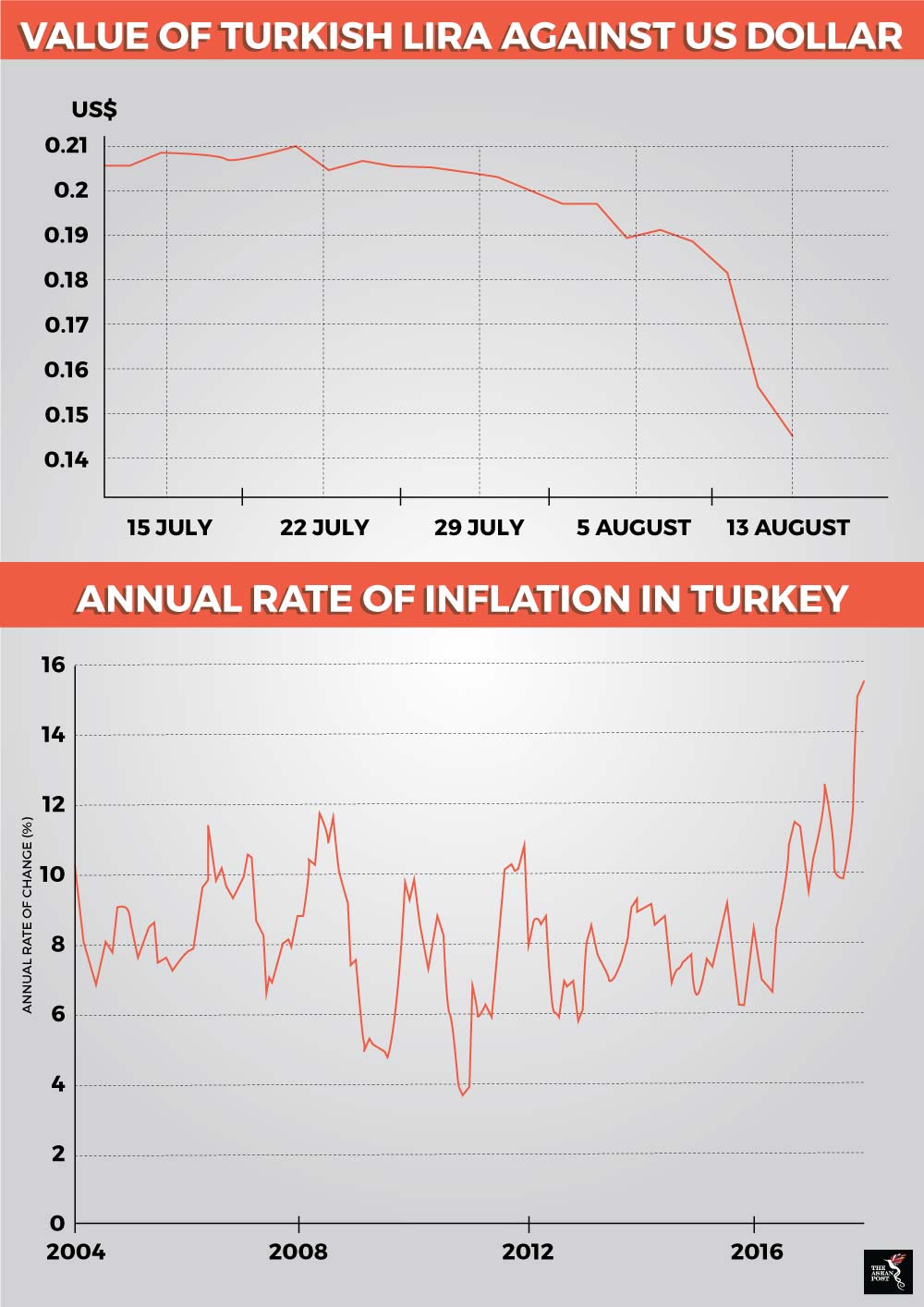

Despite being one of the fastest-growing economies in the world last year, the Turkish economy is currently in turmoil. The United States (US) has just announced sanctions on Turkey which resulted in the freefalling of its national currency, the Turkish lira. The problem is further compounded when the country’s annual inflation rate is taken into consideration, which was at 16 percent in July — exceeding the central bank's target of five percent.

Even prior to the current crisis, the Turkish economy has not been performing well. For the past year, experts have labelled the Turkish lira as the world’s worst performing currency, dropping by almost 50 percent against the US dollar in the past 12 months.

On Monday, the lira reached a record low in Asian markets as it traded at 7.24 against the US dollar. It has since recovered slightly after a response from the country’s central bank. One of the measures taken was the cutting of reserves that banks are required to hold at the central bank, which in turn frees up money for lending. The Turkish central bank is also looking to tighten its monetary policy.

Source: Twitter

The sudden 20 percent drop in the Turkish lira happened over the weekend after Trump announced that the US will double steel and aluminium tariffs on Turkey.

The current hostile climate between the US and Turkey stems from Washington’s insistence that Turkey release Evangelical Christian pastor Andrew Brunson, who is being held on terrorism charges there. After Turkey refused to release the pastor, the US imposed sanctions on the country’s justice and interior ministers. Erdogan later retaliated by freezing the assets of two US officials which led to Trump doubling tariffs in response.

Effect on Turkey

As hostilities between the US and Turkey do not look like ending soon, the worsening lira is predicted to have a damaging impact on Turkey’s economy. Key imports such as oil could become more expensive, which in turn would push domestic inflation up. Not to mention that Turkey’s current inflation rate is already at worrying levels. Those feeling the pinch will most likely be ordinary Turks who would have to cope with the rising prices of goods.

The conventional way of dealing with a plunging currency and increasing inflation is to raise interest rates, which Erdogan has refused to do. Instead, Erdogan again has called on his people to change their US dollars into Turkish lira in order to "maintain the dignity" of the currency. Erdogan has also dismissed the current crisis as mere “campaigns” orchestrated against Turkey.

Source: Various sources

Impact on Asia

The impact of the falling lira on Asian economies has been varied, but there are some significant worries. Investors are seeing the freefall of the lira as a bad sign for global trade and are selling off the currency. With global trade looking volatile, there are fears that investors would dump emerging markets currencies in favour for US-dollar backed assets.

That fear is not unfounded as India has become a victim of the spill over effect from the Turkish crisis. The Indian rupee has fallen below 70 per US dollar for the first time.

In Indonesia, the rupiah was trading at 14,610 against the greenback yesterday, which is the lowest since 2015. However, the Bank of Indonesia has quickly responded to this by surprising economists with its fourth interest rate hike this year.

Despite that, many other countries in the region are bracing for impact but do not expect much damage to their respective economies.

Singapore predicts some volatility but believes there would be no real harm to its assets.

“While there could be near-term volatility for Singapore's risk assets, Turkey's problem should not have a lasting impact as Singapore's economic and financial links to Turkey remain small,” said James Cheo, a senior investment strategist with the Bank of Singapore.

In Malaysia, the Ministry of International Trade and Industry (MITI) has said that they are ready to cushion any impact.

“We are always ready and we must cushion all of these impacts. We will come up with solutions. We hope this country will not be badly affected,” said International Trade and Industry Minister Darell Leiking.