With the humongous volume of data circulating virtually right now because of online activities such as video streaming and sending tweets, it is crucial for businesses to rely on data centres as they provide services for reducing infrastructure costs, providing uninterrupted power supply, improving data security and safety, and increasing storage.

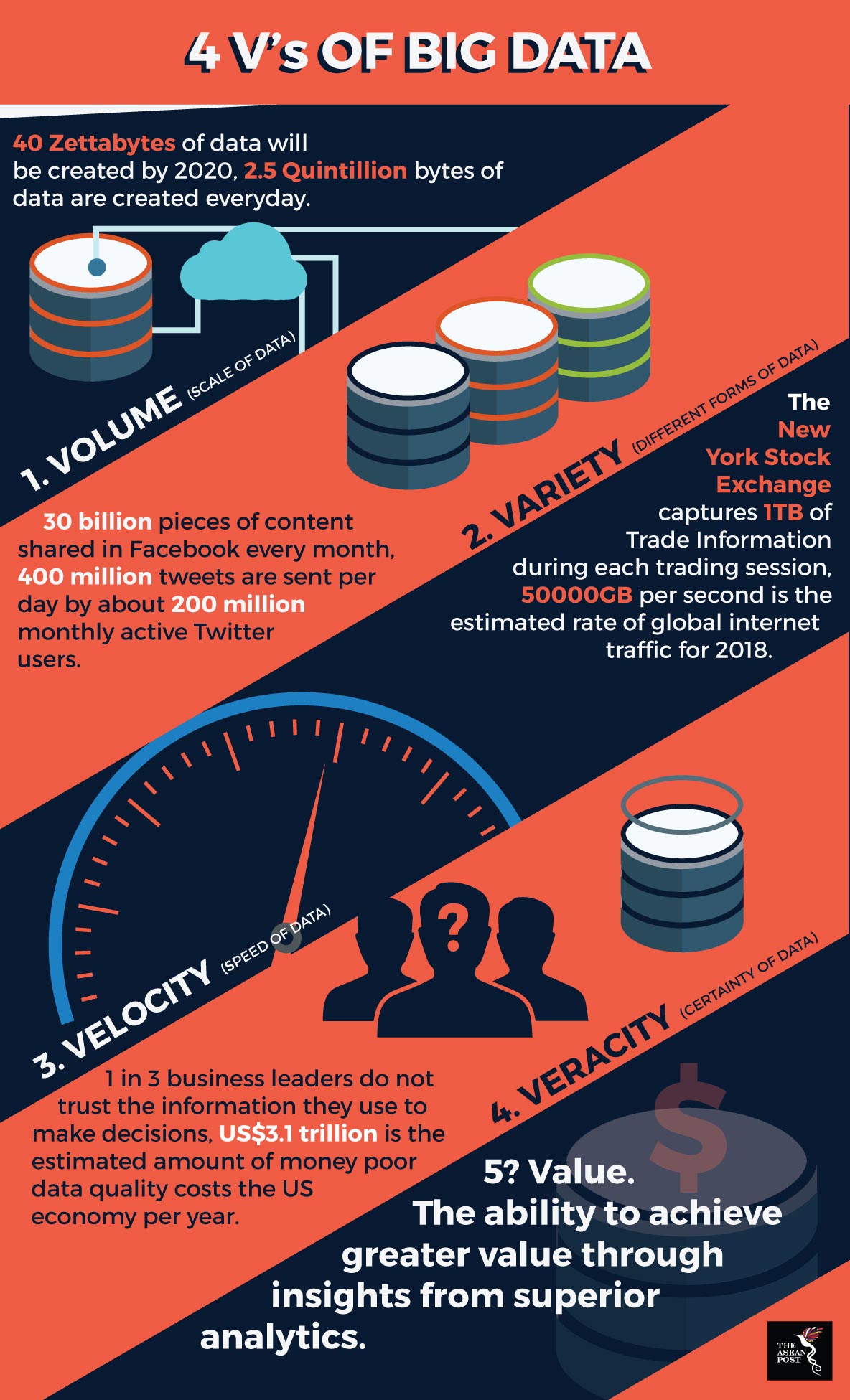

According to SAS, big data is a term that describes the large volume of data – both structured and unstructured – that inundates a business on a day-to-day basis. In other words, big data is simply the large and complex set of information on human digital activity used to analyse patterns and trends in order to predict online behaviour.

Source: IBM Big Data & Analytics Hub

Formation of data centres across the region

“Mobile computing, the Internet of Things and cloud computing are driving significant demand in the data centre industry,” said Gene Williams, senior director of Cushman & Wakefield and Data Centre Practice Leader to Forbes in September, 2017.

Specifically, Singapore is the first country in the region to have Google Cloud Platform in operation.

“Data centres in Singapore have been in operation since 2015 for Google’s internal use and we aim to improve latency and the option to store data locally for clients here,” said Diane Green, Google’s Chief of Google Cloud to Data Center Dynamics in June 2017.

It is projected that Singapore’s data centre market will reach US$1 billion in revenue by 2021, up from US$739 million in 2017 as stated in a report by 451 Research in January 2018.

Indonesia, on the other hand, is expected to be the fastest growing data centre services market in the region registering a 35% compound annual growth rate (CAGR) as mentioned by Frost and Sullivan in 2016.

Aside from data consumption trends and technology driven demands, government regulation is also another factor in shaping the data centre services market. In the Surfing the data wave: The surge in Asia Pacific’s data centre market report by PwC in January 2017, the Indonesian government stipulated that customer data in Indonesian banks must be stored domestically by October 2017. This has resulted in a surge in market demand from both, the cloud and financial sectors for world-class data centre services in Indonesia as mentioned in a 2016 Equinix Report.

In addition, Singapore’s Personal Data Protection Act (PDPA) prohibits the transfer of personal data outside the country, unless the overseas company gives assurances that it will comply with the PDPA’s regulations. So, this not only limits data transfer abroad but also encourages the local industry to build its own data centres. A 2016 Broadgroup Report states that by the end of 2017, Indonesia’s Telkomsigma will grow its data centre to 110,000k m² space while Singapore’s Singtel is going to expand to 105,000k m² space.

Hyperscaling is inevitable

Unlike old-school data centre architecture, the hyperscale model works with hundreds of thousands of individual servers that are made to operate together via a high-speed network as explained by data centre hardware manufacturer, Raritan.

A hyperscale data centre is built around three key concepts - infrastructure and distributed systems that are able to support hyperscale data centre operations, scalability for computing tasks to ensure efficient performance based on demand and appropriate revenue generation to justify the shift to hyperscale.

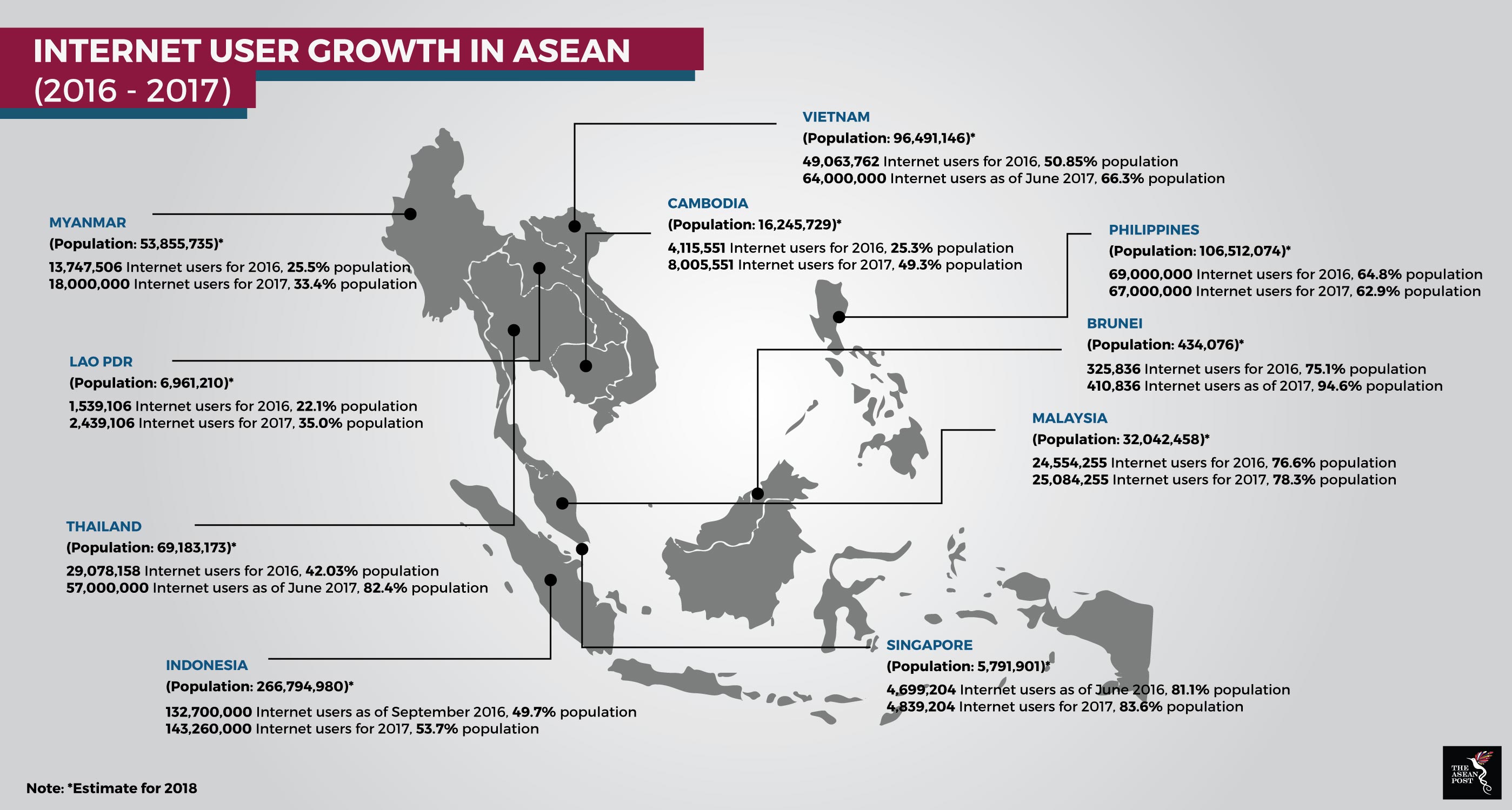

Source: Internet World Stats

As a whole, hyperscale requires a smaller footprint but has a higher cost-effectiveness when compared to traditional data centres that usually require at least 1,000 square meters of space or more.

According to a report by consultancy firm Linesight, hyperscale-type facilities with capacities of 60 to 100 megawatts (MW) will comprise more than half of data centres worldwide by 2020. Linesight also predicts that Asia Pacific’s data centre capacity will surpass Europe’s by 2020.

Big kids on the data playground like Google and Facebook are pioneer hyperscalers that are driving the lion’s share of demand and have the capital to build their own data centres as reported by Bisnow in September, 2017. These cloud-based companies build supercomputers to accommodate their hyperscale needs and many of them run on Linux.

The rising penetration of internet usage in Southeast Asia has set the stage for hyperscale technology to be implemented in data centres across the region in the near future. It is this sort of futuristic vision that ASEAN nations need to adopt moving forward.