The wait is finally over. After weeks of speculation that Uber’s Southeast Asia’s operations would be sold off to Southeast Asian ride-hailing giant Grab, the deal – the largest of its kind in the region – was officially announced earlier today.

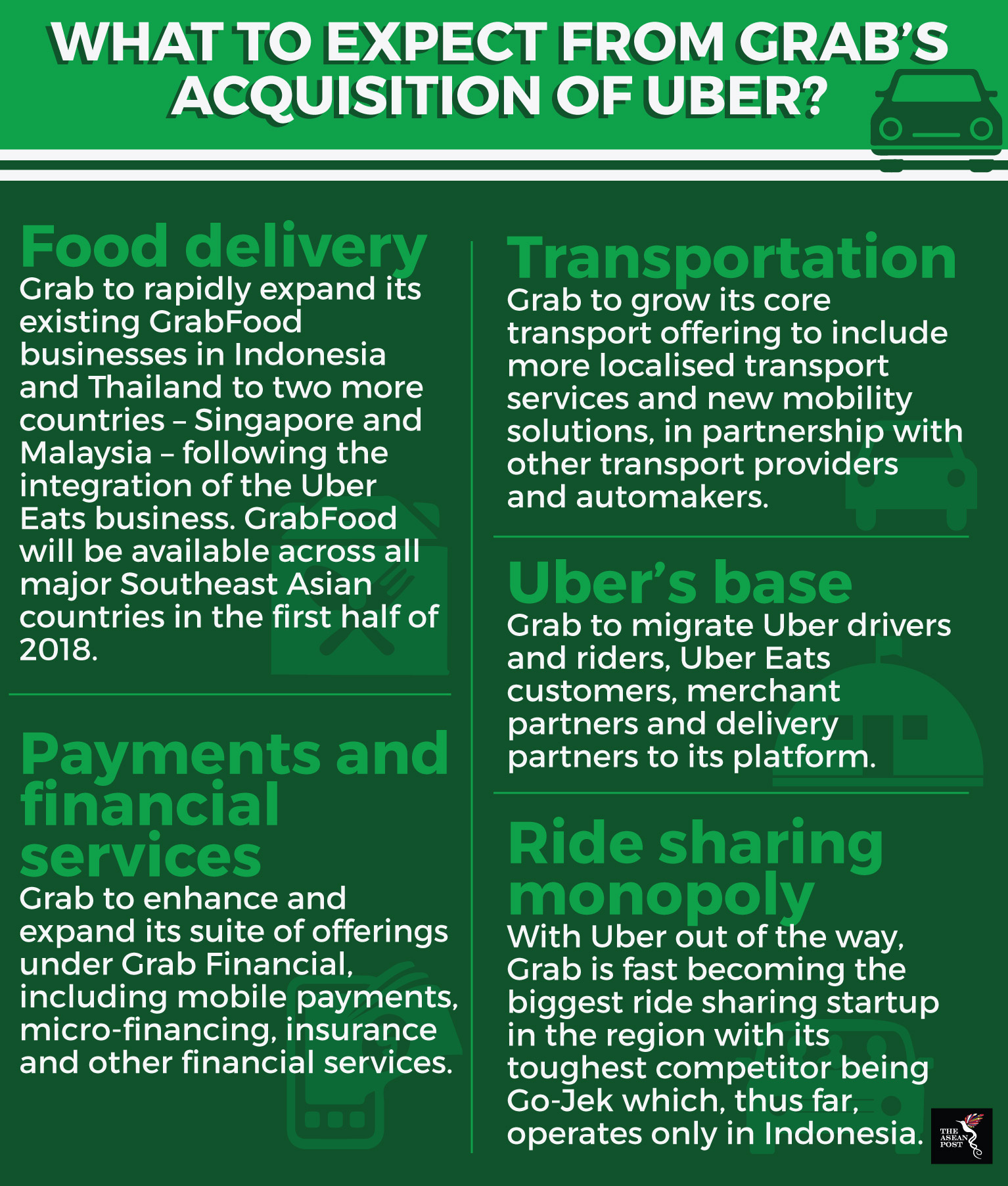

According to the media release from Grab, Uber’s ridesharing and food delivery business (UberEats) will be integrated into its existing multi-modal transportation and fintech platform. This would push the Singaporean based startup towards becoming the top online-to-offline (O2O) mobile platform in Southeast Asia and a major player within the food delivery market.

Grab would take over Uber’s operations and assets in Malaysia, Indonesia, Singapore, Thailand, Vietnam, Myanmar, Cambodia and the Philippines. While the exact sale price was not disclosed, as part of the acquisition deal, Uber would take a 27.5 percent stake in Grab and its Chief Executive Officer (CEO), Dara Khosrowshahi will be given a seat on Grab’s board of directors.

Anthony Tan, Group CEO and Co-founder of Grab hailed the acquisition as “…the beginning of a new era.”

“The combined business is the leader in platform and cost efficiency in the region. Together with Uber, we are now in an even better position to fulfil our promise to outserve our customers,” he added.

Behind the deal

Grab’s purchase of Uber’s Southeast Asian operations comes on the heels of the latter’s dismal performance in the region. Since entering the market in 2013, it is estimated that the San Francisco based startup had burned through a costly US$200 million per year. Adding to that, Uber had been plagued by a myriad of scandals from sexual harassment cases to incidences of corruption and cyber-attack coverups which had severely dented its image and wallet.

On the other hand, Grab, which has been Uber’s fiercest rival in the region had benefitted greatly from its strategy of localising its ride sharing services. In its latest round of funding, it received US$2.5 billion in capital injection from investors which helped in its expansion into Cambodia, at the end of last year, further increasing its regional presence.

Rumours of Uber’s withdrawal from Southeast Asia began when Japan’s SoftBank – which also backs Grab – clinched a deal with the ride services firm in January this year via its US$98 billion Vision Fund. The consortium deal which was based on a discounted valuation of Uber at US$48 billion – 30 percent lower from its previous valuation of US$68 billion – ensured SoftBank became Uber’s largest majority shareholder.

Hence, it would make better business sense for SoftBank to reduce competition amongst ride hailing startups in its portfolio and consolidate such assets. This would only augment its rapid growth in the Southeast Asian ride hailing market which is expected to reach US$20.1 billion by 2025. Besides that, Uber’s planned Initial Public Offering (IPO) in 2019 has necessitated a financial clean-up of sorts leading to exits in not only the Southeast Asian market, but the Chinese and Russian markets as well. Now it seems that much of SoftBank’s investment into Uber will go towards strengthening its position in the North American market ahead of competitors like Lyft.

In an email to employees, Khosrowshahi addressed the recent consolidations and stressed that it is not reflective of its overall long-term strategy.

“This transaction now puts us in a position to compete with real focus and weight in the core markets where we operate, while giving us valuable and growing equity stakes in a number of big and important markets where we don’t,” he wrote.

The bitter pill that the leadership at Uber must swallow is that, the rapid expansion of the company saw it disregarding hyperlocality in its business model – merely transplanting its US business model into other markets. Herein, native ride sharing applications like Grab in Southeast Asia, Didi Chuxing in China and Yandex in Russia proved better adapted to making full use of its value add – which is the understanding of local nuances that helped them secure a significant chunk of the local markets they operated in.

Grab’s victory over its fiercest rival in this region is hence a testament to the importance of hyperlocalisation when doing business especially in a vibrant region like Southeast Asia. It is no surprise then, that by capitalising on this trait, Grab has positioned itself as a market leader in one of the world’s fastest growing regions.