Singapore is putting together the final few pieces of its e-payment infrastructure jigsaw puzzle with the introduction of the Singapore Quick Response (SGQR) code.

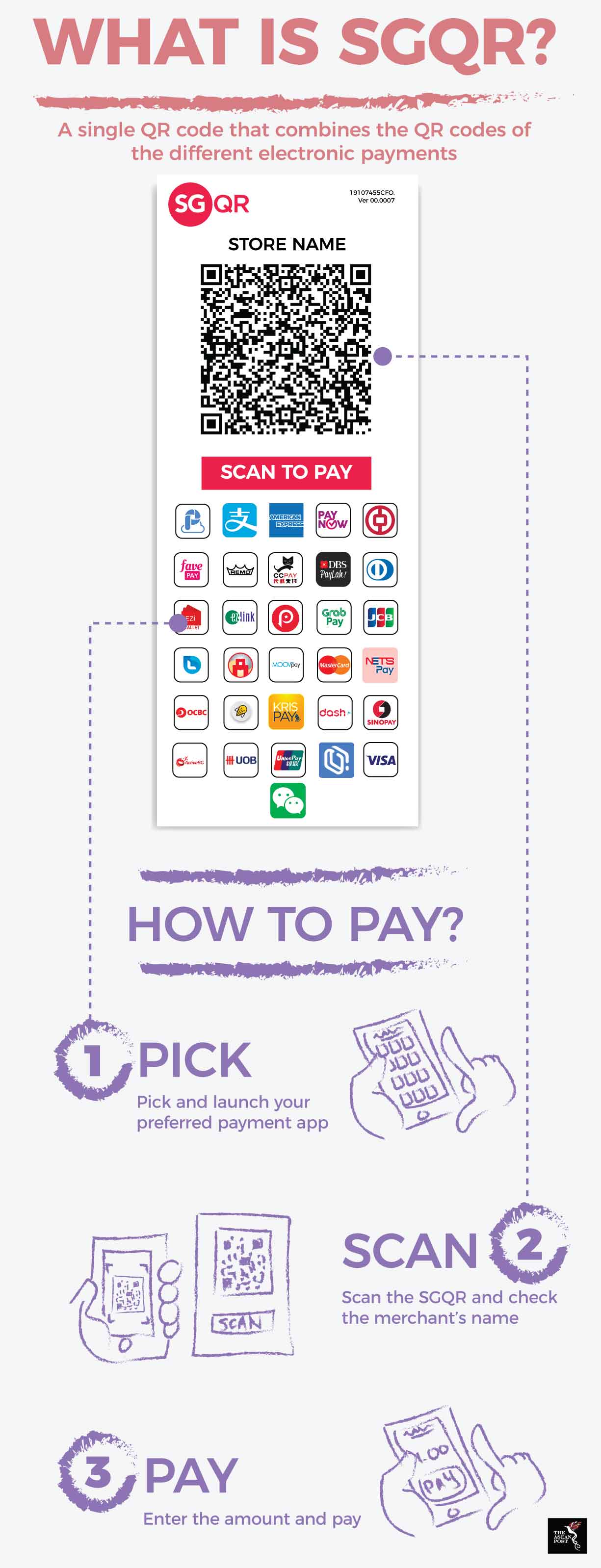

As SGQR is rolled out over the next six months, store merchants will only need to display one single QR code that will work with all the payment vendors they have signed up with. Gone will be the days when they need to display a different code for each vendor.

Cashless transactions are gaining pace in the region. In 2016, non-cash transaction in Emerging Asia grew by 28.6 percent year-on-year. According to Statista, digital payments in Asia will grow 16.4 percent per annum to reach US$2.5 trillion per annum in 2022, representing nearly half the global total estimates of US$5.4 trillion.

Rather than let market forces dictate the growth of the e-payment ecosystem, as is the case in China, Singapore opted to custom design one. The model aims to be competitive and interoperative, and to work with the nation’s existing financial system.

The first piece of the puzzle was FAST, a 24/7 real-time payment system that was put in place in 2014. It serves as the backbone that enables payments across bank accounts and between consumers and businesses, said Ong Ye Kung, board member of the Monetary Authority of Singapore (MAS) and Singapore’s Minister for Education.

Through a service called PayNow, consumers can link their bank accounts to a personal ID or mobile number. Money can be transferred by just selecting the recipient’s mobile number from the contact list. Organisations can also transfer funds to consumers via the personal ID.

Conversely, with PayNow Corporate, companies are also assigned IDs called a Unique Entity Number (UEN). To date, 40,000 businesses have registered. Generally, QR codes contain this information and the Singapore government aims to standardise this with the universal SGQR system. It expects to replace over 19,000 QR codes in use today.

An EY survey found that 54 percent of fintech companies in ASEAN are engaged in payments, money transfer and remittance services.

Through FAST, non-bank players and fintech companies can also have access to central payment infrastructure in the future. E-wallets can then perform two-way transactions with bank accounts. Companies such as Grab, Liquid Group, MatchMove, Razer and TransferWise have joined a working group set up by the government to develop business and technical requirements for non-banks to connect directly to FAST.

Source: Monetary Authority of Singapore, Infocomm Media Development Authority

Source: Monetary Authority of Singapore, Infocomm Media Development Authority

“Open access to a common infrastructure like FAST means banks and non-banks will have to compete harder to gain and retain customers,” said Ong. “They will have to innovate and offer value-added services constantly to stay ahead of the curve.”

Even with a single QR code in use, each payment player will still be able to differentiate themselves with their in-store stickers or decals, said Ng Aik-Phong, managing director, Fave Singapore. “FavePay will still issue Point of Sales decals, highlighting 10 to 20 percent cashback if they scan the SGQR code (with the Fave app).”

Fave also differentiates itself with a “Discovery” function that identifies FavePay acceptance locations, sorted by distance. It is a function that customers love, Ng added.

The final piece in the e-payments puzzle is regulation. The country was recently shaken by the SingHealth data breach in July. By allowing interoperability between banks and non-banks and access to bank accounts, a breach may have far more serious ramifications. MAS has since directed financial institutions to further tighten their customer identity verification measures.

MAS is currently reviewing a set of guidelines for e-payment user protection. Under these guidelines, financial institutions are expected to provide timely notifications to users when payments are transacted. This will enable users to alert them if an unauthorised transaction occurs. The guidelines also apportion liability for losses due to unauthorised transactions, as well as provide an avenue to rectify errors if a user sends money to the wrong recipient.

In a keynote address in June, Jacqueline Loh, MAS’ deputy managing director, said a proposed Payment Services Bill (PSB) will regulate the payments industry by activity. The PSB broadens the regulatory scope to cover e-payments but “right-sizes” regulations to the risk each activity poses.

E-wallets, like digital banking, must manage their technology, cybersecurity and safeguard their customers’ monies. However, they are used for day-to-day transactions and need to be very liquid. The vendors also do not give out loans with the float. Therefore, they should not be burdened with bank-like requirements, Loh said. They may be given proportionately simpler options such as holding customer monies as a deposit with a bank.

Another risk with e-payments is money laundering and terrorist financing (MLTF). “In this context while know-your-customer (KYC) continues to be a key requirement, we allow smaller wallets holding funds of no more than SGD1,000 (US$730) to carry out simplified KYC requirements. This framework is similar to those used in Hong Kong, India, Australia and the United Kingdom (UK),” Loh said.

Singapore is also looking at cross-border e-commerce, which is expected to grow 25 percent annually until 2020, nearly twice that of domestic e-commerce. Progress may be slower here as each country is at a different stage of development with different technical interfaces, legal and regulatory frameworks.

Related articles:

Singapore’s a prime target for hackers

Singapore data breach could affect banks

Digital payments are the future of transactions in Southeast Asia