Southeast Asia continues to be urbanising at a rapid pace. Alongside this phenomenal growth, a younger and increasingly wealthier urban consumer base with bigger spending power has been steadily growing.

This growth is set to boost the online consumer sector even more as the rapid use of technology is poised to add another facet to how citizens in the region shop. Within the 10-nation grouping of the Association of Southeast Asian Nations (ASEAN), there are over 200 million digital consumers who have purchased goods and services online and 230 million online-engaged consumers who have researched products or services online exclusively.

New digital channels, vastly available through the internet are changing consumer spending patterns. Coupled with the startling growth of smartphone usage and increasing broadband penetration in the region, companies now must extend from the traditional brick and mortar model and embrace digital retail.

E-commerce boom

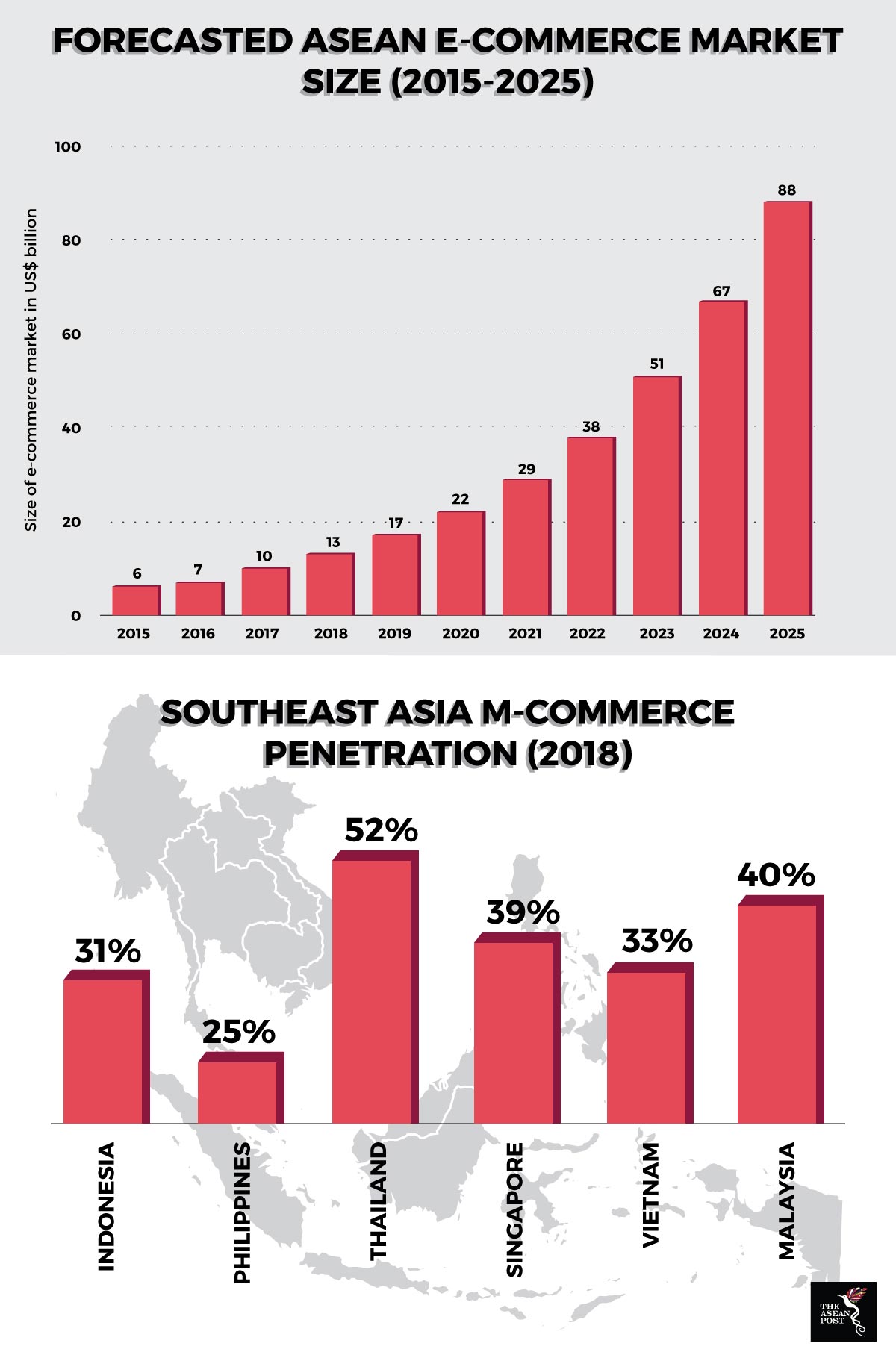

The e-commerce market in the region is set to grow at a compound annual growth rate (CAGR) of 31 percent until 2025 with an expected value of around US$88 billion.

Indonesia is set to be the leading e-commerce player within the region, accounting for 52 percent of the total growth in this market by 2025. The Indonesian government is actively making regulations there conducive to allow more foreign investment into the sector. Already, 100 percent foreign ownership is allowed for businesses approved by the Investment Coordinating Board (BKPM).

Within developed ASEAN, Singapore is the most advanced e-commerce market. It has the highest internet penetration and speed rates which make it easier for digital businesses to thrive. Besides that, it is ranked second on the Ease of Doing Business Index which is the reason why Southeast Asian e-commerce giants like Lazada and Zalora have chosen to be headquartered in the island republic.

In Thailand, the government’s Thailand 4.0 digital initiative is set to have a monumental effect on the country’s e-commerce sector. Current trends indicate that e-commerce will continue to be the primary mode of purchase as digital sales have been growing at more than 100 percent – outpacing the growth of physical store purchases.

Elsewhere, Malaysia continues to show promise within the e-commerce market, as it seeks to improve internet user penetration and broadband speeds. However, as of 2016, only around one-third of purchases were made online. Vietnam and the Philippines are also rapidly developing online retail markets, although, the e-commerce scene in these two countries are relatively quiet when compared to their neighbours.

Source: Various sources

Despite the widespread adoption of e-commerce in the region, ASEAN still lags behind global markets like China, Japan, the United States (US) and the European Union (EU) by a significant amount. Most ASEAN countries register a smaller percentage of e-commerce sales in the retail sector of around just four percent. The figures pale in comparison to those of China at 16 percent. There is still plenty to be done in terms of improving infrastructure to deliver higher internet speeds. Building consumer confidence in online retail and beefing-up transaction security are also key areas that need attention.

Leveraging on ASEAN’s strength

To improve the latter, ASEAN should rightly leverage on one of its unique strengths – mobile commerce. M-commerce as it is otherwise known, has seen a significant boost thanks to skyrocketing mobile connectivity rates.

Mobile subscriptions in ASEAN have increased well above the global average. The number of connections has exceeded the number of people living in the region with many having more than one active SIM card. About 21 percent of the population – or 130 million people – are smartphone users and 89 percent of internet users utilise smartphones as their primary device.

M-commerce will likely gain momentum at a rapid pace as 3G and 4G networks become more pervasive across the region. Furthermore, smartphones in general are becoming more affordable across the globe and consumers living in the region have been taking advantage of this. In 2017, 62 percent of smartphones shipped to Southeast Asia were priced at US$150 or less.

Stronger networks and increasing smartphone penetration rates are making ASEAN consumers among the world’s strongest adopters of social media for shopping. According to a 2018 report by We Are Social, social media penetration in ASEAN stands at 53 percent – 16 percent higher than the global average of 37 percent.

ASEAN shoppers use social media platforms like Facebook and Instagram especially on their smartphones to transact online, read product reviews and gain access to promotional offerings by some of the top brands in the world. In 2016, an estimated 30 percent of digital sales in the region took place via a social network compared to 16 percent globally.

With technological strides being made and urbane middle-class population growth in the region, companies must recognise the shift in customer focus from offline to online. On top of that, online services offer supplementary value-adds that are tailored to the specific requirements of consumers which make them more attractive compared to traditional retail options.

Going forward, technology will continue to evolve and it won’t be too long before we see the incorporation of virtual reality, augmented reality and artificial intelligence being used to revolutionise the retail space as never before. For retailers to stay relevant, they must take heed of these changes and embrace the unprecedented opportunity to tap into such technologies to ensure growth and relevance. Those who succeed in doing so will then be able to attract an increasingly larger segment of society, build consumer loyalty and ultimately capture a greater share of the retail market.