In 2017, Vietnam deputy prime minister Vuong Dinh Hue announced aims of increasing the number of businesses operating in Vietnam from 500,000 to one million by 2020.

Given the relative low costs of operating in Vietnam, a youthful pool of talent from which to recruit, and a tech savvy generation to market to, this target appears achievable. Vietnam’s startups grew 14% in the first quarter of 2017, with 39,580 startups entering the market. Out of these, tech startups have seen the most growth, capitalising on the country’s 50.05 million internet users in 2017, out of which 42.18 million are mobile internet users. That number is projected to grow to 51.3 million by 2020.

The need for tech solutions is not lost on this generation of startup founders, many of whom are overseas graduates with experience working abroad in these sectors. Success stories include MisFit Wearables Corp, started by Vietnamese-American Sonny Vu in 2011 to produce activity trackers. It was acquired by Fossil Group for the sum of US$260 million in 2015.

Many of these solutions also help address shortcomings in efficiency faced by traditional sectors like agriculture for example.

Mimosatek, for instance, is an irrigation, fertigation and greenhouse solution which automates these processes while keeping the amount of water used, measurable. Not only does this help farmers minimize their manual labour, since irrigation can be controlled from a smartphone app, they can also put the saved costs in water and electricity to better use elsewhere.

“Now that this farmer is using our product, he uses 30 percent less water, 30 percent less electricity and he has 25 percent more crops,” explained Mimosatek chief operating officer Lam Anh Le to German broadcaster Deutsche Welle.

Source: TechinAsia

Nurture

Despite the available talent, one area that is lacking is the nurturing of startups. Some startups may have the technological expertise, but lack the business acumen to run the startup effectively. Vietnamese startups could also do with more mentors. This is a role largely played by startup incubators, the major ones of which currently number about 14 in Vietnam.

“We train founders and also help them in concept and development, and everything else from the very beginning to the end of their journey,” explained Quang Mai Duy, a co-director of Founders Institute, which has successfully guided 28 startups in the country so far.

“We help them with the idea, pitching, fundraising, publicity, everything,” added Quang Mai Duy.

According to Duy, around 45% of these are Viet Kieu, or Vietnamese who have studied or worked overseas. It is also they who provide the know-how behind these startups, and who are also successful at expanding their startups overseas when the time is ripe. Yet, to thrive in a purely Vietnamese setting requires local business connections, a skill incubators can help to instil.

Funding

It is also startup incubators which sometimes help to raise funding for startups to gain a foothold in the market. Food service startup Fresh Deli, for instance, was set up with the help of a US$20,000 investment placed by the Vietnam Silicon Valley Accelerator under its Vietnam Silicon Valley (VSV) project. VSV makes it a point to invest in the early stages of startup, and raises funds annually to do so. Over the years 2014-2017, VSV has invested in around 50 startups spanning the logistics, IT and food industries.

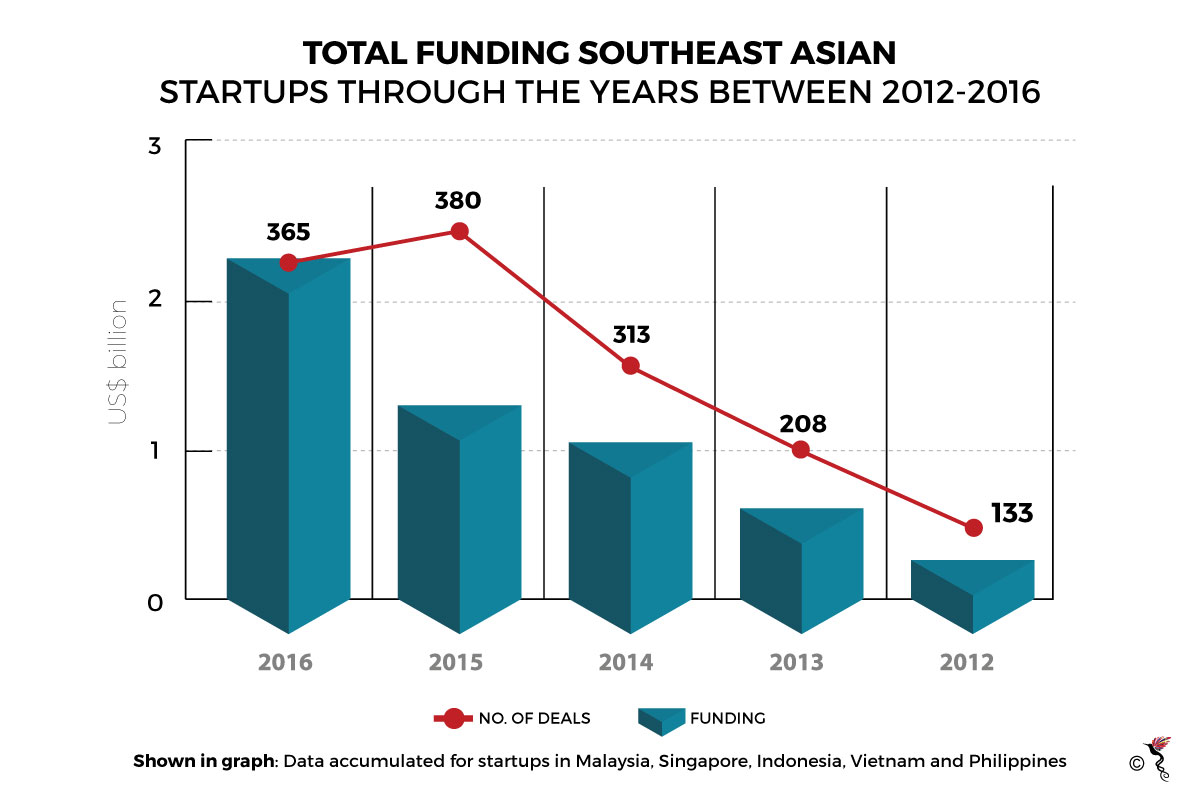

Venture capital funding into Vietnam startups amounted to US$200 million in 2016. However funding to grow a startup all the way to becoming global remains scarce. To attract foreign investment into startups, a sound legal framework would need to be in place in order to regulate venture capital investment. Currently, there are no clear guidelines on the protection of foreign investor interests. Complicated licensing and tax regimes also make it difficult for startups to take advantage of immediate market opportunities.

"On the investor end, there remains a disparity between startup valuations and the actual startup potential to interested investors," explained Ryu Hirota, principal of venture capital firm Spiral Ventures to DealStreetAsia. Startups at the pre-seed and seed stages would ask for big sums in exchange for big picture targets like market potential or by citing comparisons against international equivalents. While this reduces investor confidence in the short term, it could also create setbacks for the startups to acquire future funding too.

All in all, Vietnam’s setbacks are not difficult to overcome, and the local startup scene is more rife than ever with potential. It is internationalisation where Vietnamese startups would need to overcome a different set of challenges altogether, and may not as yet be prepared for.

Recommended stories: