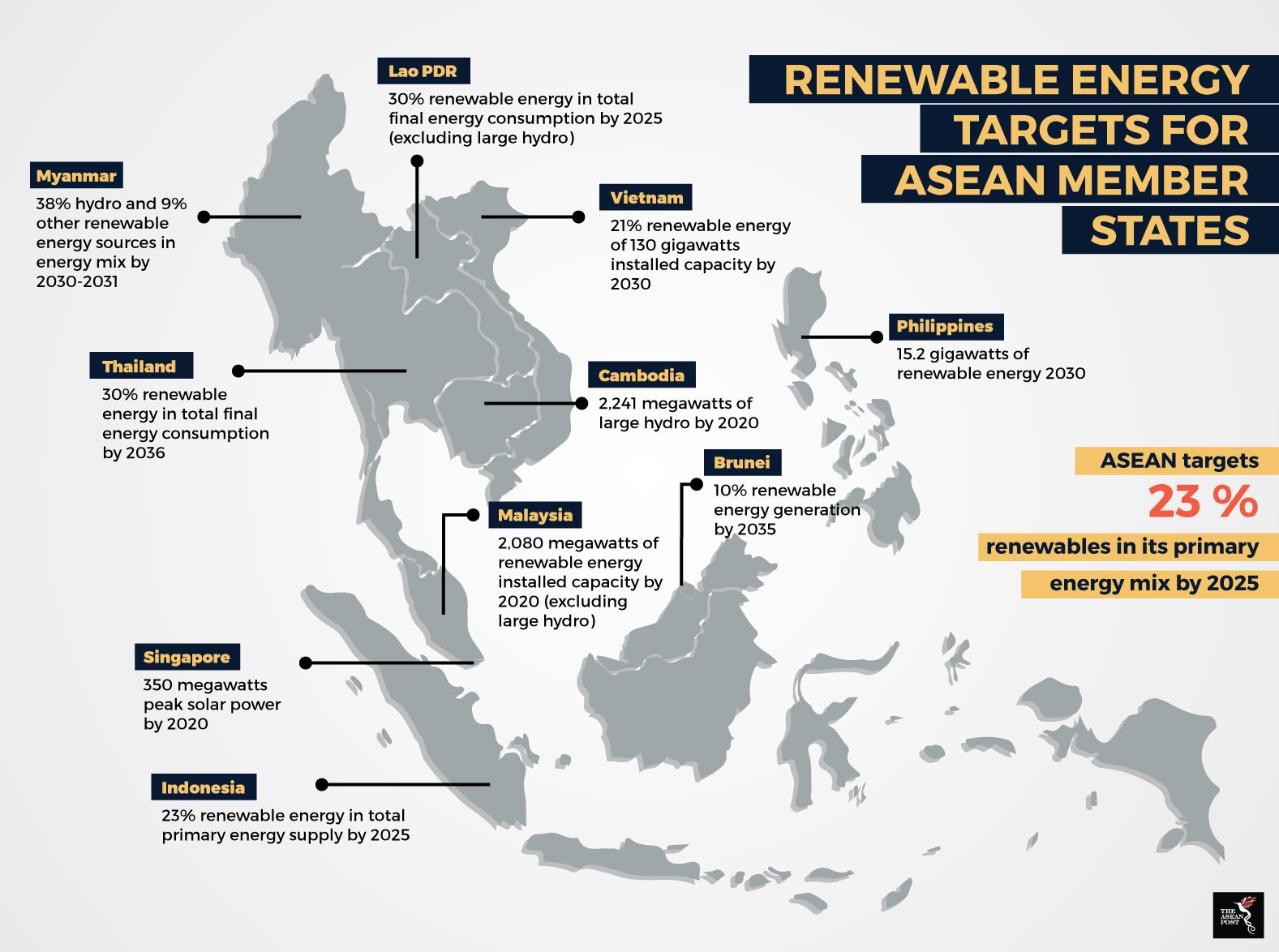

Estimates by the International Renewable Energy Association (IRENA) and the ASEAN Centre for Energy (ACE) indicate that US$290 billion of total investment in renewable energy capacity will be necessary to attain the regional aspirational target of 23 percent primary energy from renewable energy by 2025. Hence, renewable energy investment would need to be substantially scaled up to an estimated US$27 billion annually.

Macroeconomic conditions in the region are generally favourable, given robust economic growth rates and solid fundamentals alongside a strong demand for energy. However, the sentiment derived from this is a mixed bag.

Countries like Malaysia, Philippines and Thailand which have slightly lower growth rates compared to the likes of Cambodia, Lao PDR and Myanmar (CLM) have strong international and local financial institution involvement. Besides that, the former are more mature markets where the familiarity with renewable energy presents a low risk investment opportunity. On top of that, CLM countries have weaker capital markets and higher political and commercial risks compared to larger economies with bigger stock market capitalisation combined with more experience in renewable energy development.

Nevertheless, CLM economies boast growth rates, upwards of seven percent with a huge gap in energy demand and a geography suited to renewable energy development. Myanmar for example, has a potential hydropower capacity of 108 GW but so far, only 2.6 percent or 2,820 MW of this potential has been fulfilled.

Furthermore, CLM countries each have a tentative roadmap towards meeting renewable energy goals which can only be achieved through sound investment related policy implementation. According to an IRENA report, Southeast Asian countries that have attracted the highest investments in renewable energy in recent years have solid legal, institutional and administrative frameworks. In this context, unclear legal and regulatory frameworks like non-bankable power purchase agreements (PPAs) and weak feed-in-tariff (FiT) pricing, serve as major barriers.

Source: IRENA

Policy shortfalls

To address policy challenges, countries must establish long-term frameworks which are predictable and flexible enough to adjust to a rapidly evolving market environment and technology landscape. According to a white paper released by IRENA, one way of doing so is to establish “one-stop shops” for infrastructure investors. These “shops” would provide assistance to investors by ensuring proper administrative coordination to encourage investment.

Besides that, law and dispute resolution mechanisms should be made open, transparent and non-discriminatory. Another area that often gets bogged down by hefty and complex legal processes is the issue of land tenure. Hence, governments should introduce some level of state-backed guarantee in the event of land disputes. Besides that, governments can designate special renewable energy development areas which can have a tremendous positive impact on the sector.

Grid regulation should also be an important policy priority. All grid related dealings should rightly be under the responsibility of a single regulatory body and clarified upfront on a non-retroactive basis before projects are implemented. On top of that, the regulatory body should also be fiscally responsible to ensure a predictable revenue stream. Revenue predictability, in this case is vital in order to ensure lower capital costs.

Furthermore, there is a persistent knowledge gap amongst governmental, municipal and provincial stakeholders which result in poorly designed and poorly performing projects. Although public-private partnerships (PPP) do help in project structuring, most local governments lack the capacity to assign legal, commercial, financial and political risk between the public and private sectors in order to secure a more stable long-term revenue stream.

Besides that, compliance with international policy standards is paramount in order to standout as a more attractive option to investors. Among the ways of achieving this is to participate in multilateral international agreements like international trade promotion, investment protection and intellectual property rights. This would be vital to deliver political and economic stability and produce positive effects on investment.

Equally important is collaboration in the political and economic domains which would work to limit risk perception that might hinder investment flow. Particularly at an international level, such an approach would be beneficial in terms of delivering benefits towards institutional design, policy definition, rule production, market supervision and best practices sharing.