OPEC producers are finding that shale oil drillers aren’t their only adversaries in their battle to drain a three-year crude glut .

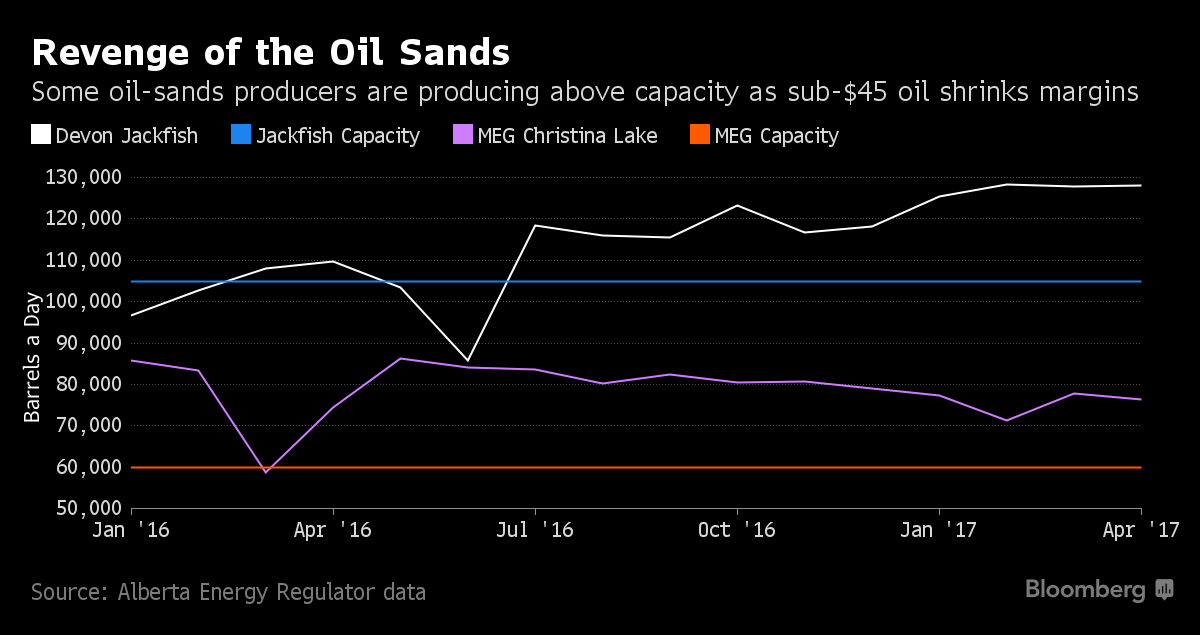

As oil rigs in the U.S. jumped 45 percent this year, north of the border, oil-sands companies including Devon Energy Corp., Suncor Energy Inc. and Cenovus Energy Inc. have ramped up operations as well. Their thermal production sites are running as much as 30 percent above capacity this year, squeezing barrels from existing production sites to maximize revenue.

Oil sands will be second to shale as the biggest contributor to global supply growth over the next two years with half a million barrels a day of production scheduled to enter the market, according to IHS Energy. The growth seen across North America is blunting the impact of output cuts agreed to by the Organization of Petroleum Exporting Countries and other producers including Russia.

Northern Alberta’s oil sands, the world’s third-largest crude reserves, are one more complication for the Organization of Petroleum Exporting Countries. The group announced an output cut in November in an attempt to eliminate a glut that reduced prices from $100 a barrel three years ago to less than half that today.

“You see them really driving down costs and one of the big ways is optimization,” Kevin Birn, a director at IHS Energy in Calgary, said by phone. “In an era of low oil prices, operational excellence is going to be the mantra.”

Devon’s Jackfish oil-sands wells pumped 128,000 barrels a day in April, 23,000 over the stated capacity, Alberta Energy Regulator data show. Suncor has reduced bottlenecks at its Firebag site, which produced above its 180,000-barrel-a-day capacity for two of the first four months of the year. Cenovus’ Christina Lake Phase F, which began operation last year, topped 50,000 between November and March.

Full Throttle

Oil-sands producers are running equipment at full throttle as projects sanctioned before the price collapse ramp up. Suncor’s Fort Hills mine and Canadian Natural Resources Ltd.’s Horizon expansion are scheduled to start this year.

Evidence of OPEC’s struggle came at the May meeting, at which a decision to extend production cuts were followed by a collapse in prices to below $45 a barrel.

With margins shrinking, oil companies are seeking to eke out as much as they can from operations to compensate for smaller margins, a factor helping encourage oil sands producers to push their machinery, Birn said.

The industry is fighting to stay competitive as investment is diverted to other energy sources such as Texas shale. Since December, international oil companies including Royal Dutch Shell Plc, ConocoPhillips, Marathon Oil Corp. and Statoil ASA have sold oil-sands assets to local companies such as Canadian Natural and Cenovus. The sellers have used the proceeds to pay down debt and deploy capital to other areas such as shale and natural gas.

Oil-sands producers cut capital spending to the lowest level in more than a decade this year after curtailing plans to expand or build new projects, the Canadian Association of Petroleum Producers said in a report June 13.

Efficiency Drive

The drive for efficiency, along with lower gas prices, has driven the average break-even operating cost on thermal oil sands to less than $10 a barrel from about $15 in 2014, Birn said. Expanding or building a site requires a price of $50 to $60 because of the up-front investment required.

“Obviously, the price of oil has provided some incentive,” Rob Dutton, senior vice president of Canadian operations at Devon, said in a phone interview.

Christina Lake

MEG Energy Corp.’s Christina Lake oil sands has operated above capacity for every quarter through April since March last year, according to AER data. The company’s Modified Steam and Gas Push technology frees up “steam to be redeployed” to new well pads, spokesman Davis Sheremata said in an email.

Not all operators have been as successful at driving their machinery to new levels. ConocoPhillips’ Surmont and Nexen Energy ULC’s Long Lake oil sands sites reduced production after a fire last March at the Syncrude Canada Ltd. upgrader reduced supplies of light, synthetic oil that’s mixed with bitumen so it can flow down pipelines. Syncrude has been plagued by a series of breakdowns in recent years.

Even with capital spending in the oil sands dropping to C$15 billion this year, less than half what it was in 2014, Western Canada’s oil sands production will rise by 720,000 barrels a day to 3.12 million in 2020 as conventional production in the region stays little changed at 1.2 million, according to CAPP.

“I have more optimism now than in eight years in things that will make the operations better,” Devon’s Dutton said. “The margin is still healthy and there is still a great deal of cash to be generated from these assets.” – Bloomberg