Micro, Small and Medium Enterprises (MSMEs) were the saviours of the Indonesian economy out of the 1998 financial crisis. But now, MSMEs are collapsing in times of crisis due to the COVID-19 pandemic.

MSMEs are one of the sectors severely affected by the social restriction policies implemented by the government. As a result of the COVID-19 preventative measures, MSMEs had to reduce their operation hours, whereas, for those in the food business sector, customers are even prohibited from dining-in in order to prevent the spread of the deadly virus.

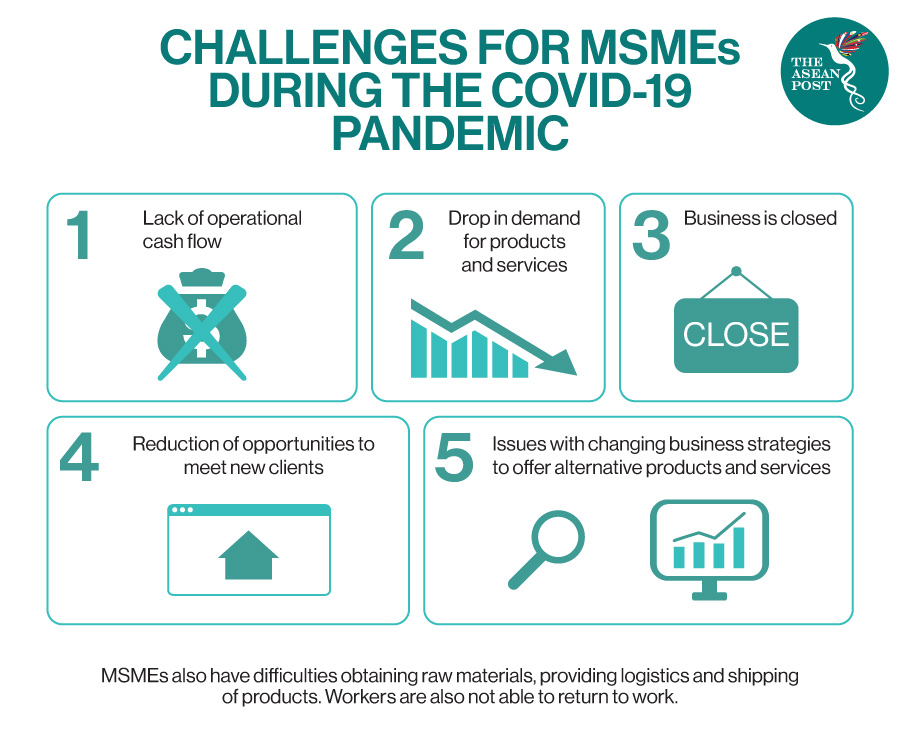

The problems experienced by MSMEs during this pandemic are much more complicated compared to the previous monetary crisis. This includes digital marketing constraints, supply chain issues, late distribution of raw materials and human resources.

Ikhsan Ingratubun, Chairman of the Indonesian MSME Association (AKUMINDO) said that 30 million MSMEs had gone out of business due to the pandemic. The current situation is much different from the 1998 crisis where MSMEs could still survive.

The 1998 crisis was caused by default on foreign debt which caused dependence, while the current one was caused by health and had no correlation with capital. Restrictions on operating hours, a decrease in people's purchasing power, and the prohibition of eating out have hampered the movement of MSMEs, while these regulations did not exist during the crisis of 1998.

Data from Bank Indonesia stated that 87.5 percent of MSMEs were affected by COVID-19 and experienced a decline in sales, while only 12.5 percent were resistant to the economic shocks. Figures from Statistics Indonesia (BPS) showed that of the 64.7 million existing MSMEs, only 13 percent of MSMEs are present on digital platforms. The figures showcase the importance of online presence for businesses in the pandemic.

The government is also trying to provide financial assistance to MSMEs, but its reach is still limited. During the first half of the second quarter of 2021, aid was distributed to around 9.8 million MSMEs out of a total target of 12.8 million MSMEs by the Productive Micro Business Assistance (BPUM). However, it was reported that only about 20 percent of MSMEs have received aid thus far.

Other than that, only 7.5 percent of total SMEs have entered the digital ecosystem. Going digital is crucial for MSMEs to survive during the pandemic. An article titled ‘Social Media and E-commerce as a Solution to Marketing Challenges During the COVID-19 Pandemic’ suggested that making logos, stickers, google accounts, WhatsApp Business accounts, Instagram and Gofood accounts could increase sales of MSMEs in the food sector during the pandemic.

Current Policies

So far, the policies issued by the Indonesian government for MSMEs affected by COVID include:

- social support;

- MSME tax incentives;

- credit restructuring and relaxation;

- working capital stimulus, and

- strengthening MSME collaboration with state-owned enterprises (SOEs).

Some MSMEs have also carried out various actions to deal with the pandemic, namely product innovation, customer and stakeholder management, and digital marketing. A digital marketing pattern enables business owners to reach a broader market, and look for sources of soft loans for capital, among others.

Short-Term Strategy

An article titled ‘Saving micro, small and medium enterprises from the impact of the COVID-19 pandemic’ finds that other strategies need to be adopted to complement existing policies. The complementary approach can be in the form of a short-term strategy or a long-term strategy.

In the case of a short-term plan, MSMEs firstly need to implement strict health protocols in their economic activities. Whereas, the government needs to provide the space and support for digital services to the MSMEs.

Moreover, simplifying administrative processes related to the policy of easing or delaying credit payments for MSMEs and promoting changes in business strategies could also help these businesses to survive.

Long-Term Strategy

Meanwhile, the long-term strategy involves a roadmap by the government for MSMEs in the post-COVID-19 business world. MSME players need to be equipped with an understanding of business forms in the industrial era 4.0 and also the use of digital technology.

Other than that, the government can cooperate with institutions in the field of entrepreneurship to utilise their resources, including using analytical models such as the Business Model Canvas (BMC) to devise a strategy for MSMEs to grow post-COVID-19 and becoming sustainable business models in Indonesia.

Lastly, there needs to be a collaboration between the government and corporations and SOEs in empowering MSMEs. These companies can also foster MSMEs as partners in their business lines.

As the problems experienced by MSMEs during the current pandemic are much different from the 1998 crisis, the government needs to take a holistic approach to save Indonesian MSMEs.