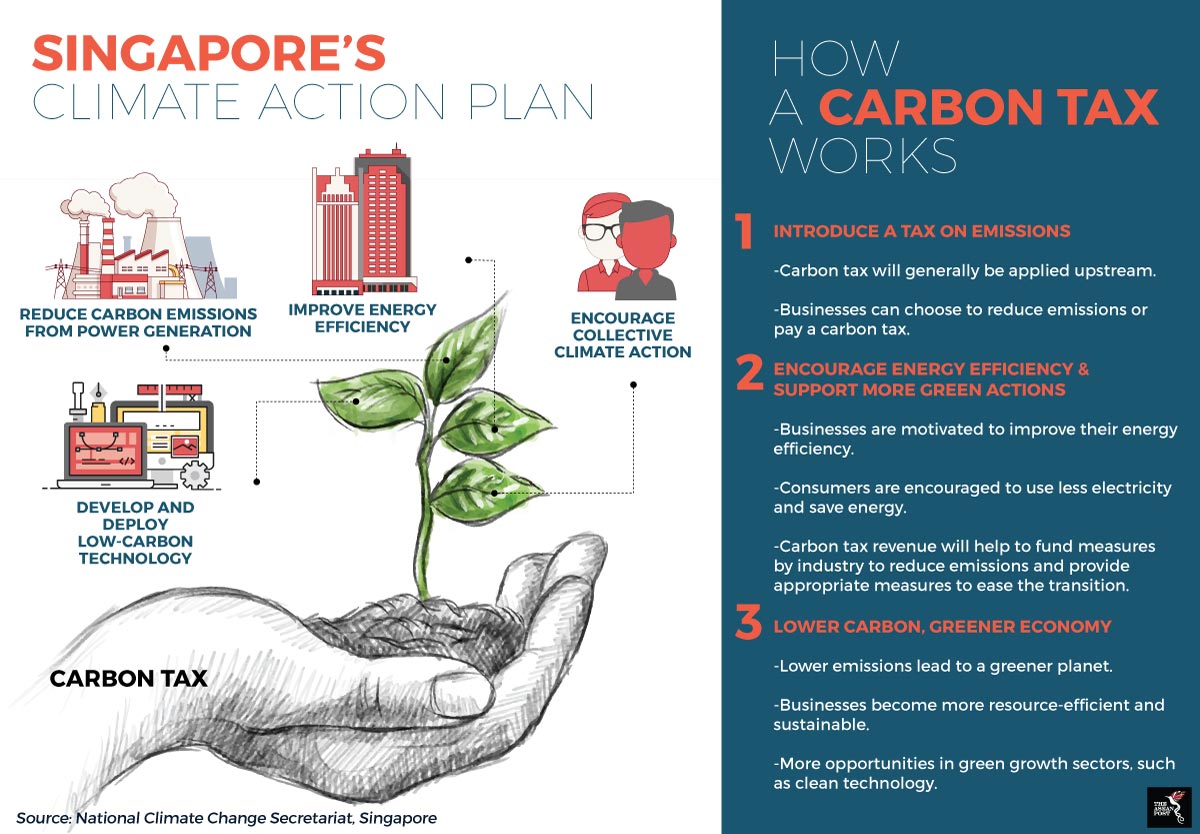

Singapore announced a carbon tax in its 2018 Budget, last Monday, being the first country in Southeast Asia to do so. The tax will be implemented in 2019 and will contribute to Singapore’s efforts to lower greenhouse emissions.

Despite its small land area, Singapore is the world's 26th-largest carbon emitter per capita, which makes this an important step towards limiting global temperature increases, as per the Paris Agreement on climate change, the first universal, global climate bill.

Finance Minister, Heng Swee Keat said the tax would be imposed on all facilities producing 25,000 tonnes or more of greenhouse gas emissions a year. The tax, to be applied to all sectors, will be SG$5.0 per tonne of greenhouse gas emissions from 2019 to 2023, after which the levy will be reviewed and possibly raised to between SG$10 and SG$15 per tonne by 2030.

"Singapore produces less carbon emissions per dollar of GDP than most countries. We intend to further reduce our emissions intensity to make a bigger effort to combat climate change," said Heng.

It is rather unexpected that a market-driven economy like Singapore has chosen tax - that will hit big emitters instead of individuals - as a mode for changing its practices. With the price of oil being set internationally, the big refineries will be unable to pass on the cost and instead be forced to become more efficient.

What does it mean for companies?

According to Agence France Presse (AFP), the tax levy will affect about 30-40 companies in Singapore, mainly those from the petroleum refining, chemicals and semiconductor sectors. Heng also said the new carbon tax would encourage businesses to deploy measures that will decrease emissions. In return, the companies will be more competitive as tighter limits are enforced by more countries when international deals are present.

The Singapore government would provide support to companies to help them become energy-efficient. The country is said to be able to collect carbon tax revenues of nearly SG$1.0 billion in the first five years, but the government is willing to spend more than that to help companies.

“Shell welcomes the Singapore government’s initiative to put a tax on carbon emissions from its large industrial and power plants. This would be an important step towards meeting its carbon objectives set after the Paris agreement,” Shell chief economist Steven Fries told Independent Chemical Information Service, ICIS.

Apart from pushing these companies to be more efficient, the tax could also bring about further opportunities in green and clean-energy industries.

Mark Billington, regional director, Institute of Chartered Accountants in England and Wales, South East Asia was cited in The Straits Times saying, “In Australia and parts of Europe, the introduction of carbon taxes or carbon trading schemes has seen a decline in refining industries - the positive outcome of this is the parallel increase in investment in clean technology and job creation. This pattern may repeat itself in Singapore, given the government's intentions to help the industry, which could see Asia's main oil-trading hub dominated by cleaner resources in the future.”

What does it mean to households?

While the implementation of carbon tax does not apply to households, individuals may still see a trickle-down effect through a rise in electricity tariffs. Singapore’s National Climate Change Secretariat (NCCS) had said that the carbon tax will translate to an increase of SG$1.70 to SG$3.30 per month for the average family living in a four-room flat which pays around SG$72 per month in electricity bills.

The Government will also be increasing the amount of Utilities-Save (U-Save) under the GST voucher for three years in order to conceal the impact of tax on households. From 2019 to 2021, households will receive SG$20 more in their annual U-Save which will result up to an average of SG$13.70 in additional expenses.

For a city-state like Singapore that still heavily depends on fossil fuels to keep the country up and running, the carbon tax is quite a fair and economical way to reduce greenhouse gas emissions and to keep the country clean. In the long-run, citizens who pay a small price now will be able to see its benefits. Through this, other countries in the region should also follow suit in implementing the carbon tax to see a greener and cleaner future.