Asia stocks mostly fell Tuesday as markets brace for a sharp United States (US) interest rate hike and similar moves by other central banks as they struggle to control inflation, with traders increasingly worried about another possible recession.

Surging prices, moves to tighten monetary policy, China's COVID lockdowns, the Ukraine war and a stronger dollar have come together in recent weeks to cause a massive headache for investors, sending them running to the hills.

All eyes are on the conclusion Wednesday of the Federal Reserve's two-day policy meeting, where it is expected to lift borrowing costs 0.5 percentage points for the first time since 2000.

However, while officials see a hawkish move as necessary to control 40-year high inflation while still allowing for economic growth, there is a growing unease that they could knock the fragile pandemic recovery off course and even cause a recession.

Meanwhile, the policy board is also expected to discuss offloading the trillions of dollars worth of bonds bought to help keep prices subdued in the past, a move known as quantitative easing.

"With a 50 basis point hike... all but certain, the (post meeting) press conference will provide important colour around the prospects of a soft landing, the neutral fed funds rate and balance sheet normalisation," said SPI Asset Management's Stephen Innes.

"One question on everyone's mind: Are 75 basis point increments on the table?"

Forecasts for a swift run-up in rates this year have hammered tech firms who are reliant on debt to fund growth, though dup-buying helped them record a much-needed gain Monday in New York.

However, Asian traders were unable to track the positive lead with liquidity thinned out by public holidays around the region.

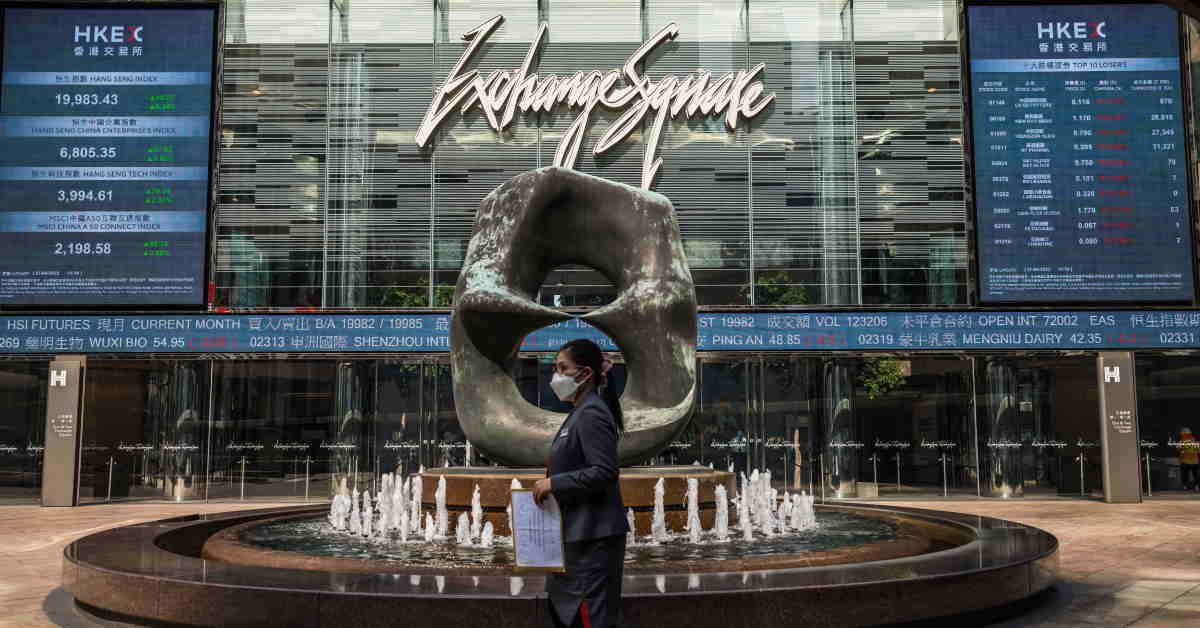

Hong Kong returned from a long weekend break to lead the retreat, shedding more than two percent at one point before paring those losses, following a more than four percent surge Friday.

Sydney also fell ahead of an expected interest rate hike by the Reserve Bank of Australia later in the day, while Taipei and Wellington were also down. Still, Seoul edged up slightly.

Tokyo, Shanghai, Mumbai, Singapore and Jakarta were closed.

Investors are also reeling from a sharp slowdown in Chinese activity caused by lockdowns in key parts of the country including financial hub Shanghai, and strict containment in Beijing.

The measures, and leaders' refusal to shift from their zero-COVID policy, have hamstrung the world's number two economy and figures in other countries including the US suggest they are now having a global impact.

The strife in China continues to weigh on oil prices owing to fears about the impact on demand from the biggest crude importer.

Oil prices edged up as European Union (EU) chiefs discuss a possible embargo on shipments from Russia linked to its invasion of Ukraine.

A sanctions plan is being put together by the European Commission (EC) that could be put to member states Wednesday, sources, adding that the ban would be introduced over six to eight months to give countries time to diversify their supply.

Key Figures At Around 0220 GMT

Hong Kong - Hang Seng Index: DOWN 0.5 percent at 20,980.03

Tokyo - Nikkei 225: Closed for a holiday

Shanghai - Composite: Closed for a holiday

Euro/dollar: UP at $1.0524 from $1.0506 on Monday

Pound/dollar: UP at $1.2521 from $1.2489

Euro/pound: DOWN at 84.05 pence from 84.09 pence

Dollar/yen: DOWN at 130.05 yen from 130.16 yen

West Texas Intermediate: UP 0.3 percent at $105.46 per barrel

Brent North Sea crude: UP 0.3 percent at $107.90 per barrel

New York - Dow: UP 0.3 percent at 33,061.50 (close)

London - FTSE 100: Closed for a holiday