Singapore which prides itself as one of the "cleanest" countries in the world is now listed at number seven on the top 10 biggest penalties paid list after being prosecuted under the US Foreign Corrupt Practices Act (FCPA).

The last biggest case seen in Singapore was the Singapore Technologies (ST) Marine scandal, where seven senior executives were towed to court and given six-figure fines and jail sentences for making petty-cash claims on fake entertainment expenses, but was instead channelling these payments in bribes to the employees of their eventual client companies.

What’s the story?

Keppel Offshore & Marine (O&M), a unit of conglomerate Singapore’s Keppel Corporation and the largest oil rig producer in the country, has been slapped with a fine of USD422 million for giving bribes. These corrupt payments totalled to more than USD50 million and was given to officials in Brazil in exchange for projects as business deals over a span of thirteen years.

According to US admissions and court documents, beginning 2001 and continuing until at least 2014, Keppel O&M “conspired to violate the FCPA by paying approximately $55 million in bribes to officials at the Brazilian state-owned oil company Petrobras and to the then-governing political party in Brazil, in order to win 13 contracts with Petrobras and another Brazilian entity.”

The other Brazilian entity here links back to Sete Brasil, a Brazilian oil rig builder which develops, builds and supplies ultra-deep-water drilling rigs for oil and gas exploration in Brazil. Prior to this case, the two mentioned Brazilian oil companies have been embroiled in a sprawling graft probe dubbed “Operation Car Wash” carried out by the country’s federal police since 2014.

How did they do it?

Keppel O&M made the bribe payments by paying outsized commissions to an agent, “under the guise of legitimate consulting agreements”. This agent then made payments for the benefit of the Brazilian officials and politicians of the Brazilian Workers’ Party.

“In an attempt to conceal their crimes, the defendants used the global financial system – including the United States banking system – to disguise the source and disbursement of the bribe payments by passing funds through a series of shell companies,” Bridget Rohde, acting U.S. Attorney in Brooklyn, said in a statement.

Key figures

Brazilian Zwi Skornicki, who was not named in the US court documents, is believed to be Keppel’s former agent and intermediary in this case whose role was to primarily secure the contracts. He was first engaged by Keppel Corp subsidiary Keppel Fels (which was merged into Keppel Offshore and Marine in 2002) to work as its agent, and he operated out of Keppel's office in Rio de Janeiro.

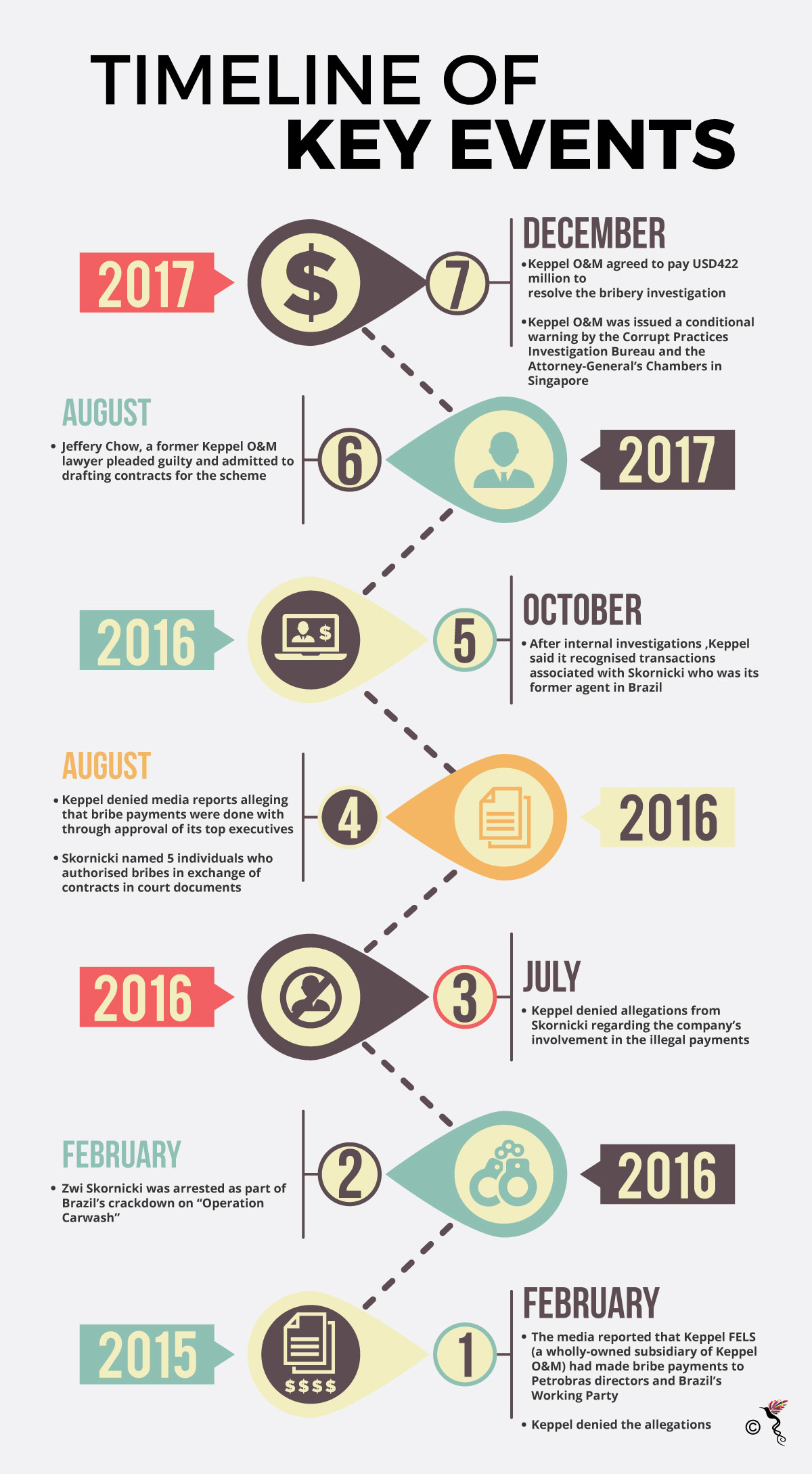

Skornicki was arrested in February 2016 as part of arrests under “Operation Car Wash”.

A report by Bloomberg in August 2016, which reported on Mr Skornicki’s testimony in court, named five top managers at Keppel and its marine and offshore units who allegedly knew about and authorised his bribe-for-contract payments in Brazil.

These key figures include former CEOs of Keppel O&M Chow Yew Yuen and Tong Chong Heong, former CEOs of Keppel FELS Brasil Tay Kim Hock and Kwok Kai Choong, as well as former Keppel CEO Choo Chiau Beng. Mr Choo was also Singapore's non-resident ambassador to Brazil from 2004 to 2016.

Source: US Department of Justice

Another Keppel executive who prepared the agreements, is believed to be Jeffery Chow - a senior member at Keppel O&M’s legal team from 1990 to 2017. The Department of Justice have unsealed charges against Jeffery “who pleaded guilty to one count of conspiracy to violate the FCPA on Aug. 29, 2017 in the Eastern District of New York.” He is currently awaiting sentencing.

Through this scheme, Keppel O&M managed to secure 13 contracts throughout 13 years where O&M and its related entities earned US$351.8 million in excess.

Some of the projects include the P-48 Project, the P-51 and P-52 Projects, The P-61 Project and the Sete Brasil Projects for the construction of a fleet of ultra-deepwater rigs for which Petrobras would be the end user amongst others.

Current status

According to a Bloomberg report, Keppel O&M has accepted a conditional warning from the Corrupt Practices Investigation Bureau in Singapore and its Brazil unit reached a leniency agreement with the Prosecutor’s Office in Brazil, stated a Keppel Corporation in a statement. The USD422 million in fines will be allocated between the US, Singapore and Brazil, it added.

This latest bribery case involving Keppel O&M, has raised questions about its corporate governance structure and has caused a furore amongst the general Singaporean public. This episode has also raised eyebrows regionally and globally, given that it’s internationally renowned sovereign wealth fund Temasek Holdings owns a controlling stake in Keppel Corporation.

For all its glory as a prime business and trading hub in the region and the world, an incident like this is bound to sully Singapore’s squeaky-clean business environment possibly even turning investors away should this matter escalate any further.

Keppel O&M may be an outlier in the bigger picture, but it serves as a hard reminder to the island republic that even it, isn’t free from the luring clasps of corrupt practices.

Recommended stories: