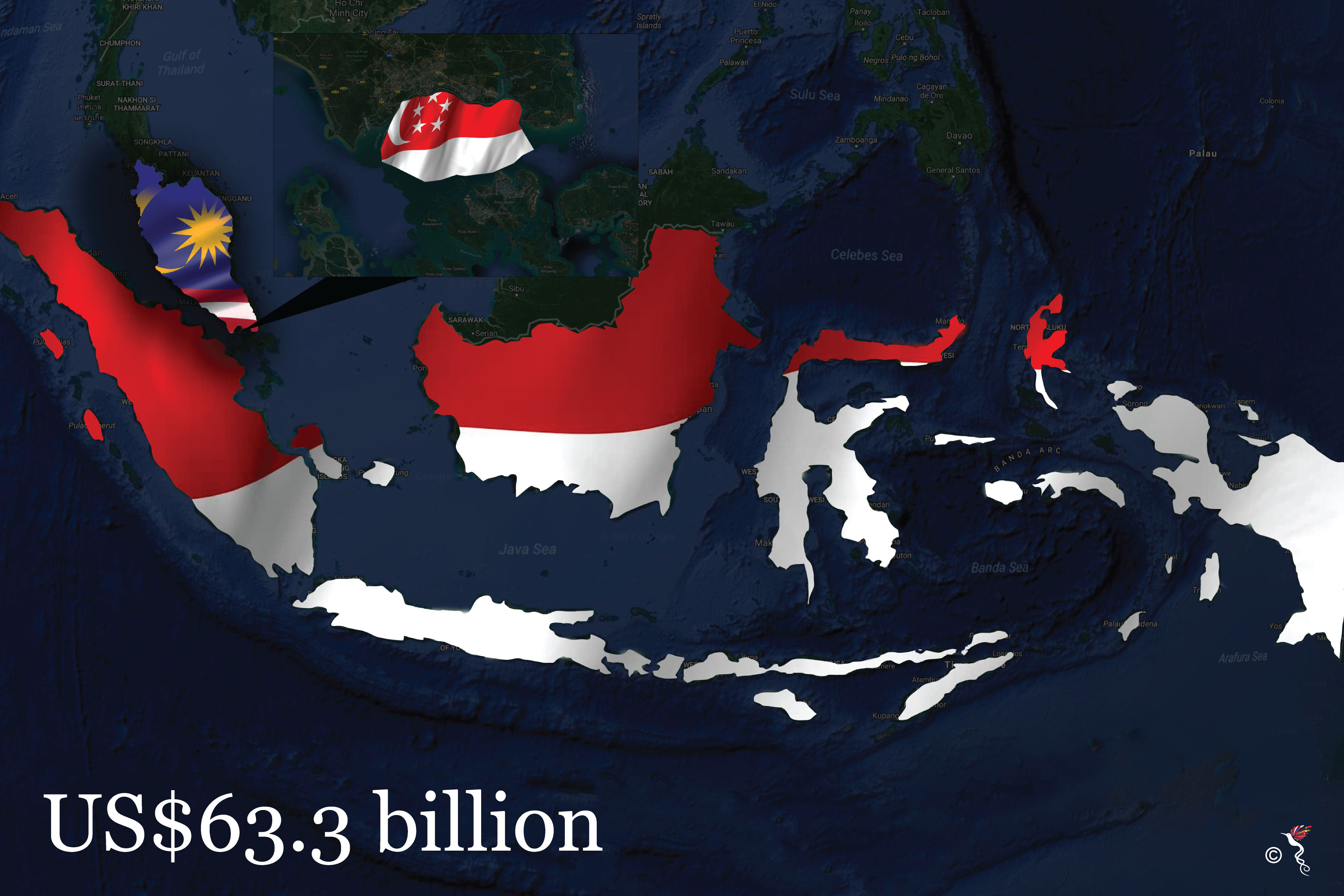

Singapore, Malaysia and Indonesia recorded total deal activity valued at US$63.3 billion spread across 818 deals in the first half of 2017.

Global valuation and corporate finance advisor Duff & Phelps said Singapore recorded a total merger and acquisition (M&A) deal volume of 383 deals during the period valued at US$42.6 billion compared to US$40.5 billion in the first half of 2016.

It said outbound deals accounted for about 68% of the total deal value compared to 66% in 2016, followed by inbound deals which contributed to 19% of the total deal value compared with 15% for the full year 2016.

During the same period, it said Singapore witnessed 90 private equity and venture capital (PE/VC) investments amounting to approximately US$ 3.2 billion while initial public offering (IPO) listings in Singapore witnessed a decline, with IPO capital raised in 2017 up to June amounting to approximately US$ 300 million compared to US$ 1.9 billion for full year 2016.

Duff & Phelps said Malaysia recorded a total of 233 M&A deals during the year, valued at US$ 11.7 billion, where inbound deals accounted for majority of M&A deals by capturing a share of 70%.

It said Indonesia has continued with the pace it picked up last year with M&A deals mounting to nearly US$4 billion in the first half while regional PE/VC investments in first half of 2017 amounted to 124 deals with a combined deal value of approximately US$ 4.5 billion.

“The region has shown a robust growth in M&A and investment activity in the first half of 2017, in spite of the negative outlook in certain sectors. Corporates and funds have been opportunistic in tapping into the global markets, leveraging low valuations in certain sectors and high growth in certain other sectors,” said Duff & Phelps MD Srividya Gopalakrishnan.

Srividya said Singapore has contributed to a significant part of the deal values, driven by outbound transactions while Malaysia and Indonesia have contributed to the growth in deal making, driven by inbound investments.

“When we look at the outlook for the second half of the year, on one hand, the market sentiments are negative which is leading to uncertainty in deal making. This is attributable to slower pick up in oil prices, a steady stream of bad news coming from the shipping and marine sector, a lack of large acquisitions in the private sector, a reduced number of IPOs, slowing growth in developing economies and rapid and unprecedented changes in global regulations among other factors,” she said.

She said the positive trends emerging in the region which could impact the second half of the year include growth in M&A deal volumes and value, a significant increase in PE/VC investment, a strong IPO pipeline for the second half.

Others include improved infrastructure in developing countries due to non-traditional sources of energy, more alternate investment funds setting up a base in Singapore, significant development in the tech start-up ecosystem in Southeast Asia including an increase in tech unicorns in the region and several global companies setting up their intellectual property hubs in Singapore.

“While it will be interesting to see how deal making pans out for the rest of the year, we are hoping for a sustained level of momentum in overall deal values and a pick-up in private sector transactions and investments, going forward,” she added.