The Southeast Asian budget hotel market is currently worth between US$15 million to US$20 million, according to reporting by The Edge Markets in 2017. However, the real beneficiaries of this market could be the booking platforms who redirect tourists to budget hotels that offer the best deals.

Most booking platforms employ a standardised model, aggregating available rooms in hotels within a certain city and forming a network of available rooms across multiple cities. According to a list compiled by Siteminder, a hotel channel management platform in 2017, major players in the Southeast Asian region currently include Booking.com, Agoda, Expedia, GTA and Traveloka. Southeast Asian start-ups might be getting a leg up soon, by taking a creative approach towards this business model.

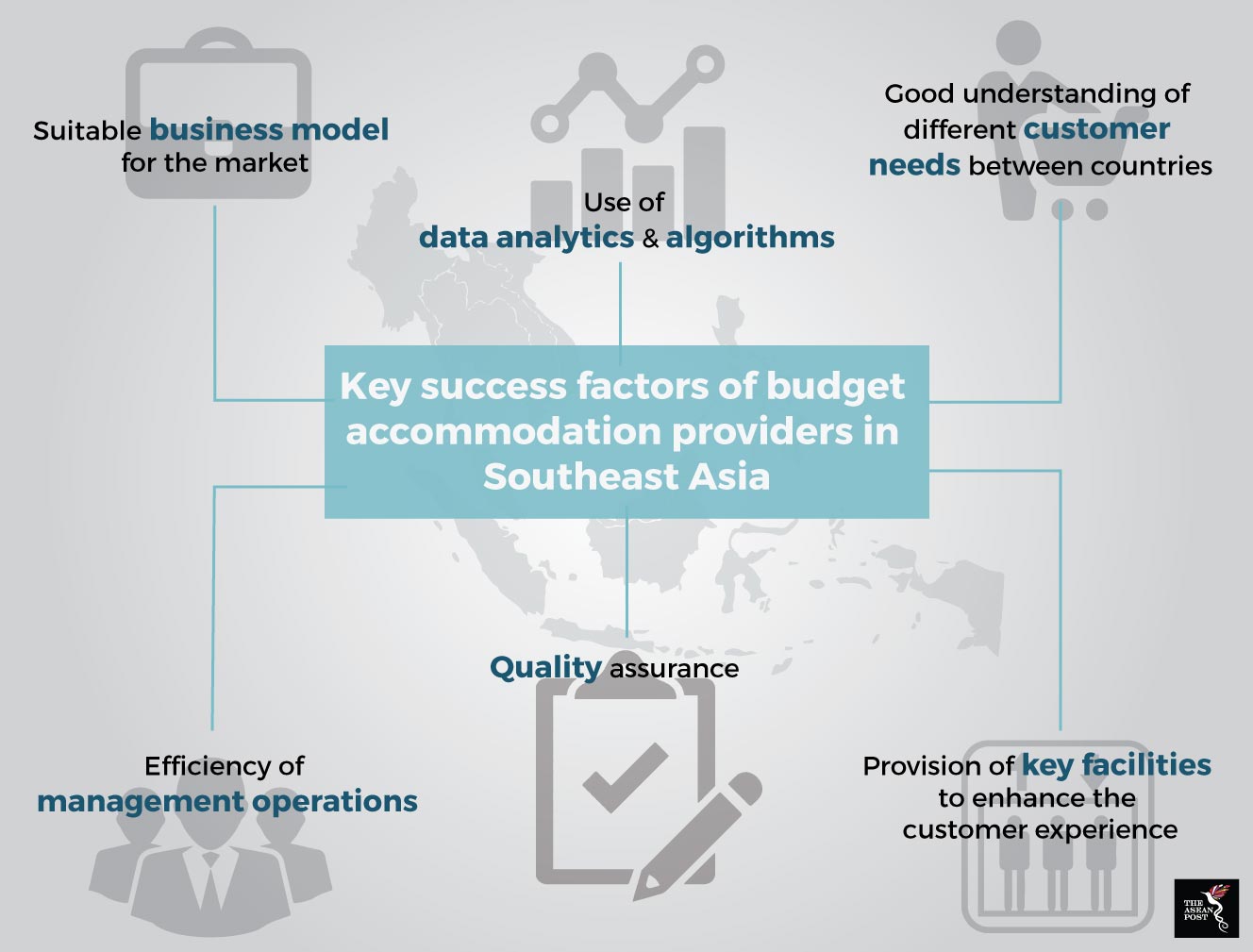

Booking platforms can improve their services by innovating around evolving customer needs. Speed of booking, is one aspect of the customer experience that regional booking platform RedDoorz aims to focus on. Realising that around 65-70% of all bookings it garners consists of on-the-spot rather than advanced bookings, it has decided to focus on advertising its services in airports and railway stations. The RedDoorz website is also optimised to ensure that the booking form is displayed prominently on the landing page, which keeps guests focused on completing their booking.

RedDoorz further sweetens the deal for customers by assuring customers have access to facilities such as clean linen, WiFi and toiletries. Guaranteeing such facilities was the sole unique selling point of former booking platform, Tinggal, which switched to a different business model when it found that growth in that area was limited. In fact, the focus on just one market differentiator may not prove attractive to tourists who often look for a combination of perks when deciding on a hotel room.

The business model of Rocket International-backed ZenRooms, on the other hand, leverages on partnerships with small, independently-owned hotels. As with most other aggregators, it has made affordability its selling point, and expanded its global base to 5,000 rooms within just 15 months of being established. The company was set up in 2016, and already has a presence in Sri Lanka, Brazil, Hong Kong, the Philippines, Thailand, Malaysia, Singapore and Indonesia.

Rapidly scaling across eight countries might not have been helpful, as this did not allow ZenRooms time to develop a more solid product fit for all the countries it had a presence as reported by TechCrunch. ZenRooms recently refuted claims that it is on the brink of being sold, saying that it had downsized operations in Thailand because of unprofitability.

In fact, focusing on a smaller market size has worked for RedDoorz, which established itself in Indonesia, Singapore and Philippines before scaling across Southeast Asia. Besides being an aggregator, it will soon operate a new business model, namely the direct leasing and operations of brick and mortar hotels. RedDoorz recently raised US$11 million in a Series B funding to open 100 such hotels across Southeast Asia. Its first such hotel will be located in East Coast Road, Singapore, branded as a Peranakan-style hotel, offering 65 rooms for rent.

“Both these business models will work for us in the long run,” Amit Saberwal, founder of RedDoorz told the Business Times Singapore in March 2018.

“The new lease model is also a great model for property owners who are sitting on properties that have been handed over to them via family legacy and are no longer a core business for them. We partner such people to keep their business alive and kicking,” he added.

Such a full-franchise business model is already being operated by Nida Rooms, which also offers a semi-franchise option to its 4,000 partner-hotels across Thailand, Indonesia, Philippines and Malaysia. The semi-franchise model works by allowing the hotel partner to retain their original branding but still use the Nida operations platform to run operations.

Source: TechCrunch

“We want to look into things like short stays and check-ins,” Kaneswaran Avili, chief executive officer and founder of Hotel Nida told The Star Malaysia during its launch back in November, 2017.

“And we’ll only get the flexibility to do this if we operate our own hotel,” he added.

Further innovations could be in the works, but these are likely to be add-ons rather than core business models. Increasing customer support could be one key point to address, as well as expanding on the variety of product offerings. Such features would build customer loyalty by ensuring go-to reliability. However, booking platforms would also be wise to take these expansions one step at the time.