Property investors anticipated a boom in Singapore as prices increased sharply by 9.1 percent over the past year. However, the Monetary Authority of Singapore (MAS) introduced strong measures to dampen what it describes as “euphoria” in the market.

By December, MAS issued warnings of “excessive exuberance” in the property market and voiced concern that the market may be oversupplied.

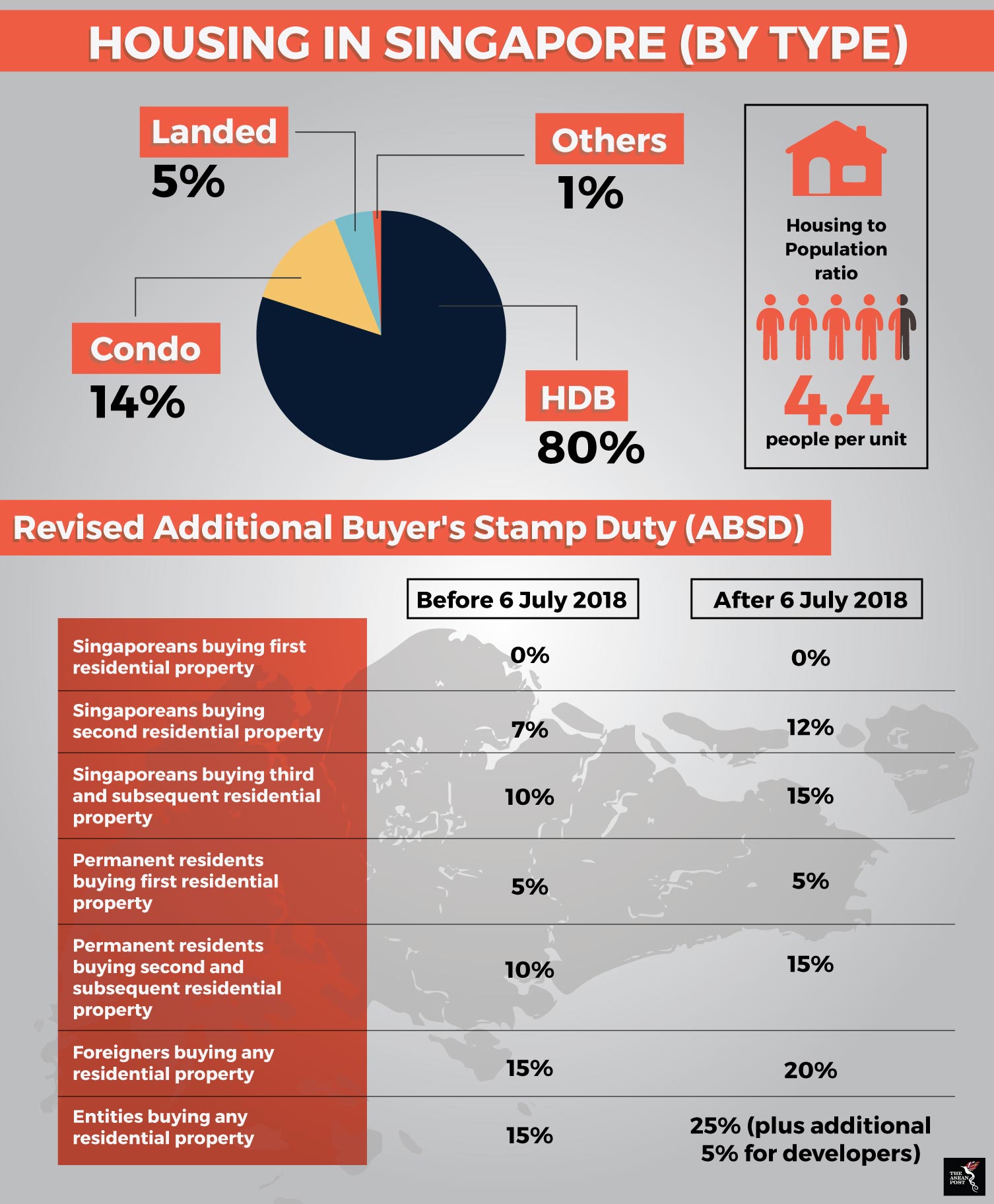

Not satisfied that the advisory had achieved the desired effect, the government decided to put a dampener and cool the market before a property bubble could form. The finance and national development ministries and MAS released a joint statement to raise the Additional Buyer’s Stamp Duty (ABSD) by five percentage points for citizens and permanent residents buying their second and subsequent residential properties.

Although there is no rate change for first-time buyers, the government added five percentage points to loan-to-value housing loans given out by financial institutions. Individual borrowers can now only borrow up to 75 percent (from 80 percent) or 55 percent (from 60 percent) if the loan tenure is over 30 years or extends past the borrower’s age of 65. The revised limits will not apply to loans by the Housing and Development Board (HDB).

The tighter loan requirements force first-time buyers to hold off on their purchase and not jump in the speculative market.

En-blocs blocked

The Singapore government is also imposing a 25 percent (15 percent previously) ABSD on entities buying residential property with an additional five percent for developers, to address the sharp rise in demand and prices for en-bloc properties, where groups of owners of older apartments can opt to sell their entire blocks for redevelopment.

As developers cannot landbank and have a five-year deadline to complete their projects, the 5,500 units sold since 2017 are expected to yield 20,000 new units within the next four to five years, said Maybank Kim Eng in a report. Therefore, the effects of over-supply may only be felt from late-2020 onwards. “We see private housing supply rising to over 17,000 units in 2021,” wrote Maybank Kim Eng analyst Derrick Heng.

The Ministry of National Development (MND) recently announced that it will release six land sites and nine reserve sites in the second half of 2018 as part of its Government Land Sales (GLS) programme to meet strong demand for land. These sites can yield up to 8,040 private homes and 124,200 square metres of commercial space.

Sources: data.gov.sg, Monetary Authority of Singapore

Singapore’s housing to population ratio from 2010 to 2016 hovered between 4.43 to 4.61, with the number of homes growing in tandem with the population. On average, there are 4.4 people living in one unit of housing.

However, the island state’s population growth has been declining over the years – 0.1 percent in 2017 – and without a significant change in immigration policies, a lack of demand for housing may create a private property glut in the next five years.

Windfall-spurred surge

En-bloc sales tend to be a financial windfall for sellers who then need to look for new homes. This has the effect of raising prices of property in neighbouring areas. Even if some of the sellers opt to downgrade from private housing to a Housing and Development Board (HDB) flat, the surge in demand will likely increase the resale prices of HDB units as well.

The government’s new cooling measures are expected to dampen speculative property demand and reduce local banks’ exposure to the property sector should property prices fall significantly. At the end of March 2018, 42 to 50 percent of loans by DBS, OCBC and UOB – three of Singapore’s larger banks – are exposed to the property sector.

Property developers may respond by completing their projects earlier than scheduled in a race to mop up the receding demand and hasten a property glut. However, a housing glut may not be high on Singapore’s list of concerns. The United States (US)-China trade war for instance has the potential to disrupt Singapore’s economy.

Minister for Trade and Industry Chan Chun Sing told parliament that tariffs imposed by both counties are applicable to a majority of countries including Singapore. The tariffs will also disrupt global supply chains. The trade war could also cause a slowdown in global trade and affect business sentiment.

The minister said Singapore’s exports of products affected by US tariffs account for 0.1 percent of total domestic exports to the world. However, Singapore companies also produce intermediate components used in China-made products. The net impact on Singapore’s economy and workers are “less easily quantified, given the fluidity of the US and China’s tit-for-tat responses,” Chan said.

This, perhaps, could be the real reason for the sudden and drastic measures to cool the property market although a glut may only arise in five years.