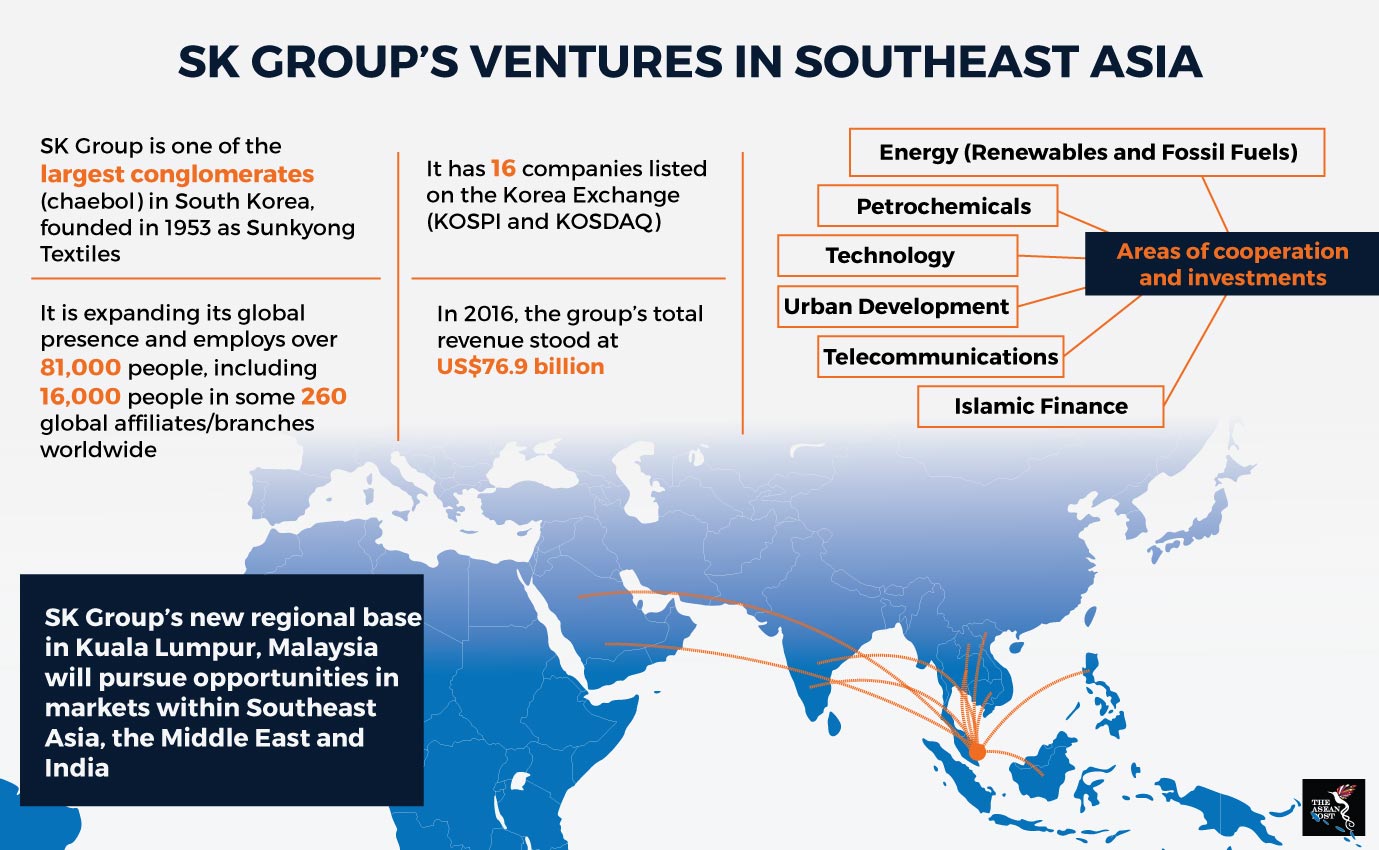

South Korea’s second largest conglomerate by market capitalisation, SK Group has set its sights on expanding to the ever growing and dynamic market that is Southeast Asia.

Why is Southeast Asia a lure?

The Association of Southeast Asian Nations (ASEAN) region has been the apple of every investor’s eye given its tremendous prospects and excellent economic growth rates.

According to the Organisation for Economic Co-operation and Development (OECD), the average real Gross Domestic Product (GDP) growth of ASEAN member states is expected to be 5.2 percent between 2018 to 2022. In that same time period, the economies of Lao, Cambodia and Myanmar are expected to grow the fastest, averaging 7.2 percent. This is followed by the ASEAN-5 (Malaysia, Indonesia, Philippines, Thailand, Vietnam) at an average of 5.3 percent and lastly, the more developed member states – Singapore and Brunei – at 1.4 percent on average.

Besides that, ASEAN member states have improved business conditions in their respective countries. A survey conducted by PricewaterhouseCoopers on industry leaders revealed that the tiger economies of Vietnam, Indonesia and Thailand are among the top destinations of outbound investments in the Asia Pacific region.

Source: World Economic Forum

Moreover, trade opportunities in ASEAN member countries and the wider Asia Pacific region could intensify as negotiations for the Regional Comprehensive Economic Partnership (RCEP) trade deal are concluded. If ratified, the agreement which encompasses all 10 ASEAN member states, South Korea, India, China, Japan, Australia and New Zealand would be the largest trade and investment agreement reached since the end of the GATT Uruguay Round which established the World Trade Organisation (WTO).

SK Group’s venture into the region

Soon after the Lunar New Year, group chairman of SK Group, Chey Tae-won and several important executives embarked on a trip to Southeast Asia which resulted in several memorandums of understanding (MoU) and joint ventures being signed with the governments of Malaysia, Singapore and Vietnam.

Malaysia was selected to be the latest regional hub for SK Group which is also looking to use it as a launchpad to expand their businesses to other parts of Southeast Asia, India and the Middle East. The group signed an MoU with Malaysia to explore investment opportunities and to create blue ocean business opportunities in the country in various sectors including technology, energy, telecommunications and urban development. Besides that, SK Group also agreed to invest in a petrochemical refinery plant, Rapid, which is currently built by Malaysian state oil company, Petronas. According to Chey Tae-won, the conglomerate has bigger aspirations for Malaysia and hopes its investments in Malaysia will exceed US$17 billion in the coming years.

In Vietnam, SK Group’s investments come at a ripe moment when the Vietnamese government is looking to privatise many of its state-run companies. Vietnam’s prime minister, Nguyen Xuan Phuc, also solicited SK’s help to develop infrastructure for semiconductor production and smart cities.

Prior to heading to Vietnam, SK Group also met with industry leaders from Singapore to discuss prospects of the Southeast Asian markets. The group also consulted with Anthony Tan, Chief Executive Officer of leading ride-sharing application, Grab, to seek ways to cooperate in terms of future mobility businesses like self-driving cars and ride-sharing.

Impact on Southeast Asian economies

SK’s venture into Southeast Asia has been a welcome proposition by most quarters. The economic reasons are very much understood as such investments and partnerships help boost jobs, and drive economic growth.

In the longer term, SK Group’s investments can be viewed as a step by South Korea to strengthen its pivot towards Southeast Asia since the latter’s president visited the region in November, 2017. ASEAN is South Korea’s second largest trading partner and bilateral trade broke the US$100 billion mark in 2016. The regional association is also South Korea’s second largest investment destination and SK’s foray seeks to bolster this even further.