Norway, Germany, France and the United Kingdom (UK) have already announced an end date for the sale of gasoline and diesel cars. Norway has set its deadline as 2025 earliest, Germany and India in 2030 while France and the UK are planning to end the sale of gasoline and diesel cars in 2040. Meanwhile, other countries are also mulling doing the same thing.

While this paints a bleak picture for the world’s oil industry since gasoline is the most consumed petroleum product, the scenario is different in Southeast Asia. According to the International Energy Agency (IEA) Southeast Asia Energy Outlook 2017, oil demand in the region is expected to increase steadily. The report points out that oil demand is set to increase from 4.7 million barrels per day to around 6.6 million barrels per day in 2040.

State of oil in Southeast Asia

Despite the rise in demand for oil in the region, oil production is expected to drop. It is forecast that oil production will drop by 30% by 2040. Aside from Brunei and Thailand, the region’s biggest oil producers such as Malaysia, Indonesia and Vietnam are having a tough time keeping up with the growing pace of oil demand in the region.

IEA reports that oil production in Southeast Asia is declining or will decline leading up to 2040. Indonesia, who is the biggest oil producer in the region is currently facing a crisis of sorts in its oil production. Since 2000, Indonesia has seen a 40% drop in oil production. Indonesia’s oil production is expected to drop to 510 thousand barrels per day from today’s 880 thousand barrels per day. Besides that, with the current climate of the global oil industry, Indonesia is struggling to find capital investment to fund explorations for new oil reserves.

Meanwhile, Malaysia, the only other country aside from Brunei that remains a net oil exporter, still maintains the same level of oil output since the early 2000s. However due to declining reserves, output is expected to further decline in the future.

Dwindling reserves and lower investments in oil infrastructure and exploration has led Southeast Asia going from being self-sufficient in oil products to becoming a net importer. Oil production as a whole in the region is expected to drop 30% by 2040, while oil imports are expected to multiply more than two-fold.

Source: International Energy Agency Southeast Asia Energy Outlook 2017

Planes, trains and automobiles

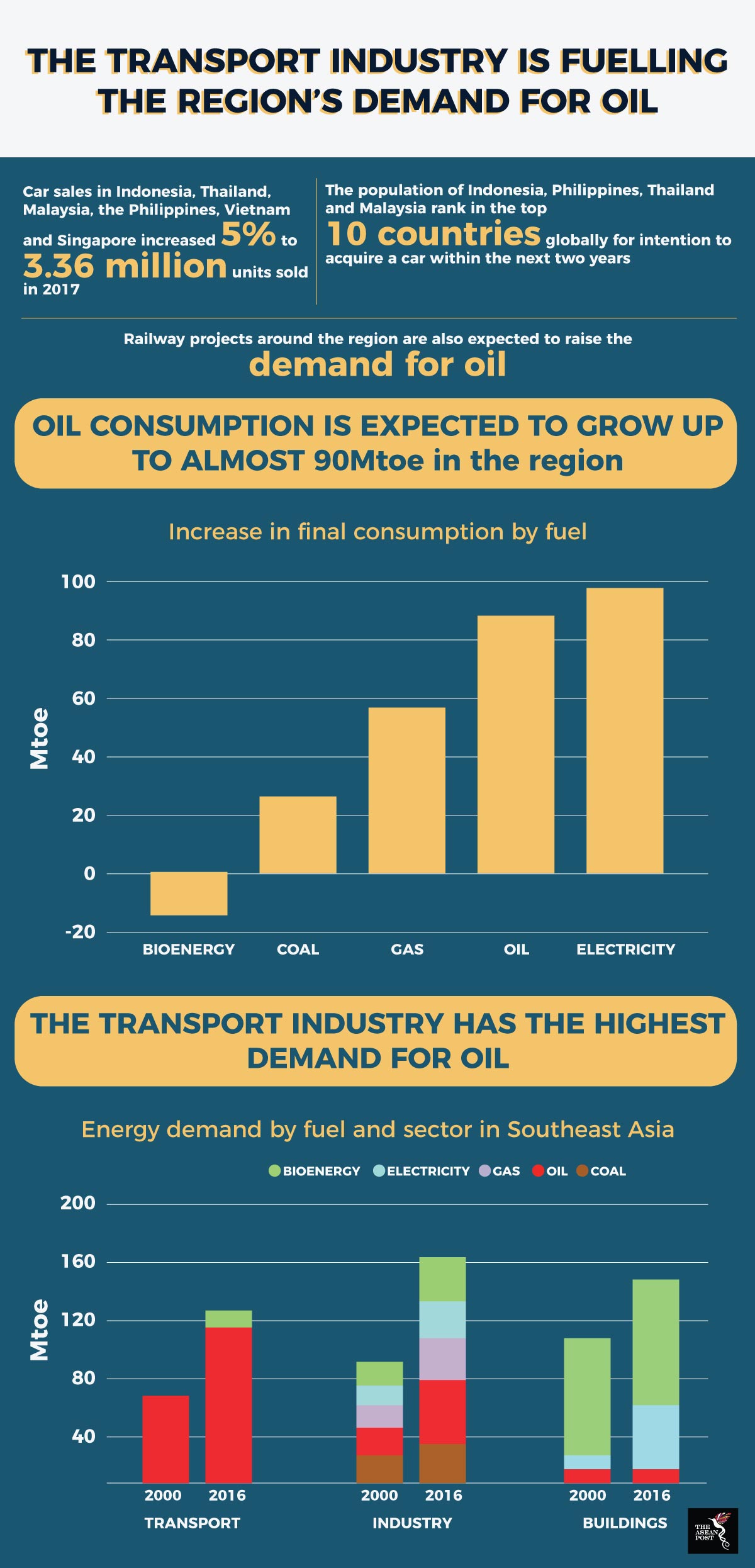

One of the main drivers for the increase in demand for oil is the access to mobility the region has enjoyed for the past few years. Over the past decade, we’ve seen more airports and budget airlines being established in the region. Southeast Asia has also become a travel hub for tourists from China. With more planes whizzing in and out of tourist destinations in the region, more fuel is needed to fly these airplanes.

Aside from that, the infrastructure boom in the region could also be responsible for driving up demand for oil in the region. Almost every country in Southeast Asia is undertaking massive railway projects to improve local and regional connectivity. Once these projects are completed, they would need massive amounts of oil to run the trains.

Another burgeoning industry in the region is the automotive industry. Last year, aggregate new car sales in Singapore, Indonesia, Malaysia, Thailand, Vietnam and the Philippines rose five percent to nearly 3.4 million units sold. Aside from that, it is estimated that vehicle ownership across the region is expected to grow more than 40% by 2040.

The IEA projects that oil will meet around 90% of transport-related demand by 2040. The increased demand for oil might indicate that Southeast Asia’s economy is growing but it’s also bad news for our environment.

The transport industry, more particularly the automotive industry’s reliance on oil is something that can be mitigated. Just like how other countries are planning to ban gasoline and diesel cars, ASEAN countries should aspire to be like that one day. What’s important is taking that first step in that direction.