It’s no secret that Southeast Asia has become a hotbed for tech startups. Since 2012, there have been a number of tech companies that have become household names and changed the lives of people in Southeast Asia. Many of these brands are now ubiquitous around the region.

Growth in funding

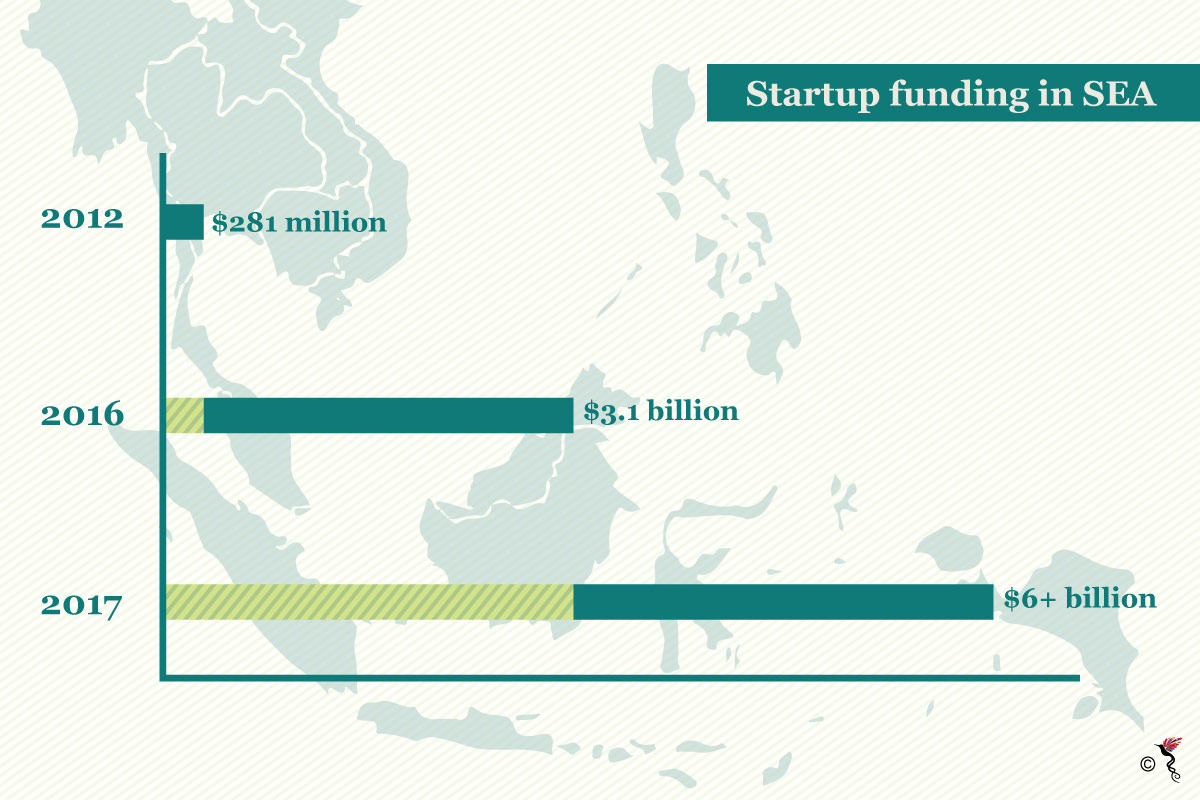

There have been a number of high profile investments in 2017, so it’s easy to forget how large a funding increase there has been in the last half-decade.

In 2012, the total funding to the region’s private tech companies reached a total of 281 million dollars. By the end of 2016, that total had ballooned to 3.1 billion dollars. That is already an impressive increase over a five-year span – but it can't compare to the growth that 2017 has shown so far.

There is a chance that the year’s total funding could match or surpass the total from 2012-2016. As of September 2017, funding totals have more than doubled those from 2016 at 6.4 billion dollars.

So, what has been driving the constant growth? It’s been a mix of innovative thinking and a deep understanding of the unique behaviours of the people who live in Southeast Asia.

Startup funding in Southeast Asia.

Understanding the market

Hyper-local projects, like Go-Jek, have shown that an understanding of the travel preferences of regular Indonesians held a massive opportunity for a motorcycle ride hailing business. As Go-Jek expanded, it took advantage of other opportunities and expanded its services to include food and medicine delivery. This keen understanding of the local market and the foresight to take advantage of all opportunities is what helped Go-Jek raise 1.2 billion dollars in funding earlier this year.

This understanding doesn’t simply allow Southeast Asian start-ups to thrive in their local markets, it also allows these companies to go toe-to-toe with the big boys from Silicon Valley when those brands try to enter the market.

Standing next to the ‘big boys’

This is why companies like Grab are able to stand up and compete with western giants like Uber in the ride-sourcing business. Four billion dollars in funding has given Grab the ability to compete on all fronts. That’s how they’ve become the presence that continually thwarts Uber’s attempts to achieve market dominance.

A good understanding of opportunities within the markets extends further than ride apps. That’s how Lazada became a one-stop hub for online shopping years before Amazon officially entered the market. It will take a lot to take over their lead in the market, which is why Jack Ma’s Alibaba has been willing to bet two billion dollars in the business since 2016.

Another example of a local start-up gaining the attention of big players is Indonesia’s Traveloka. The flight search engine caught the attention of the American company, Expedia. Instead of trying to compete with Traveloka, Expedia made the decision to partner with them instead. This led to an investment of 350 million dollars – and the addition of hotel bookings to Traveloka’s capabilities.

Plenty of opportunities left

A rapidly growing population, improving infrastructure, and increased innovation all but ensure that Southeast Asia will continue to produce quality tech start-ups. While 2018 may not show as much overall growth as 2017 did, it would be safe to bet on tech startups in Southeast Asia to generate real interest from investors.

Data from CB Insights was used in this article.

Recommended stories: