Member states of the Association of Southeast Asian Nations (ASEAN) are now, more than ever, exposed to the risks of climate change and environmental degradation. More nations have now answered the clarion call of the Paris Agreement and are including investments for projects that help protect the environment under their respective national agendas.

ASEAN cannot afford to be left behind. Not only do these projects have long-term benefits for the planet, but the rush to develop them opens up lucrative investment opportunities too. ASEAN’s green finance potential can be realised via traditional investment vehicles like bonds, stocks and exchange-traded funds, whereby the underlying business is related to operations or projects that improve the environment.

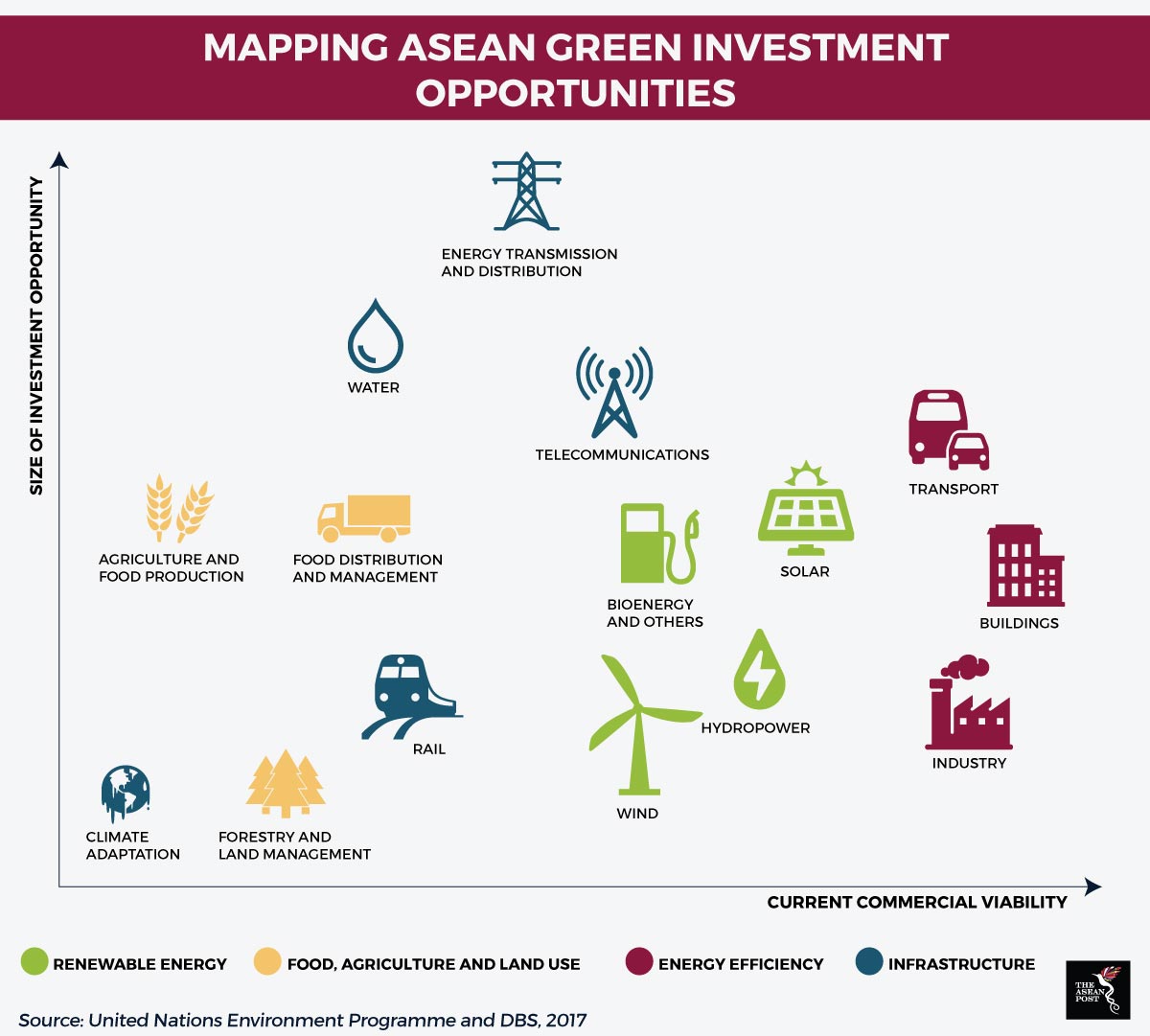

According to a 2017 report by the United Nations and Singapore financial services provider, DBS, the market for green investment in ASEAN is projected to be worth a whopping US$3 trillion from 2016 to 2030. The market is spread across four areas – infrastructure (US$1.8 trillion), renewable energy (US$400 billion), energy efficiency (US$400 billion) and food, agriculture and land use (US$400 billion).

The report highlighted that currently, there is a US$160 billion gap in green finance supply in the region as the projected average annual demand sits at approximately US$200 billion between 2016 and 2030. This translates to a necessary 400 percent increase in total annual green finance to satisfy ASEAN’s projected green investment appetite by 2030.

As it stands, an estimated 75 percent of current green financing comes from public finance and the remainder from private financing. However, it is projected that future private financing will increase from 25 percent to 60 percent whereas public financing will drop to 40 percent. Hence, private green financing flows will have to scale up by a factor of over 10.

Singapore rises to the challenge

The island republic has been heralded as one of the best financial centres in the world. Furthermore, its track record in environmentally sustainable practices, including its aspirations for a network of smart and sustainable cities in the ASEAN region have positioned it to be the hub of green finance in the region.

According to Associate Professor Simon Tay, chairman of the Singapore Institute of International Affairs (SIIA), “Pursuing green finance is a logical, attainable and necessary next step for Singapore, both as a financial hub and for our contribution to global environmental challenges.”

Echoing his sentiment, Yeo Lian Sim, who is also Special Adviser, Diversity, Singapore Exchange (SGX) said that, “Many companies listed on the SGX who already do sustainability reporting and the rest who will do so from 2018, are well placed to benefit from progress in green financing opportunities.”

A report released in November 2017 by the SIAA outlined four recommendations in order to make Singapore a hub for green finance.

The first step is for Singapore’s government to take leadership and set a clear direction and policy goals towards shifting the economy to a sustainable path. The government should start by forming a roadmap that would coordinate actions towards this goal. It should also encourage private companies to rethink their business models to make them more sustainable.

Besides that, the financial sector must develop an awareness of green financing and put into place, practical measures to build knowledge and capacity in this regard. This can be in the form of a Green Advisory Panel made up of industry and thought leaders and experts from Singapore and the world over.

The green finance market in Singapore also needs a “jump start.” The government can start the ball rolling by incentivising the markets with green bonds and other green investment instruments. Financial institutions and banks should be lending or supporting green projects. Moreover, green financial products must be positioned as attractive choices. This would mean improving the “sales channels” of investment products that are targeted at both, retail and corporate investors.

The final recommendation is to define the value of “green.” This is especially important in order to be better able to distinguish between what are green investments and what aren’t. It will better enhance Singapore’s green standards and ensure that it remains compatible with international ones. It is suggested that a “band of green” be established, marking the minimum global green standards.

A sustainable future will forever remain an unreached ambition if the dollars and cents aren’t available to finance any suggested green initiative. Hence, green investments are the bedrock on which we could build a sustainable planet. Here in the ASEAN region where the demand for it is ever present, its time to meet it.