When it comes to ride-hailing applications in Southeast Asia, Uber and Grab are just as well-known as SVoD (Subscription Video on Demand) service providers like Netflix and iflix. Apart from being at the top of their industry within the region, both sets of rivals share another thing in common, where one is a homegrown business while the other came from the US.

There are many challenges faced by Uber in sustaining its application in Southeast Asia. The 2.8-billion-dollar loss suffered by Uber's ride-hailing services in 2016, was accounted from its range of services such as UberPool, UberX and SUV, excluding its businesses in China.

However, the Uber ride-hailing app in Southeast Asia has been trying to make its way into the stock market to show the rise in sales growth, which remains strong this year in certain parts of the region, mainly Singapore, Malaysia, Vietnam and Thailand.

According to Uber’s new CEO, Dara Khosrowshahi, the IPO (Initial Public Offering) valued at 68 billion dollars allows its investors and employees to access to its accounting while increasing Uber's revenue at a faster pace.

A few Uber users have spoken about their experience with Uber's mobile application and its functions. Responding to The ASEAN Post, a Singaporean Uber user, Osama Shah, 29, said “Generally (I) prefer Uber when there’s no surcharge.” Another user of both Uber and Grab, Chuong Nguyen, 20 from Vietnam replied, “First, I was a Grab user, but later I found out that Uber costs a little less so I used Uber instead.”

Across Southeast Asia, Singapore has a total population of 5.6 million while a total of three million Indonesians contacted their banks to authorise e-payment methods for the ride-hailing application. Meanwhile, Thailand, Vietnam and Singapore are currently advancing to become a single market for the ride-hailing app with an amount of 600 million users accumulatively. Keeping that in mind, people have the tendency to stick with their preferred application throughout the entire journey, especially when they travel back and forth. Hence, it is important for these ride-hailing companies to appeal to the preferences of these users.

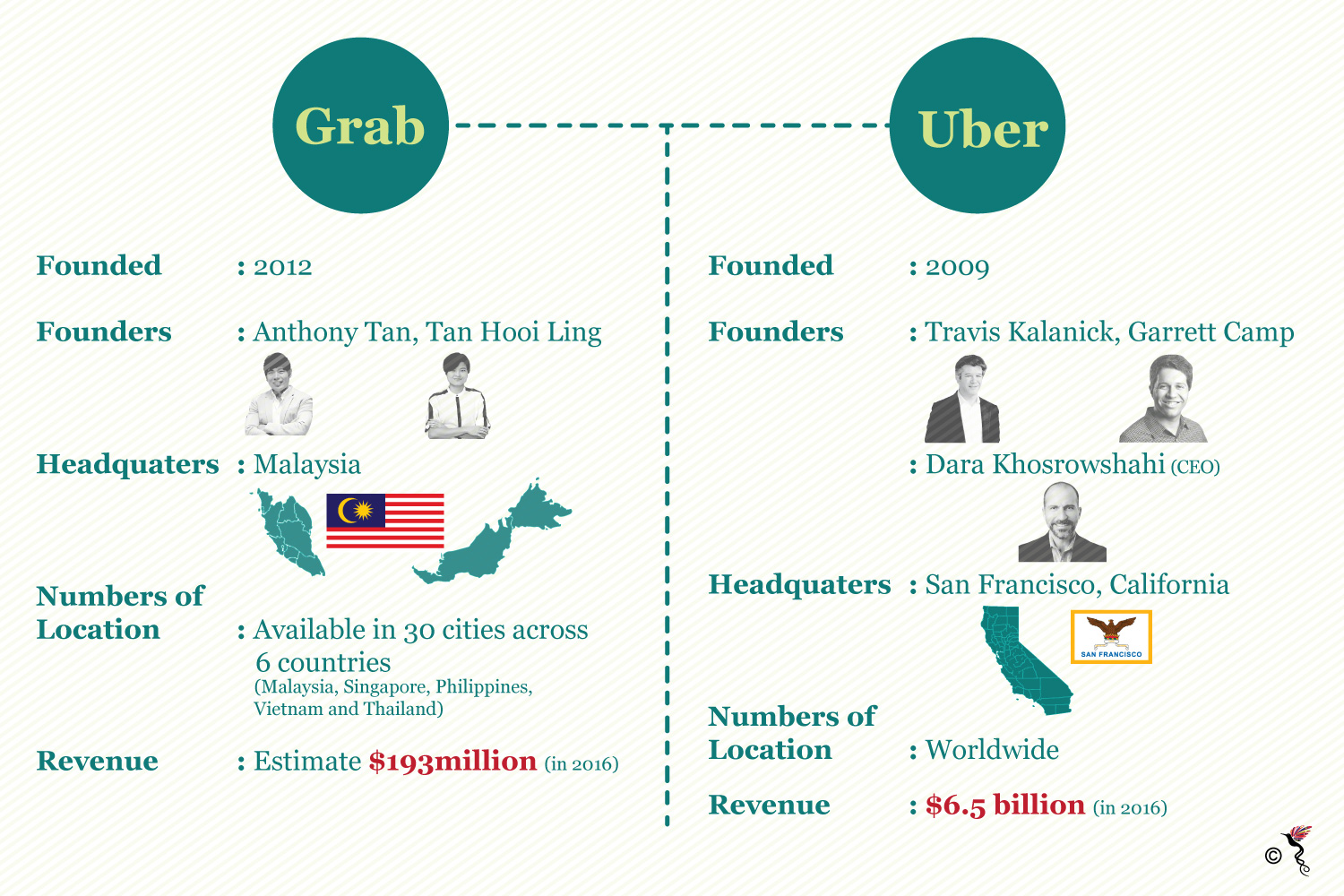

The overview profiles on Grab and Uber in Southeast Asia.

In any competition, there can only be one winner. As pricing policy in Uber is still undetermined, prices of ride-hailing services in each destination may vary from one another. This has created uncertainty among its users which may prompt them to look for other ride-hailing options.

“Based on my observation, the competition between Grab and Uber is getting stiff. Grab is flexible and adaptive but Uber is a little rigid. Why Grab is flexible and adaptive? Grab has a strong competitive edge,” National University of Singapore transport analyst, Lee Der Horng, said when approached by The ASEAN Post.

Grab, originally named MyTeksi, was launched in Malaysia back in 2012. Five years later, Grab currently operates in 87 cities across six nations (Singapore, Indonesia, Philippines, Vietnam, Thailand and Myanmar) within Southeast Asia.

The application's founders, Anthony Tan and Tan Hooi Ling, submitted the business plan of the app as an entry into the 2011 Harvard Business Plan Competition; while only placing second, the ride-hailing application showed potential as they raised 90 million dollars within the first year of its funding exercises from investors like Tiger Global Management, GGV Capital, Vertex Venture Holdings, Qunar and Hillhouse Capital Management.

Partnership offers began pouring in when the application expanded around the Southeast Asian region. Even Lyft (Uber’s main rival in the US) jumped onto the Grab bandwagon which allowed Grab users who are travelling to the US could order rides from Lyft from their Grab app in 2016 before the alliance was called off.

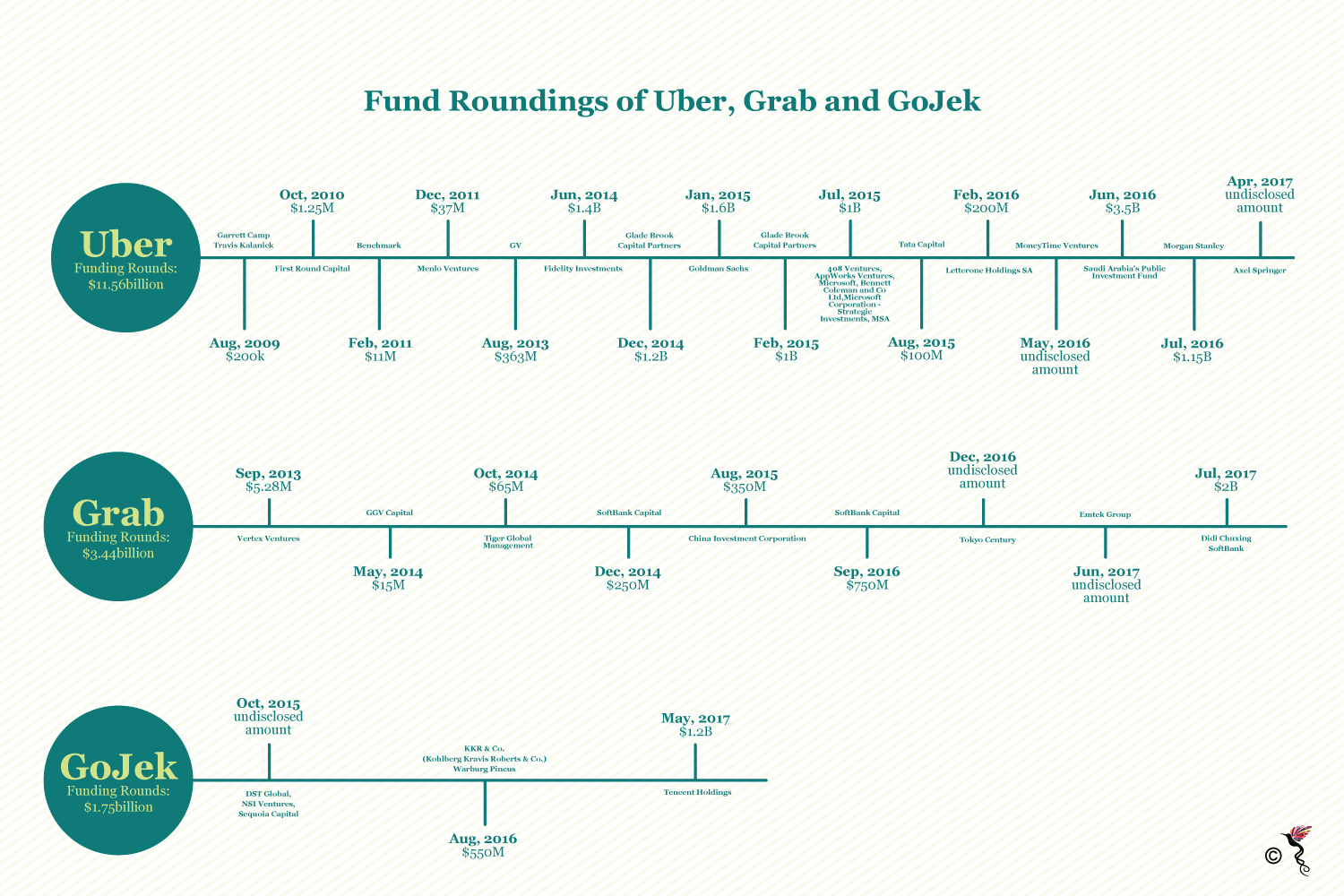

As far as startups go in the Southeast Asian region, Grab is considered a "unicorn" in the industry. The term "unicorn" refers to startup companies like Grab and GO-JEK that have surpassed 1 billion dollars in investment and capital – Grab's current market share is valued at 3.3 billion dollars. The surge of capital investments came from over 10 financiers including SoftBank, Toyota Motor Corporation, Didi Chuxing and Tokyo Century.

Earlier this year, Grab acquired Kudo – an Indonesian startup technology company that develops cutting edge solution to enrich the e-commerce and payment market in Indonesia. “They have their own electronic payment mechanism. One can use the Grab payment system whether in Singapore or Malaysia. They are lowering the bar. Other parts of ASEAN, they (Grab) have mobility needs.” Lee Der Horng added.

However, public’s acceptance for Grab was challenged in countries like Malaysia where taxi cabs have a questionable reputation in regards to safety. When Grab launched GrabCar, there were mixed responses from the users and conventional taxi drivers – customers started to favour GrabCar over taxis due to the lower costs. While it opened up job opportunities, the demand for conventional taxis diminished significantly in countries such as Malaysia and Indonesia where the mobile application was operating in.

Frequent Grab users, Cindy Sahid, 25 from Indonesia and her twin Cinthya Sahid said that using Grab instead of driving their own car was more convenient especially since traffic in Jakarta is well-known for its never ending gridlock at any given time of the day.

“Before there was Grab and GO-JEK, the only other transportations available were either taxis or public buses, with taxis there’s always the question of security – same goes for buses in Jakarta,” Cinthya Sahid said.

At this moment, Grab is one of the leading ride-hailing platforms in many Southeast Asian countries and is valued for its professional management and market reach. Grab also became the first ride-hailing firm to receive a certification from the ISO (International Organisation for Standardisation). Due to Grab's localisation capabilities in Southeast Asia, the firm is able to put quality control measures in place in order to ensure its management, drivers and services adhere to the strict ISO guidelines.

“When ride-hailing apps launched here it was a blessing, its altogether convenient, affordable, and safe because we can share our locations with others. Even though Uber might be slightly cheaper, Grab was payable by cash – Uber only added the cash option later, my debit card was not accepted and I don’t have a credit card like a lot of my friends,” the Sahid twins added in the phone interview with The ASEAN Post.

Like iflix, Grab is leading the competition within Southeast Asian countries, with the exception of Indonesia that has GO-JEK – a one-stop mobile application that offers users services such as ride-hailing, grocery shopping, parcels delivery, as well as beauty and health facilities that users could enjoy from their homes.

Rounding of the three ride-hailing applications in the Southeast Asian region.

GO-JEK dominated the Indonesian market by creating an Uber-like system for motorcycle taxis. It outfoxed Uber in Indonesia by supplying a more convenient mode of transportation that locals prefer over riding a car and getting stuck in traffic. The company plays a huge role in bolstering the Indonesian economy by opening a new market for job seekers. Much like its tagline "life without limits", this Jakarta based startup has proven that there is no limit to innovation and technology.

“It was always a hassle to deliver orders through the post office, now I can just use Go-Send and I’d know that the package has been delivered – on the same day,” Dwi Putri Martania, 25 an online shop owner said when The ASEAN Post called for a comment.

“It’s not just delivering packages; I can buy tickets for shows at the cinema that I know will be sold out, I can have a mechanic come to me if my car broke down, I can even get an hourly housekeeper while I get my nails done. GO-JEK is everything one can need, and it’s affordable,” Martania added.

In the past three years, GO-JEK has raised up to 1.75 billion dollars within three rounds of funding from its investors. It has not only achieved the illusive "unicorn" status, but has also dominated the local market.

Grab might have lost the battle in Indonesia, but it has emerged victorious in the war for the regional market with up to 2.5 million rides being recorded daily while Uber still has a long way to go in order to catch up to Grab's performance.

Grab and Go-JEK's successes in the ride-hailing industry within Southeast Asia proved that there is a bright future for localised startups that prioritise user experience in their local market, particularly in ASEAN countries, when compared to foreign companies that are attempting to penetrate a market they do not fully understand, such as Silicon Valley's very own Uber and Netflix.