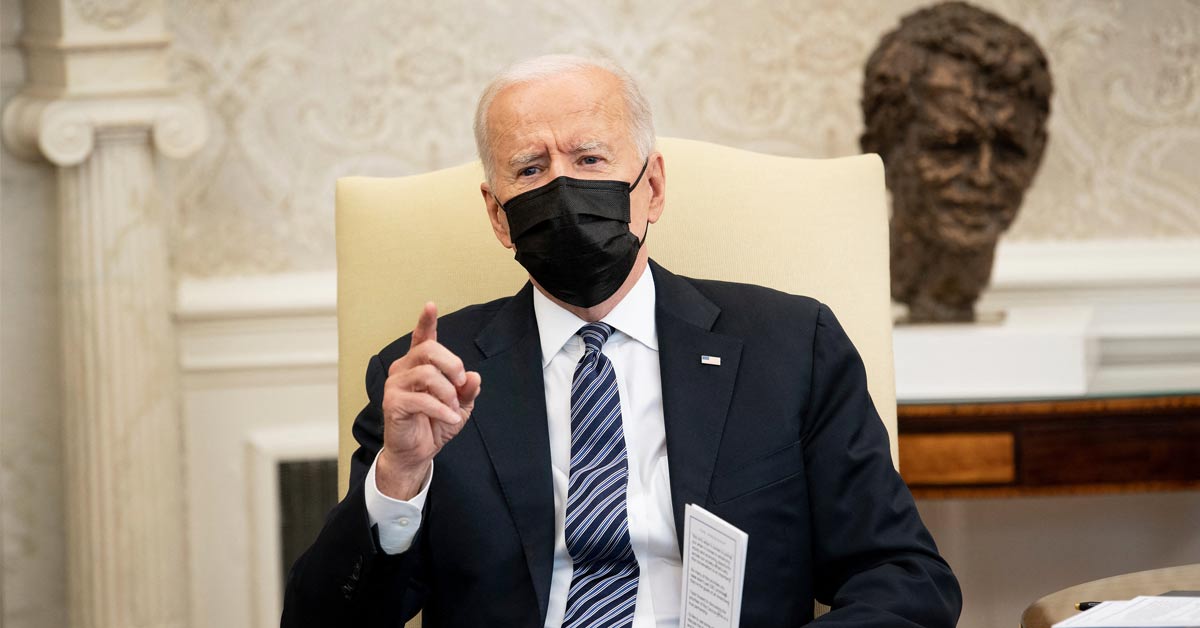

A big quake may be headed towards California. No, it is not the 7.5 magnitude earthquake that Californians have been worried about. This has only a 31 percent chance of happening. And that too from now to 30 years. Of a higher probability is the quake-causing reforms United States (US) President Joe Biden is sending the way of Big Tech in northern California.

The tech giants are surely going to feel the earth move under their feet. Not only will many Americans be happy to see them so shaken up, but so will many around the world. The people's disquiet is understandable. Beginning as start-ups in the brave new world of the internet, the tech giants had promised a level playing field for all.

Today, they are the internet. Well, almost. People expected the internet to turn the digital cyberspace democratic, but instead, it has been turned into a behemoth take-all world. Little wonder the tech titans are called FAANG (Facebook, Amazon, Apple, Netflix and Google).

Biden is doing what his two predecessors – Barack Obama and Donald Trump – didn't do. One of the reforms – a minimum global corporation tax of 21 percent – will fang-like bite at the serious money they are making around the world.

The Age of Australia estimates this to add an extra US$300 billion in annual taxes globally and "deal a hefty blow to the complex tax avoidance and profit-sharing measures adopted by many of the world's biggest and most profitable companies".

Serious money for the companies also means colossal cash for the people behind the titans.

Celebrity Net Worth, a website for billionaires, gives just the flavour we need. As of 11 April, there were eight centi-billionaires. Topping the list is Jeff Bezos with US$197 billion, followed by Elon Musk (US$176 billion), Bill Gates (US$144 billion), Bernard Arnault (US$132 billion), Mark Zuckerberg (US$118 billion), Larry Page (US$104 billion), Warren Buffett (US$101 billion) and Sergey Brin (US$100 billion).

Tax is just one quake headed the Silicon way. Appointments at the Department of Justice, the Federal Trade Commission (FTC) and elsewhere are expected to regulate the tech titans' 30 years of uncontrolled growth. The Financial Times says this could range anything from the imposition of limits on the companies' legal protections, to breaking them up.

Robin Pagnamenta, in an op-ed for The Age, suggests that two Biden nominees for the FTC and the White House, Lina Khan and Tim Wu, may just end up changing the industry enormously. A more aggressive approach is always welcome.

The two legal scholars are known to be vocal critics of Big Tech. In her article titled, "Amazon's Antitrust Paradox" written for The Yale Law Journal, Khan signals the change that she loves to see happen. The current framework in antitrust, she argues, is unequipped to capture the architecture of market power in the modern economy.

She has a point. Presently, antitrust regulations view competition through a narrow set of outcomes. Price is one of them. Viewed this 1980s-way, Amazon with its low prices will emerge as the customers' darling. Not so if the entire competitive process is examined. The regulator's lens must focus on the structure of a business and the structural role it plays in markets. It is only in this way that the dominance and evil it does in the market are uncovered.

Antitrust laws must help spot the demon, and not mistake it for a darling.

This article was first featured on 14 April, 2021 in the New Straits Times.

Related Articles: