Thai energy companies are growing beyond the country’s borders, with projects slated for the rest of the region. These planned projects are a testament to Thailand’s energy policies and the savviness of its energy companies.

It is not just the big oil giants such as PTT or B Grimm that are expanding throughout the region but renewable energy companies such as Wind Energy Holdings and solar company Superblock are also branching out in the region.

Domestically, Thailand’s energy needs are being reoriented towards renewable energy. Previously, Thailand used to be dependent on fossil fuels for its energy needs. However, according to data from the Ministry of Energy, Thailand has about four or five years left before it runs out of oil or natural gas. Therefore, the government there is looking to renewable energy as an alternative to fossil fuels.

Sources: Various

In 2015, the country launched the Thailand Integrated Energy Blueprint (TIEB) – a document that maps out its energy goals from 2015-2036. The TIEB consists of five plans outlined by the Thai government – the Power Development Plan (PDP), the Energy Efficiency Development Plan (EEDP), the Alternative Energy Development Plan (AEDP), the Natural Gas Supply Plan and the Petroleum Management Plan. Under the AEDP, the Thai government has highlighted its intention to source 30 percent of the country’s total energy consumption from renewables.

This probably explain the expansion of Thailand’s energy companies outside the country. Oil companies such as PTT need to look for new markets, while other companies benefitting from the boom in the renewable energy sector in Thailand are looking to expand to other countries as well.

Furthermore, energy demand in Southeast Asia is expected to soar in the coming years too. It makes sense that these companies would want to cash in on this demand quickly before competing companies enter the fray. According to the International Energy Agency (IEA), the region’s demand for energy is forecasted to grow by as much as 60 percent by 2040.

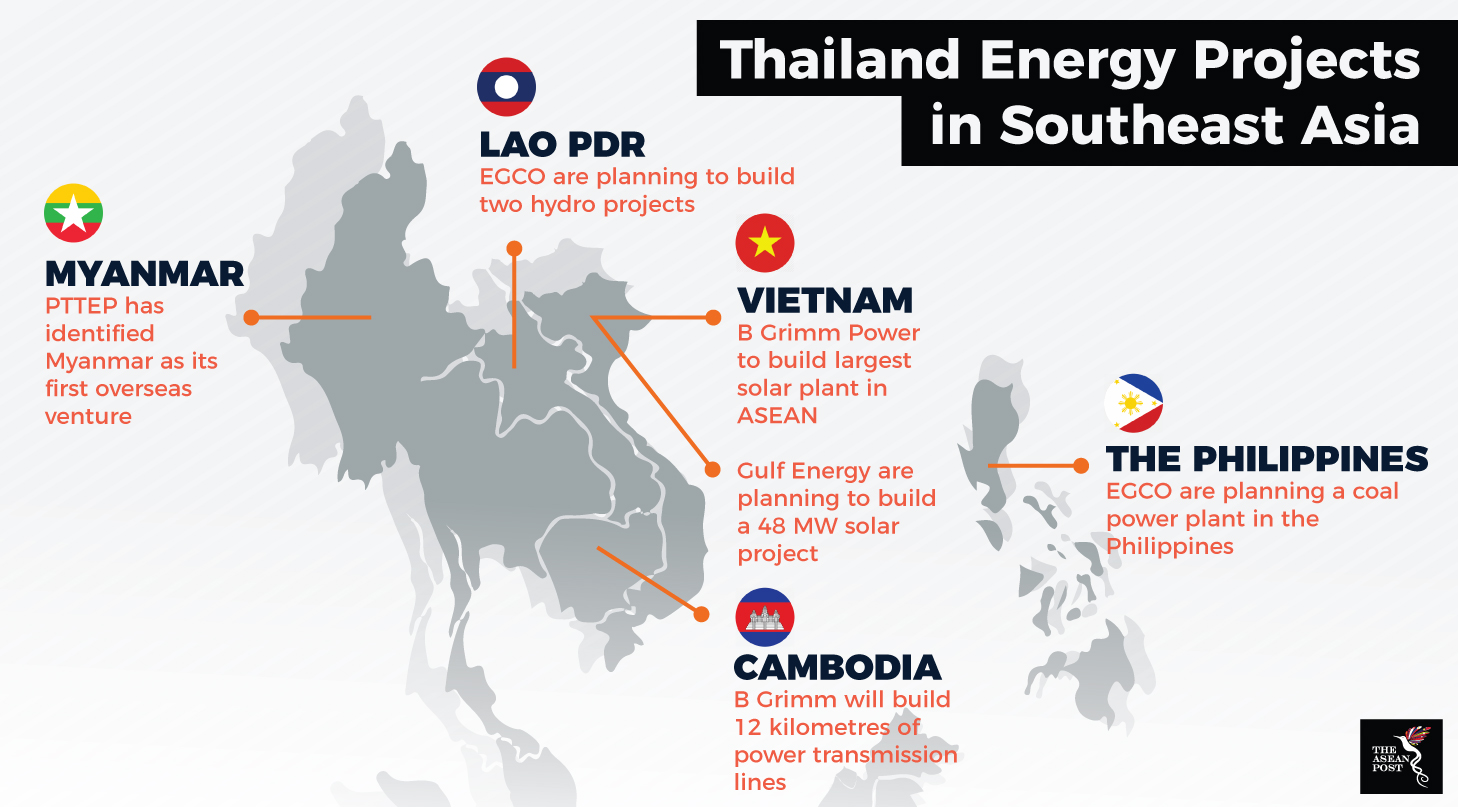

For example, PTT Exploration and Production, a subsidiary of state-owned energy company PTT, has identified Myanmar as one of the countries where it will invest heavily in technology and innovation. Myanmar will be the company’s first overseas venture in Southeast Asia.

Coal company Banpu reported in February a 250 percent surge in annual profit, partly because of new coal mine investments, including those in Indonesia, and power projects in China and Japan.

The biggest beneficiary of the growing demand for energy is the renewable sector. Due to Thailand’s early push for renewables as opposed to the rest of the region, its energy companies are leading the way in terms of renewable development in the region. Superblock, Thailand’s largest solar company, is branching out with a US$1.8 billion investment for wind farms in Vietnam.

More notably, the Asian Development Bank (ADB) has signed a US$235 million loan with Thailand conglomerate B Grimm Power to develop renewable energy projects throughout the Southeast Asian region. Prior to that, the ADB purchased a US$57.7 million equity in B Grimm Power during an initial public offering. The proceeds from the initial public offering is said to be earmarked for renewable energy projects around the region.

“B Grimm Power is at the forefront of the region’s fast-growing alternative energy sector,” said Michael Barrow, Director General of ADB’s Private Sector Operation’s Department.

The push for renewable energy in the region is a relatively new trend. Ever since ASEAN member countries signed the Paris Agreement and following the global push for renewable energy, most ASEAN countries have developed roadmaps for integrating renewable energy into their respective energy mixes. Compared to 10 years ago, the growing demand for renewable energy has also made it more affordable today. Due to Thailand’s foresight and early moves in the market, its companies are now profiting.

Thai energy companies are leading the way in terms of renewable energy in the region and it’s not by accident. These companies are flourishing because of their government’s planning, support and desire to develop a vibrant renewable energy sector. Other ASEAN countries have plenty to learn from this.