The Singapore Exchange (SGX) entered into the final phase of consultation to allow dual-class share (DCS) structure listings on 28 March. It subsequently launched a public consultation for proposed safeguards to address the risks of expropriation and entrenchment.

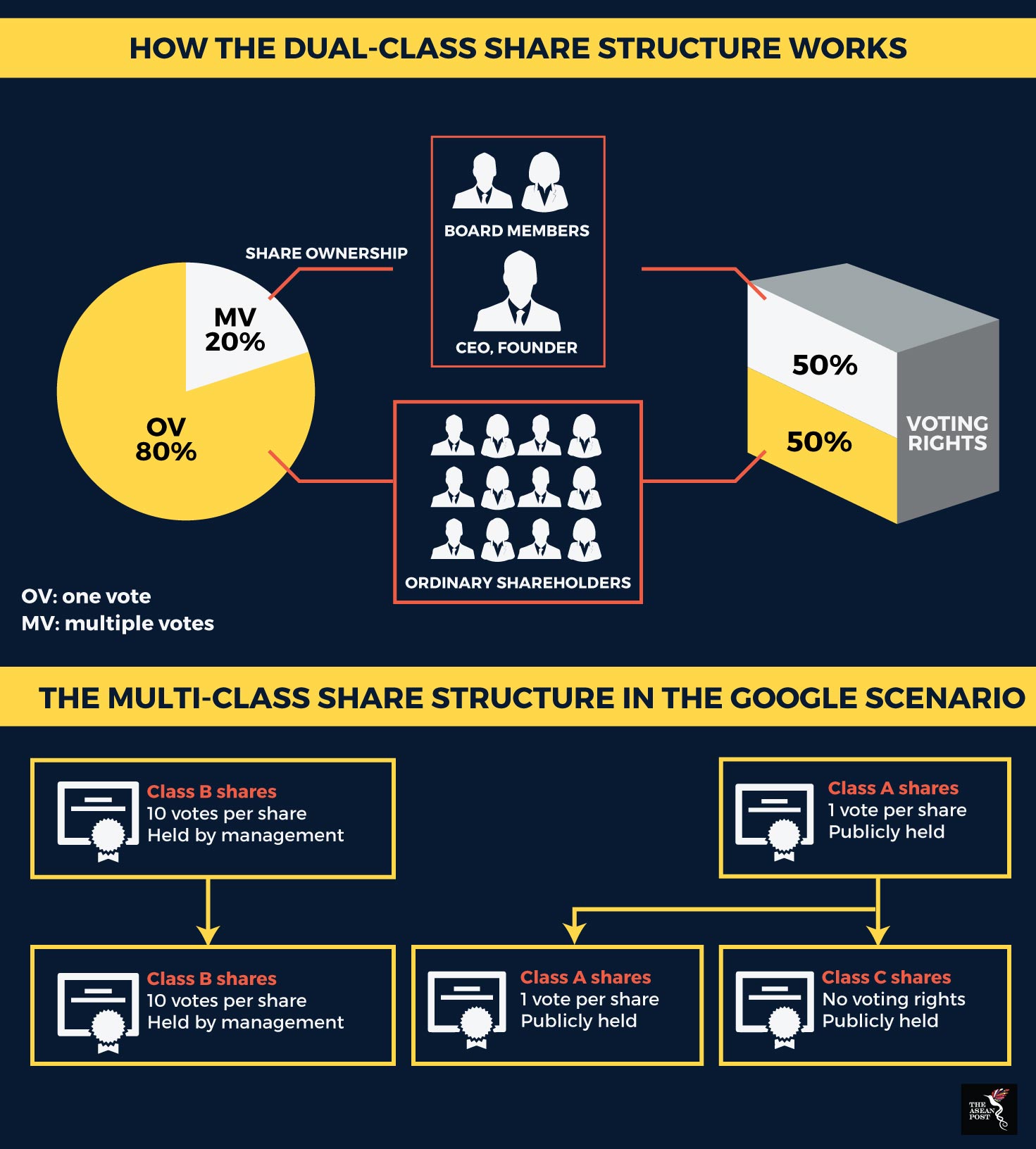

A DCS structure refers to the issuance of different classes of shares, one class of which carries heavier voting rights than the other. Such a share class structure has, in particular, proven popular with tech companies such as Google, as it gives a small pool of board members a greater amount of decision-making power even with a smaller shareholding.

Singapore is considering allowing listings of this structure to render itself more competitive. Apart from diversifying its offerings into multiple asset classes, and expanding partnerships with regional stock exchanges, the DCS structure would also help it boost market share.

“At the end of the day, to be a vibrant financial centre, you need to be multi-asset class, with a multi-investor base and grow beyond your shores. International outreach, client acquisition and international presence are very, very important,” Loh Boon Chye, chief executive officer of the SGX was quoted as saying in March.

The Singapore and Hong Kong stock exchanges had previously missed out on listings from Manchester United and Alibaba, respectively, when they refused to accommodate each company’s DCS structures to be listed.

The Hong Kong Exchanges and Clearing (HKEX) said in February that it now plans to change its listing rules to accommodate DCS listings, upon the conclusion of public consultations this March.

Singapore companies have also considered listing on the HKEX as an alternative to the SGX, in anticipation of better valuations and a more active market there.

“What the companies need is the ability to raise substantial funds in order to grow quickly as well as the freedom to focus on long-term growth. We, therefore, agree with the committee’s recommendations to allow certain companies to list using a DCS structure,” Tan Boon Gin, chief executive officer of SGX confirmed during a press conference in March.

Singapore’s proposed DCS structure is expected to allow for three alternative threshold requirements. One of these is to allow for companies with valuations of over SG$300 million to list a DCS, a factor that analysts say could give it the edge over HKEX, which is planning to set a threshold market cap of at least HK$10 billion.

Much of the concerns arise with issues of corporate governance. Issues may arise where directors hold a small percentage of shares but have a large degree of decision-making power. SGX is planning to install safeguards such as setting a maximum limit of 10 votes for multiple-vote shares, as well as limiting initial holders of multiple-vote shares to just the directors.

On the flip side, however, lies the argument that as much decision-making power as possible needs to rest with the management during a company’s initial formation stages, in order to ensure stability.

Tan stressed that the one-share-one-vote structure will continue to be the default share class structure for the SGX. Enabling a DCS, however, could open the door to multiple class share structures eventually being allowed. Even with safeguards in place, stock exchanges may have a difficult time holding down the line against more powerful companies seeking to list alternative share class structures.

Google Inc, for one, began with introducing a Class B share in its 2004 IPO, which it then followed with Class C shares in 2014 which offered no voting rights at all. Snap Inc., in its initial public offering too sold US$3.4 billion worth of shares to outside investors without offering any voting rights in exchange.

“Once the genie is out of the bottle, it’s out,” Jamie Allen of the Asian Corporate Governance Association told The Economist. While holding a public consultation might provide more fallback mechanisms for SGX to consider, the fact remains that allowing such a structure will have long-term repercussions for Singapore, whether or not it foresees them now.

While Singapore’s proposed dual-class share structure may have the necessary safeguards in place, this does not guarantee problem-free days ahead.