Businesses providing digital services in Singapore, such as the streaming of entertainment content, will have to pay the Goods and Services Tax (GST) from Jan 1, 2020, Finance Minister Heng Swee Keat announced during his Budget 2018 speech last week.

Heng said he is introducing this tax on imported services to make the country’s tax system “fair and resilient” in today’s digital economy.

“Today, services such as consultancy and marketing purchased from overseas suppliers are not subject to GST. Local consumers also do not pay GST when they download apps and music from overseas,” the minister explained.

“This change will ensure that imported and local services are accorded the same treatment,” he added.

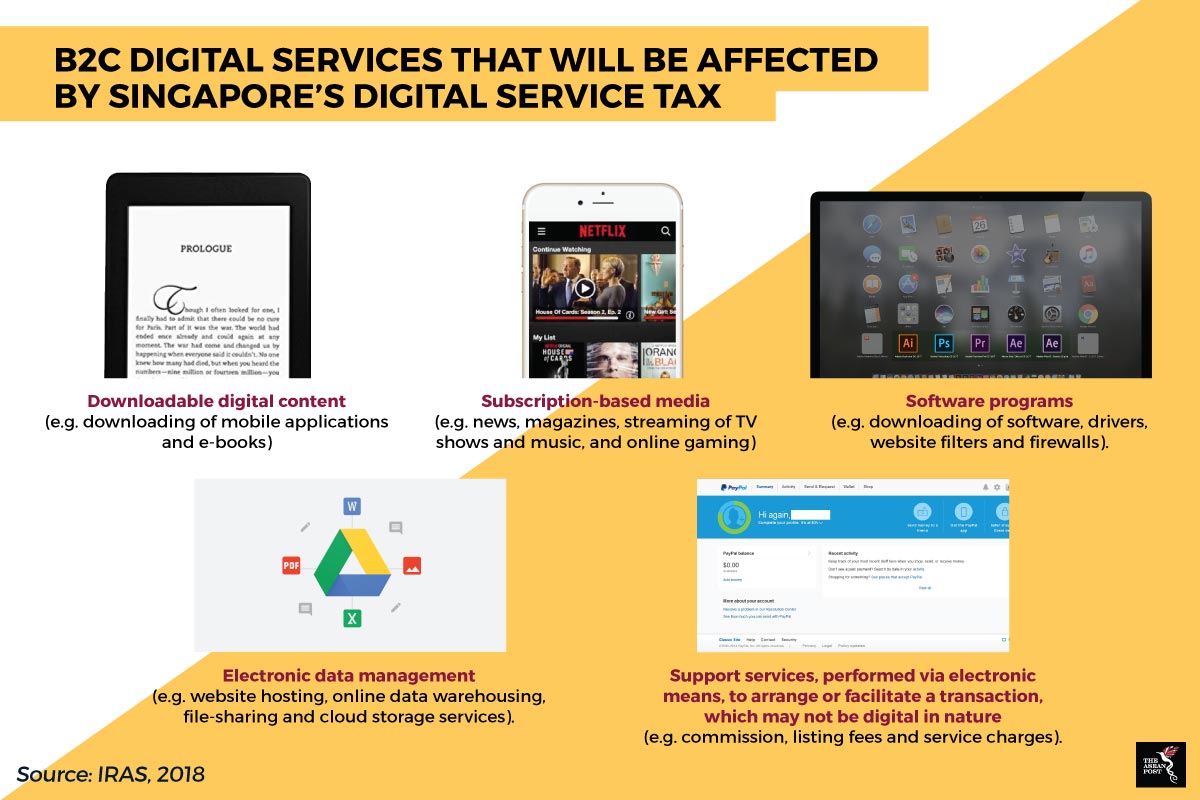

Prior to the announcement, it was speculated that an e-commerce tax would be introduced instead. However, the Singapore government mentioned that digital purchases will now be subjected to the Goods and Services Tax (GST). Labelled the “Netflix tax” by The Straits Times, people who purchase streaming services from websites such as Netflix and Spotify may be subjected to this new tax. Other taxable services could include mobile apps and software downloads.

How does this digital tax affect digital service providers?

With the new GST on imported services, providers of digital services, including overseas suppliers and electronic marketplace operators will need to be registered with the Inland Revenue Authority of Singapore (IRAS). This registration of overseas vendors will apply to those whose annual global turnover exceeds SG$1 million and the sale of digital services to consumers in Singapore exceeds SG$100,000.

According to Adrian Lee, research director at Gartner, these providers will “…face increased operational costs for compliance with the new tax regime. They will need to ramp up to handle GST reconciliation with IRAS once they cross the SG$100,000 threshold.”

“Coupled with the proposed increase in GST to 9 per cent across all businesses from 2021, this hits the digital service providers domiciled both, in and outside of Singapore with additional margin pressures as they strive to remain profitable,” he added.

It is also estimated that about 1,000 companies offering B2B digital services, as well as 100 firms in the B2C space, are expected to be affected by the new tax.

How will it affect consumers?

While businesses will experience the effects of the new tax first, consumers too will be feeling the heat as well.

“Because the GST is a tax on final consumption, it is expected that the overseas vendors would pass on the tax increase to Singapore consumers,” explained Koh Soo How, Asia-Pacific indirect taxes leader at PricewaterhouseCoopers (PwC) in an interview with online news outlet, Today.

According to Gartner’s research findings, 59 percent of Singaporeans purchase a product or service online. Business to consumer (B2C) apps such as Uber and Spotify take up the top 10 spots with the most active users per month.

This shows that there is a lot of usage of imported digital services in the city state. It is, however, up to consumers to choose to drop their spending on these taxable services or to switch sides to services that are non-taxed.

The way forward

Singapore is the first Southeast Asian country to implement a digital service tax. While in other parts of the world - including New Zealand and Japan – taxes on imported services are already present.

In 2015, consumers in Japan started paying an 8% consumption tax for all overseas online buys. The rate was increased to 10% this year. Australia will employ a similar tax this year while Malaysia is also considering a similar move.

As consumers are continuously moving towards digitalised solutions, there is no need for companies to worry about any negative consequences that this tax could bring to them.

“Innovative, forward-thinking service providers will take this in their stride as a matter of doing business in Singapore. In the same breath, consumers will not stop buying online – they will simply choose to spend more wisely and prudently,” reiterated Lee.