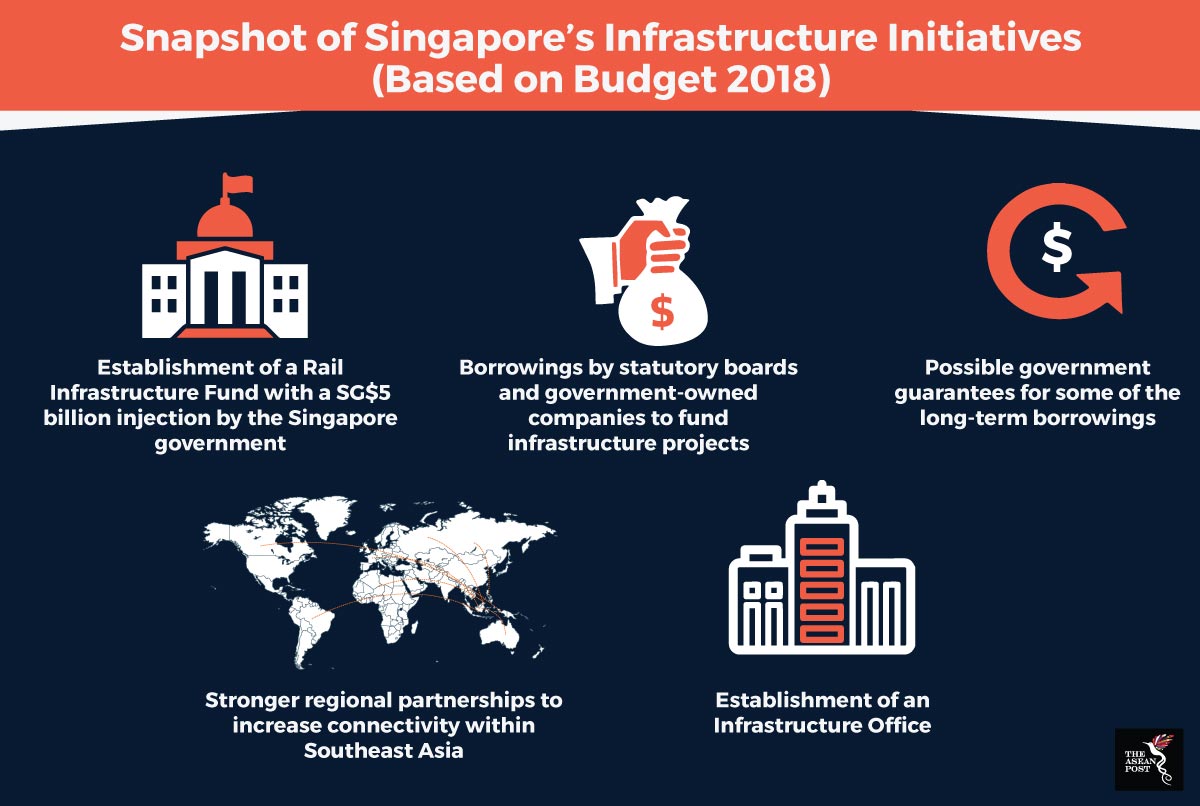

In financing long-term infrastructure projects, Singapore's government is looking at its first borrowings since the 1980s, according to analysis by The Business Times Singapore. These borrowings will be made by the country’s statutory boards and government-owned firms, finance minister Heng Swee Keat said during the recent budget announcement in February 2018. The government is also looking to provide guarantees for some of these long-term borrowings in order to reduce overall financing costs.

Government-linked infrastructure project funding is less common in Southeast Asia, but has been employed by government-linked agencies in Japan, South Korea and China over the last two decades, Samuel Chan, head of capital markets in Standard Chartered Singapore told The Business Times Singapore in a separate report.

The most common way to bridge financing gaps for infrastructure projects in Southeast Asia has been through the use of public-private partnerships, according to an Asian Development Bank Policy Brief authored in 2017. Public-private partnerships are partnerships between government agencies and private sector companies to finance, build and operate infrastructure projects, according to financial education website, Investopedia. Yet these also often require higher scrutiny, coordination and risk allocation standards compared to solely publicly-funded projects, the policy brief further noted.

Singapore MPs approved of the government linked borrowings financing plan during the first day of debates on 27 February, 2018. The Singapore government announced in 2017 that it would set aside SG$20 billion for infrastructure spending over the next five years. It is now looking to cover this expenditure through the issue of infrastructure bonds. This too will spread the cost of the investments over a longer period of time.

Source: Ministry of Finance, Singapore

Meanwhile, using national reserves to back borrowings rather than spend them outright also allows for better cash flow in the short term and higher returns in the long run.

"The reserves can then remain invested and generate returns. We are studying this carefully and discussing it with the President and the Council of Presidential Advisers," explained Heng during the recent budget announcement.

Some projects in the pipeline include Changi Airport Terminal 5, the High Speed Rail project connecting Singapore with Kuala Lumpur, the Tuas megaport, and new MRT projects. According to Lawrence Wong, National Development Minister of Singapore, infrastructure spending tends to be cyclical, alternating between new project developments and projects to replace ageing infrastructure. The city state is at present looking to expand its infrastructure further in order to maintain its competitiveness as a regional hub.

“We are building for practical needs, to enhance our hub status to attract more investments and to create more jobs for Singaporeans,” Wong told The Straits Times in February 2018. Total value of construction contracts is expected to rise from SG$24.5 billion in 2017 to SG$31 billion this year.

Heng also explained in a recent Straits Times interview how during the early years of development, Singapore would borrow from the World Bank or the Asian Development Bank to fund large-scale infrastructure projects. Yet this practice ceased when strong tax revenues and economic growth began to take effect around the mid-1980 period, as the government could rely on funding from those avenues instead.

Apart from borrowings, the Singapore government is also employing a savings mechanism for its long-term infrastructure projects. An example is the Changi Airport Development Fund for Terminal 5, which was set up in 2015, and has already amassed SG$4 million today. Following that example, a new Rail Infrastructure Fund will be established this year with an injection of SG$5 million, Heng further announced in the budget.

It is likely that life insurance companies and asset management companies would be the most likely to take up the new infrastructure bonds, according to analysis by the Singapore Business Review. Such companies have been on the lookout for more, high-quality Singapore dollar denominated local bonds throughout the years, explained Heng Hoon Kaw, UOB head of markets strategy to the business newspaper in February 2018.

“Until now, a majority of the supply of bonds from government-linked companies and statutory boards has been absorbed by banks and a limited pool of local institutional investors,” added Chan.

Singapore’s infrastructure ambitions are also likely to expand regionally. According to the budget outline, it will further establish an Infrastructure Office that will function as a hub for international and local firms from various fields to develop, finance and execute infrastructure projects. Strong regional partnerships are also being sought to enhance regional connectivity, of which China's Belt & Road Initiative, and Japan and India’s Asia-Africa Growth Corridor are just two working examples. Now that it has the right financial plan in place, Singapore seems more than ready to meet its infrastructure targets.