Southeast Asia is catching the video streaming bug as video streaming services proliferate in the region. Gone are the days where people would go to video or DVD rental shops to get the latest movies. Even traditional TV is on the wane now as video streaming allows users to choose whatever they want to watch anytime as opposed to having to wait for a favourite programme to air at its allocated time slot.

Southeast Asia’s booming digital economy has attracted big streaming players to make their services available here. Southeast Asia’s digital economy is among the fastest growing in the world, with the digital economy here expected to multiply more than six-fold, to a staggering US$200 billion economy by 2025.

Aside from that, internet penetration rates in Southeast Asia are considerably higher with 58% of the population being on the internet. This number will only rise in the future as internet access and mobile devices become more affordable for the general population.

Another reason why streaming companies want to invest in the region is due to the rising middle classes amid a region that’s fast developing economically. The middle classes are the target demographic for streaming companies because their business models rely on monthly subscriptions and a solid middle-class base would give these companies a sustained revenue stream. Furthermore, the middle classes are the most in tune with the latest technology and pop culture trends hence, the biggest consumers of television shows and movies.

Among these streaming companies is juggernaut Netflix. Netflix is the 10th-largest internet company by revenue and is the biggest name in the streaming business. It was officially valued at US$100 billion last year after reaching 117.58 users globally. Netflix entered the Southeast Asian market last year at a time when streaming services were mushrooming in the region.

Netflix may be a globally recognized brand, but the company had its work cut out when it first entered Southeast Asia. Netflix came in already handicapped in the race due to it’s pricier monthly subscription compared to regional players such as Hooq and iflix.

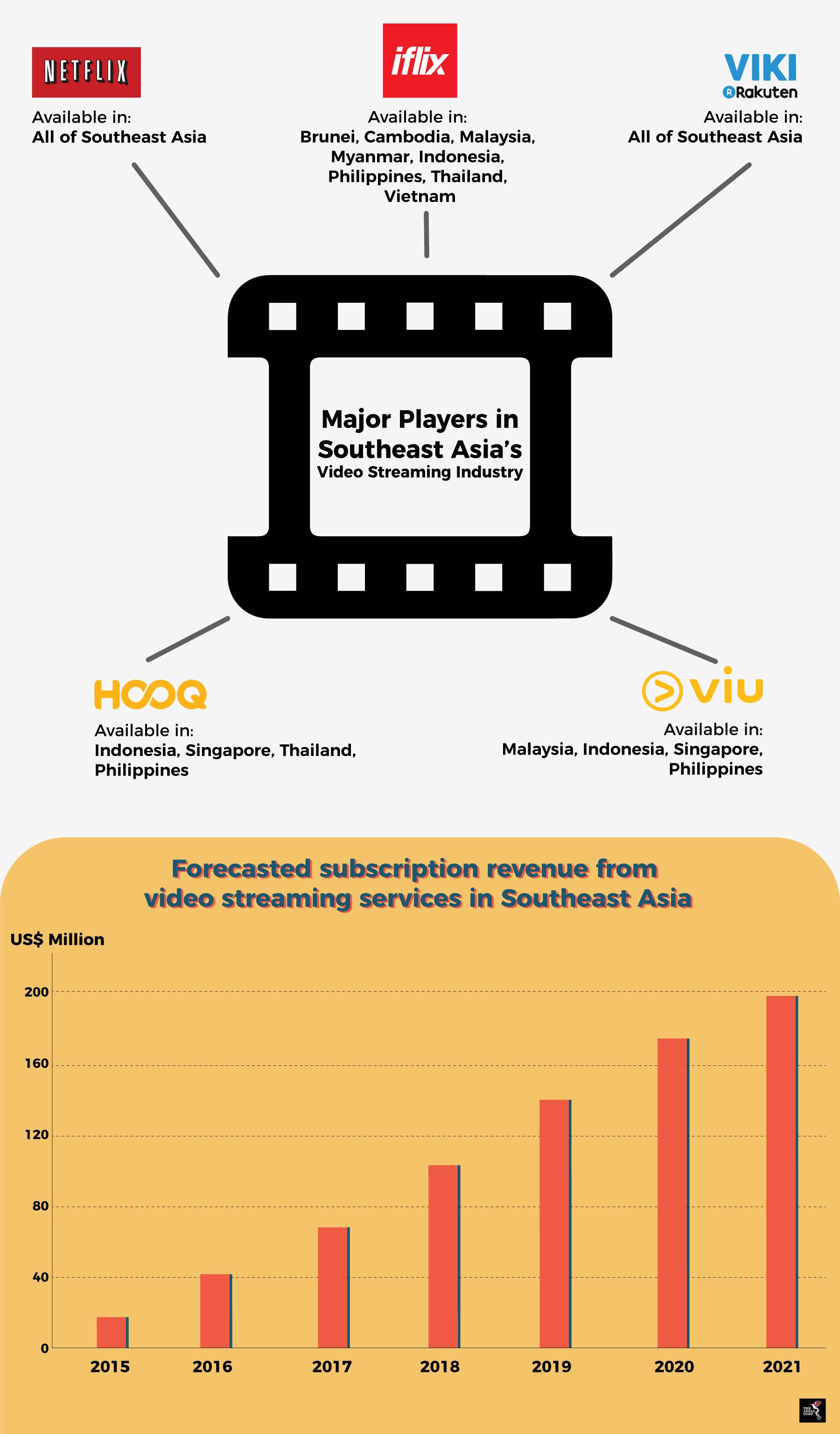

The competition for audiences in the region is a stiff one. Aside from Netflix, Singapore-based Hooq and Malaysian video streaming company, iflix are arguably the biggest players in the region. Both companies have a large footprint in the region, with iflix available in eight countries in Southeast Asia while Hooq is available in five and looking to expand further in the future.

While Netflix might offer blockbusters and renowned TV shows, other streaming services offer more localised and non-English content. iflix offers a variety of localised and non-English content that reflects the diversity of the region. Hooq, a Singapore-based joint venture backed by Sony Pictures Entertainment, Warner Bros., and Singaporean telecommunications company, SingTel also prides itself on its local content. Following in the footsteps of Netflix, Hooq and iflix are also producing their own content as opposed to merely syndicating shows and movies. In an effort to boost original content and increase localised content, Hooq signed a co-production deal with Filipino mobile brand, Globe Telecom and independent studio, Reality Entertainment to produce an original mini-series.

iflix are also doing the same after raising US$133 million from fundraisers to invest in original programming. Meanwhile, Netflix has learnt its lesson, and has begun to include more localised content on its platform. More recently, local comedians from Southeast Asia had their own stand-up specials featured on Netflix.

Another streaming service rapidly on the rise in Southeast Asia is Viu, which initially launched in Malaysia in 2016. Operated by Hong Kong based company PCCW International, Viu operates slightly different from other companies by offering a freemium model – whereby basic services are free but more premium features require a subscription. According to Viu, this tactic has been working out well for the company as premium users tripled last year.

Other regional video streaming companies include CatchPlay and Viki who are working hard to capture the audiences here. Besides Netflix, these companies will also face strong competition from Amazon Prime Video and HBO Go which are projected to expand in the region in the next two years.

The video streaming service industry in the region is rising rapidly. It is expected that by 2021, the Asia Pacific video streaming industry will have 107 million new subscribers compared to 2015, with a 220% surge in revenue from US$5.74 billion to US$18.4 billion.

The growing competition can only benefit the citizens of the region. Not only would good quality entertainment be at your fingertips, you would also be supporting local productions and talent as more companies look to produce localised content.