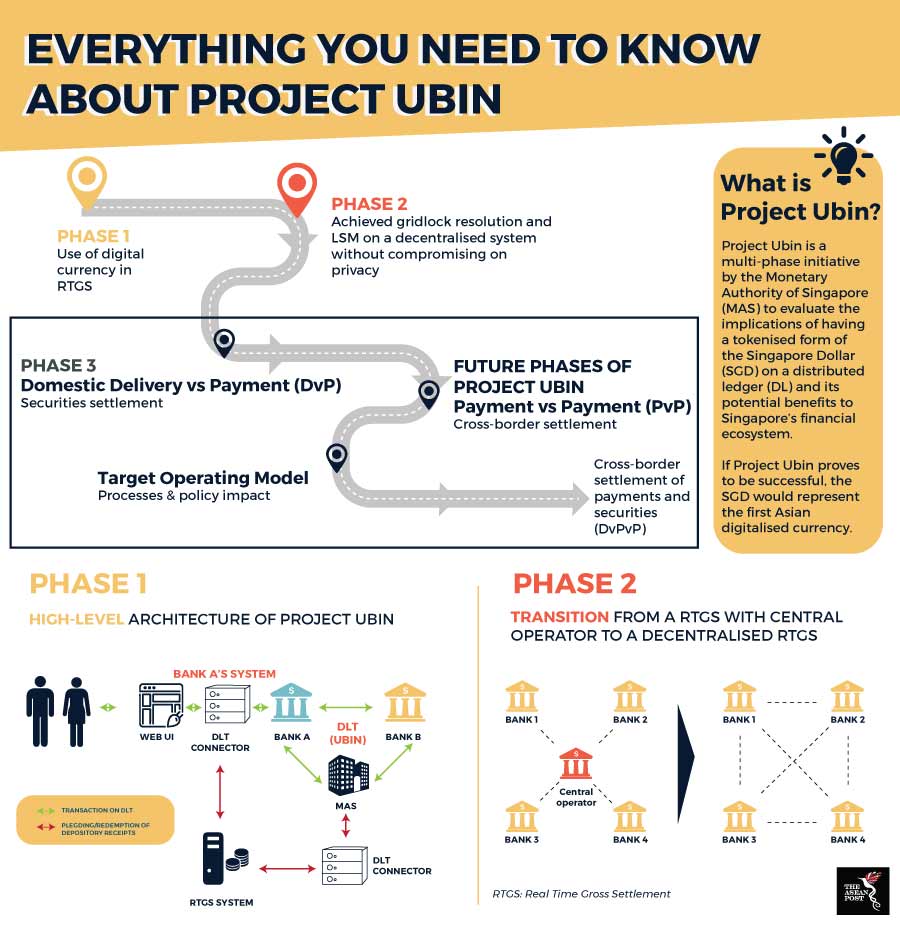

Project Ubin named after an island located northeast of the Singapore mainland is a multi-phased initiative by the Monetary Authority of Singapore (MAS) to explore the usage of Distributed Ledger Technology (DLT) commonly known as blockchain technology for the clearing and settlement of payments and securities.

The latest phase of the project saw an announcement by MAS and the Singapore Exchange (SGX) last August for a collaboration to develop Delivery versus Payment (DvP) capabilities for the settlement of tokenised assets across different blockchain platforms.

DvP refers to a settlement mechanism where payment must be made prior or simultaneously with the delivery of a security.

As such, the collaboration would improve the operational efficiency by allowing financial institutions and corporate investors to carry out simultaneous exchange and final settlement of tokenised digital currencies and securities assets as well as reduce settlement risks.

“Blockchain technology is radically transforming how financial transactions are performed today, and the ability to transact seamlessly across blockchains will open up a world of new business opportunities,” said Sopnendu Mohanty, Chief Fintech Officer of MAS.

Singapore based blockchain firm, Anquan alongside Deloitte and Nasdaq have been appointed as technology partners for this project.

Mohanty added that the involvement of these three prominent players in the technology scene “highlights the commercial interest in making this a reality.”

“We expect to see further growth in this space as fintechs leverage on the strong pool of talent and expertise in Singapore to develop innovative blockchain applications and benefits from the new opportunities created,” he said.

Leveraging on the open-source software developed and made publicly available in Project Ubin Phase 2, a report would be produced examining the potential of automating the DvP settlement processes with Smart Contracts and to identify key design considerations to ensure resilient operations and enhanced protection for investors.

A smart contract is a computer protocol based on blockchain architecture where contractual terms or business logics are codified as software code to be executed upon the fulfilment of pre-defined conditions.

Source: Monetary Authority of Singapore (MAS)

According to Tinku Gupta, Head of Technology at SGX, this initiative would effectively leverage on blockchain technology to link-up funds and securities transfers efficiently, thus eliminating both, buyers’ and sellers’ risk in the DvP process.

“This is a collaborative innovation bringing together multiple players to pursue real-world opportunities that will benefit the ecosystem,” Gupta who is also Project Chair, further remarked.

Spearheading the digital ledger revolution

Project Ubin was conceptualised with the intention of helping MAS and relevant industries better understand the technology and after a vigorous experimentation process, develop it for practical, everyday use.

The first phase of the project took six weeks and ran from 14 November to 23 December, 2016. In the report by Deloitte documenting the findings of this phase, the project was said to have been successful in accomplishing its objective of producing a digital representation of the Singapore dollar (SGD).

This tokenised version of the republic’s currency could be used for interbank settlement, testing ways bank systems can be connected to DLT, and harmonising the MAS Electronic Payment System (MEPS+) and the DLT to ensure interoperability for automated collateral management.

Phase two of the project was led by MAS and the Association of Banks Singapore (ABS) alongside a consortium of 11 financial service providers and five technology companies. The 13-week project explored the feasibility of using DLT for specific Real Time Gross Settlement (RTGS) functionalities.

The second phase focussed specifically on the viability of decentralising Liquidity Saving Mechanisms (LSM), while maintaining privacy of banking transactions. It discovered that RTGS functions could be decentralised without compromising privacy, marking a significant breakthrough in practical usage for blockchain in the financial sector.

In harnessing advances like blockchain and effectively incorporating them into daily lives, Singapore’s Project Ubin is definitely a step in the right direction. It only reinforces the tiny island republic’s attitude in always wanting to stay ahead of the curve and not shying away from being an early adopter of such ground-breaking technologies.

Related articles:

Blockchain: Gaining ground by the day