The world is watching as the United States (US)-China trade war unfolds before our eyes. While the trade war might be between two countries, but it’s effects are far reaching, especially in the current globalised landscape we all live in.

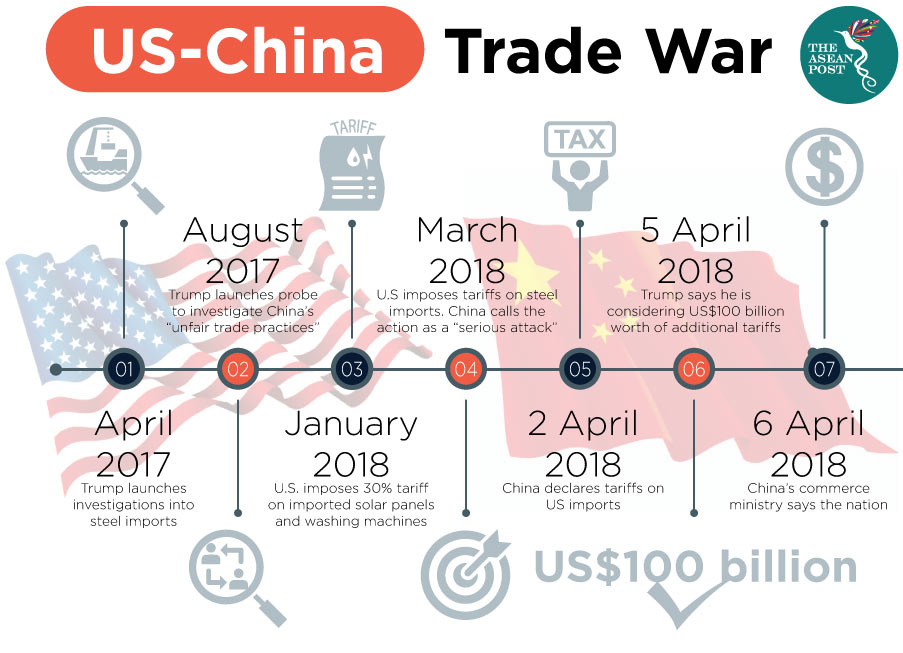

The trade war between the two countries kicked off in January when the US announced a 30% tariff on imported solar panels and a 20% tariff on washing machines. The trade war then intensified when US President Donald Trump imposed a 25% tariff on steel. These tariffs weren’t specifically directed at China but considering the effective monopoly China has over these industries, it’s clear who Donald Trump is targeting. China manufactures over 70% of the world’s solar panels and is also the world’s largest steel producer.

China did not take kindly to these tariffs. It retaliated by implementing tariffs of up to 25% on US$3 billion worth of food imports from the US. China also filed a complaint to the World Trade Organisation (WTO) over the tariffs the US has imposed on China. Angered by China’s retaliation, Donald Trump made a statement threatening more tariffs worth US$100 billion but such high tariffs are unlikely, even for Donald Trump.

Donald Trump’s attacks on China and their exports is not surprising considering his election pledge to “Make America Great Again”. According to Donald Trump’s logic, tariffs, especially the one imposed on steel imports will reinvigorate the steel manufacturing industry in the US. For Trump, the US’ reliance on cheap steel imports from China is what killed the local steel industry.

Donald Trump’s decision to pivot the US away from free trade into protectionism could not end well. The US imports products from China more than any other country in the world. With the tariffs in place, this could hurt the average American consumer as prices of Chinese goods will go up.

Aside from that, the effects of the trade war between the two countries are being felt all over the world. Despite the trade only involving two countries, the nature of global capitalism has made it impossible for a country to disentangle itself from the web of globalization.

While Southeast Asia has yet to see the fallout from the antagonisms between the two countries, alarm bells are already ringing. With China being the global hub of manufacturing goods, it receives a lot of Southeast Asian exports that are all part of China’s value-chain, meaning that these goods are part of a much larger finished product that China will then export. Once the tariffs kick in, it will not just affect the goods exported by China, but it would also have an adverse effect on the goods that China imports from Southeast Asia as part of their value chain.

The Philippines is particularly worried about the trade war. According to Bloomberg, the Philippines is most at risk if the trade war heightens as 17% of the Philippines’ exports are part of China’s value chain. Analysts are worried this would hit electronics exports the most. The electronics sector accounted for half of the Philippines exports last year with China and the US accounting for more than 12% of the market share.

Other countries in the region that are also at risk are Malaysia and Indonesia. 11.4% of Malaysia’s exports are involved in China’s value chain while the figure is 10.9% for Indonesia.

Aside from that, the steel tariffs that the US will impose is said to also affect Malaysia. Bloomberg reported that the Malaysian government will be meeting with US representatives to seek an exemption from the steel tariffs and to ask clarification regarding the solar-panel tariffs as well.

However, there’s also some optimism among analysts. China has proposed tariffs on soybeans which the US are the largest producers of. This could lead to China looking to other markets for substitute goods. According to analysts, Malaysia and Indonesia would benefit the most from this since palm oil is the substitute for soybean oil.

As the trade war between China and the US does not look like it will die down soon, ASEAN countries have to be prepared for any outcome. Most ASEAN countries still rely on exports to fuel their respective economies, so any shift in the global economic order will definitely impact them for better or worse.