Food is synonymous with Southeast Asia. From the mouth-watering delicacies in the streets of Thailand, Cambodia, Malaysia and the Philippines – just to name a few – to the Michelin starred restaurants that serve fine dining quality cuisine with a dash of authentic local flavours.

However, food as we know it is not inalienable to advents brought about by technology. Scientific engineering of the various foods we consume has taken mankind a long way on the path to increasing availability, access and quality of food.

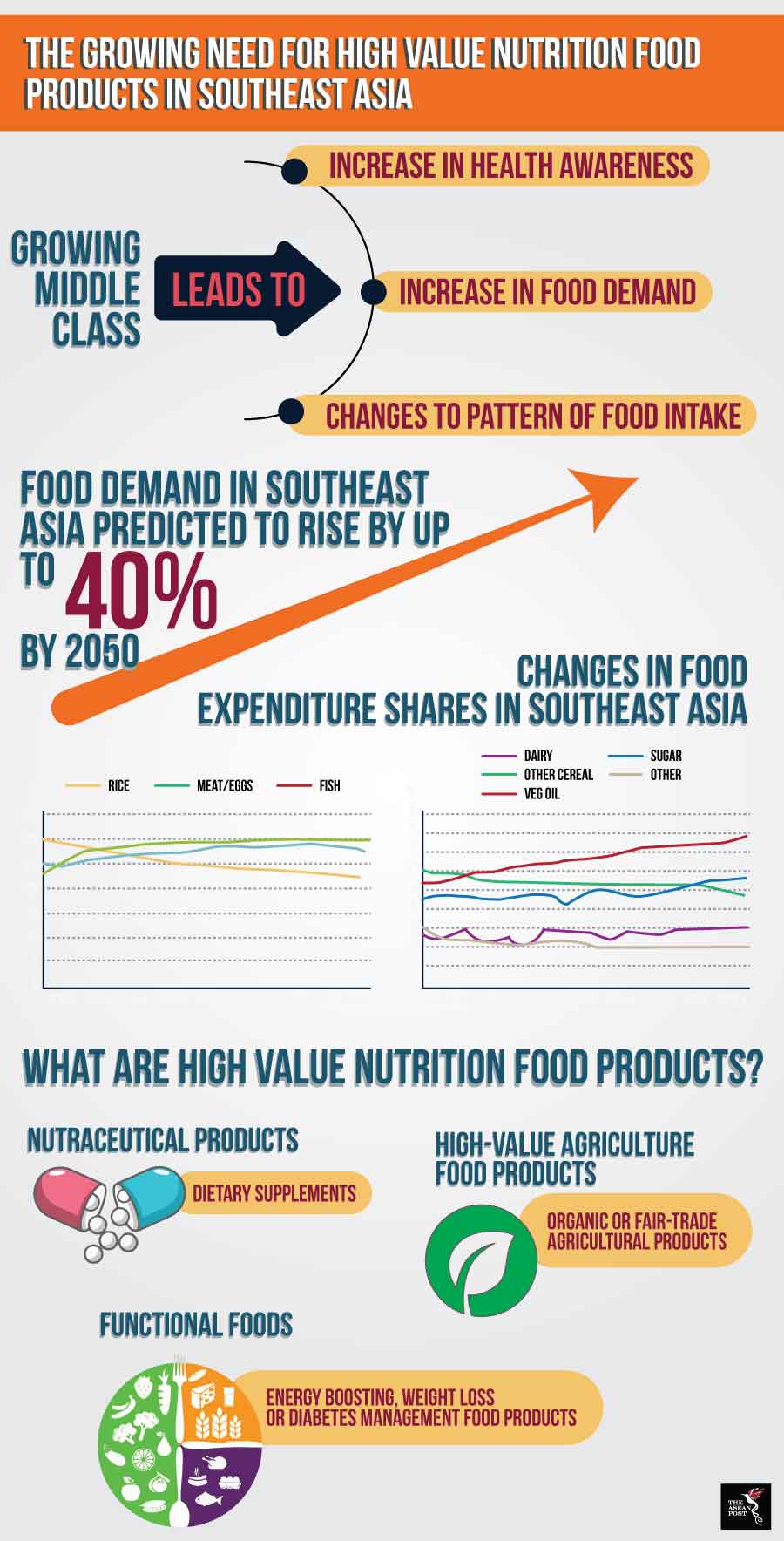

According to the World Economic Forum (WEF), food demand in Southeast Asia is estimated to increase by almost 40 percent by 2050. Coupled with an expanding middle class in the region, it is estimated that these two factors would lead to the specific increase in demand for high value nutrition food products.

What are high value nutrition foods?

High value nutrition foods are food products that supply nutritional benefits beyond the health benefits gained from the regular consumption of food. They are made up of ‘nutraceutical’ products (e.g. dietary supplements), ‘functional foods’ (e.g. energy boosting and weight management food products), and ‘high-value’ agriculture food products (e.g. organically grown and fair-trade food products).

Because such food items are pricier than regular food items, they appeal mostly to urbanites, and are mostly available within urban areas of living where most countries within the region are experiencing a spike in population. By 2050, the overall population of the Association of Southeast Asian Nations (ASEAN) is slated to reach over 700 million and the percentage of urban population within the region is expected to grow to around 65 percent from the current 48 percent.

According to a report by the Commonwealth Scientific and Industrial Research Organisation (CSIRO), the appeal of high value nutrition foods to urban populations is largely due to three underlying reasons.

Firstly, as populations increase, the demand for food will grow. Specifically, when the middle class grows, the demand for safer food – which adhere to global food safety standards – will begin to see an uptick.

Secondly, Asian diets have begun to evolve – with the growing consumption of processed foods being an integral factor – and has led to an increase in the rates of chronic diseases. To counter that, many urbanites are now prioritising health-conscious food.

A 2015 Nielsen survey revealed that 93 percent of Asia Pacific consumers are willing to pay more for foods with health attributes. Lastly, a growing awareness of food sustainability has prompted a rise in socially responsible food purchases. The report also indicated that consumers in the region are beginning to purchase fair trade products and food items which are sourced sustainably.

Source: Various sources

Source: Various sources

Regional progress

Although the regional production of high value nutritional foods is rather nascent, it doesn’t mean that Southeast Asia is without potential. Within the region, Thailand leads in terms of organic agriculture with sales figures for organically grown food increasing seven percent yearly between 2010 and 2014. Singapore is also fast becoming a hub for functional foods with the establishment of the Clinical Nutrition Research Centre in 2014. The centre aims to pursue research in understanding how food may be used to prevent and manage chronic disease and to promote healthy aging.

The growing market for functional food in the Asia-Pacific region – projected to be valued at US$5 billion by 2026 – has piqued the interest of start-ups looking to tap into this immense potential.

Life3 Biotech, a food tech start-up based in Singapore aims to develop functional foods which utilise natural, plant-based ingredients. The island nation is also home to Alchemy Foodtech which combines food tech, biotech and medtech to develop foods that can help prevent and manage diabetes. Over in Indonesia, the likes of TaniHub, eFishery and Jala all aim to develop sustainable methods of sourcing and selling organic food products.

For funding options, start-ups can look at VisVires New Protein (VVNP) – a Singapore-based venture capitalist firm focussing on disruptive food technology.

Globally, there is a shift in the way urban populations consume food – whether it is organically sourced, or genetically modified. Today, food technology is fast becoming a mainstream focus as people in general want to know more about the various foods that they consume.

Related articles: