Cryptocurrencies have been the talk of the town, or rather the region in recent times, especially after bitcoin hit a peak of almost US$20,000 at the end of 2017. Cryptocurrencies are digital currencies that use encryption techniques to secure transactions and to regulate the generation of units of the currency. Cryptocurrencies, unlike normal currencies, aren’t regulated neither are they backed by a central bank.

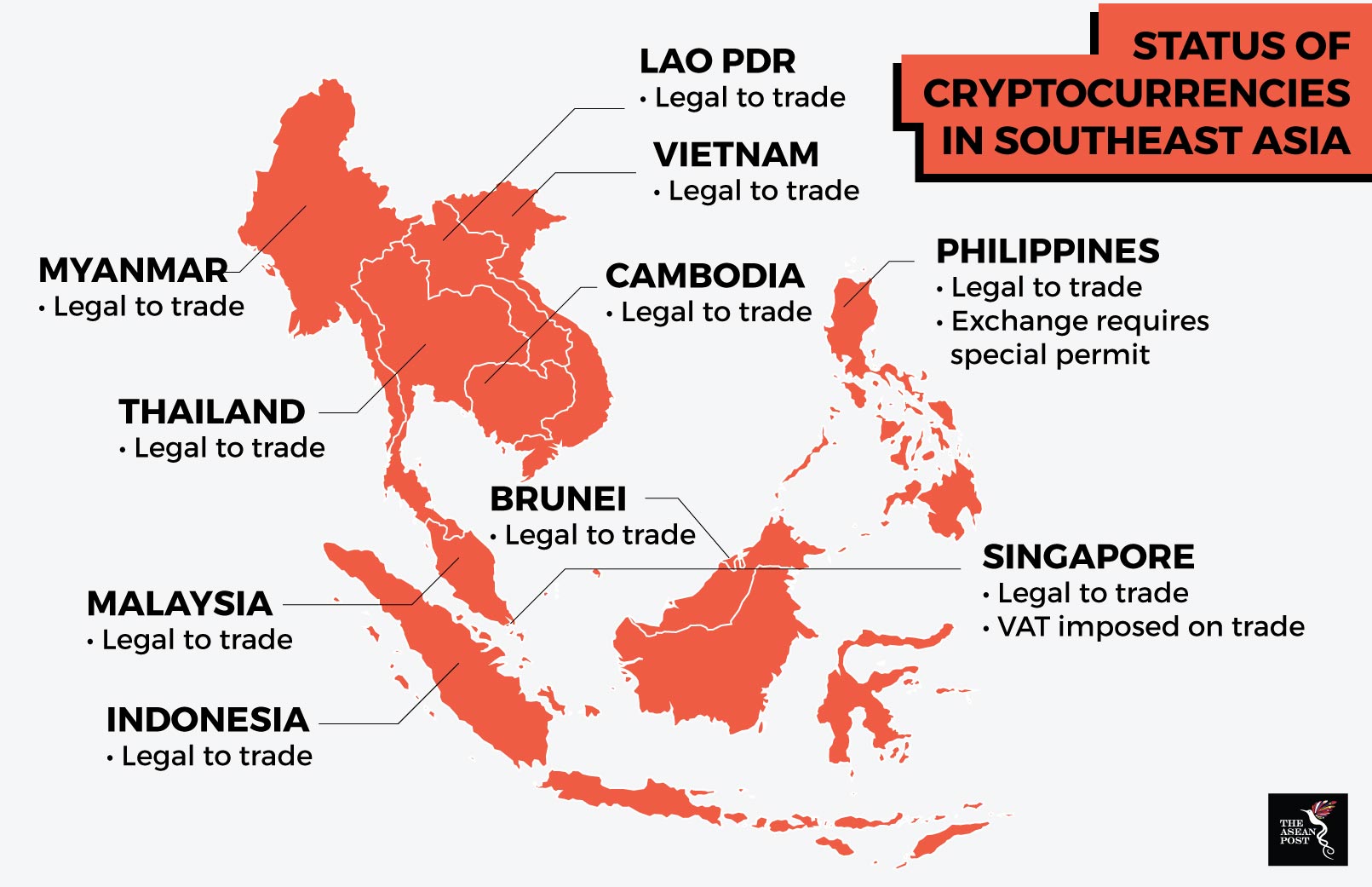

In Southeast Asia, all 10 Association of Southeast Asian Nations (ASEAN) countries allow the trading in cryptocurrencies with only Singapore imposing a tax for those trading in it. On the other hand, the Philippines requires a special permit whenever an exchange occurs. While central banks in Southeast Asia welcome this new currency system from financial technology start-ups, most are wary when dealing with the rise of cryptocurrencies such as Bitcoin and Ether, according to a 2017 Financial Times report.

For the financial sector, blockchain assures faster, more cost-effective and more secure transactions. The transfer of funds between accounts across countries can be done in mere seconds, while current systems take a few days.

Cryptocurrency start-ups are aplenty in the region. Countries like the Philippines, Cambodia and Malaysia seem to be popular destinations for cryptocurrency developers. Some example of such companies includes Filipino Coins.ph, Cambodian Cryptoasia and Malaysian Copycash.

Cryptocurrencies might be full of potential risks - from scams to potential bubble bursts - but there seems to be no signs of it slowing down, much less going away. Despite warnings from governments all over the region, some countries have decided to take steps forward.

Even now, there are new cryptocurrencies flooding the market every day. Just this week in the region, Cambodia, also dubbed the "New Tiger of Asian Economy" by the Asian Development Bank (ADB) has realised the potential of cryptocurrencies and launched their first state-run payment project - Entapay - based on blockchain technology.

The future of cryptocurrency in Cambodia

The launching of Entapay took place this week at the 2018 ASEAN Global Blockchain Summit hosted by the Cambodia Blockchain Industry Development Association (CBIDA). Men Sam An, Deputy Prime Minister of the Kingdom of Cambodia attended the summit and launched the Entapay project as the first official blockchain project endorsed by the Cambodian government.

A press release issued by the summit organisers described Entapay optimistically as “…the link between encrypted currency payments and the real world. It has the great potential to even replace Visa as the new mainstream mode of payment.”

Entapay will promote payment efficiency for digital currency users and also reduce certain marginal costs.

The CBIDA was also launched at the summit in Phnom Penh. The association aspires to create the first world-class "international digital special economic zone" and build an excellent blockchain platform for the establishment and development of blockchain enterprises.

Meanwhile, by developing blockchain technology and applying the cooperation exchange platform, the association intends to encourage ASEAN member countries to get more involved in this new financial technology and help to facilitate the development of a global intellectual economy.

Essentially, with the additional support from China and other countries within ASEAN as well as other regions in the world, the CBIDA will be the single hub for the Cambodian government for all issues related to cryptocurrency.

Concerns

Financial institutions and experts have alerted users and businesses about the negative aspects of cryptocurrency. Due to its anonymous and unregulated nature, its inability to be converted into hard currency can be used to elude important banking protocols that are needed for security purposes.

Since digital currency transactions are recorded on a ledger known as the blockchain, which is not maintained by any central banking authority but rather by independent computers, trade across borders can be carried out with minimal or no oversight.

For Cambodia, a national cryptocurrency may seem like a viable option for now. However, without the sanction of its central bank, there is not much that can be done just yet.