Brunei's seemingly vulnerable economic position is seen by China as an opportunity. The Asian superpower looks to engage with Brunei and this rejuvenated relationship could be beneficial to both parties in the long-term. How swift Brunei reacts and takes its chances could result in the petroleum rich nation successfully diversifying its economy for a brighter future.

China is so far Brunei’s largest foreign investor, contributing total investments of up to US$4.1 billion to Brunei in 2017. It’s biggest foreign investment project in Brunei consists of a US$3.4 billion oil refinery and complex being built by Chinese firm, Hengyi Group in Pulau Muara Besar Island. A second phase of development is set to follow in 2019, which is expected to cost US$12 billion to build.

Aside from this, several Chinese firms have also invested in Brunei’s transport and telecommunications sectors. Chinese carmaker Shenglong New Energy Automobile announced plans to build electric vehicles in Brunei in 2016, while China Telecom formed a local partnership with Telekom Brunei to develop connectivity services there. China’s foreign direct investments into Brunei are being facilitated by a Bank of China branch outlet which opened in Brunei back in 2016, even as banks like HSBC and Citibank shrank their operations there.

While China is looking to expand its pool of Belt and Road partners further, it also sees Brunei as the next piece of the puzzle that will help propel its interests in the South China Sea dispute.

“China is placing huge pressure on Brunei to concede joint development of its exclusive economic zone (EEZ). These are rights that clearly belong to Brunei by any reading of the UN Convention on the Law of the Sea (UNCLOS),” noted Bill Hayton, associate fellow with the Asia-Pacific Program at Chatham House.

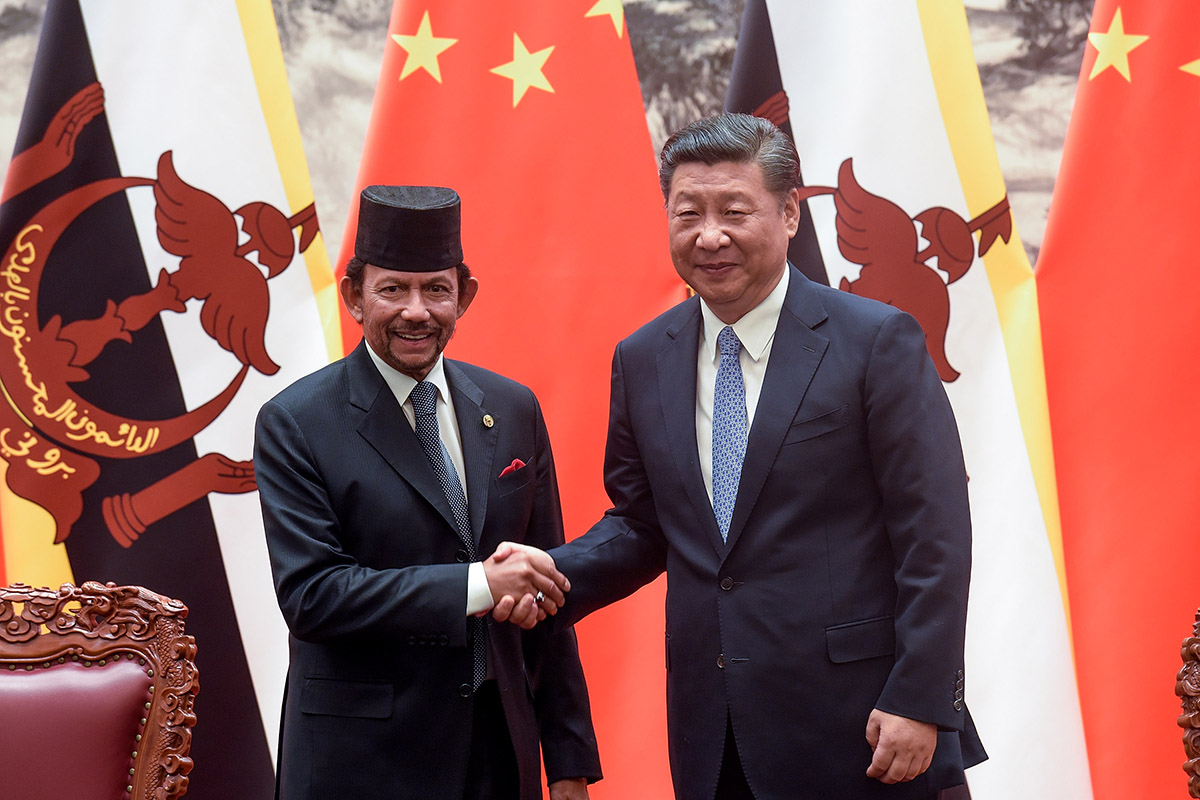

Brunei’s response has been relatively muted so far, although Sultan Hassanal Bolkiah recently congratulated Xi Jinping on the latter’s re-appointment to the presidency of the People's Republic of China.

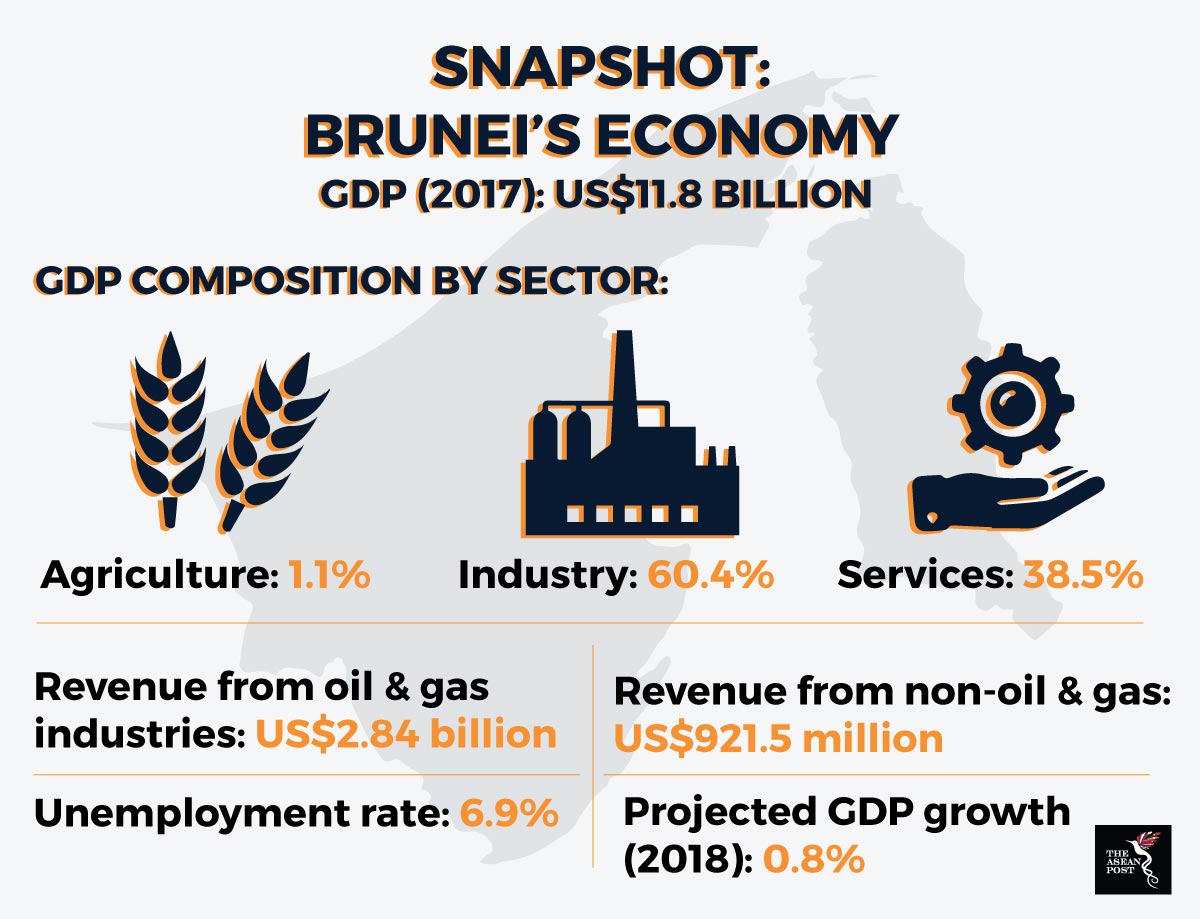

Source: Global Finance, CEIC 2017

Brunei is faced with the challenge of having to quickly diversify its sources of income within the short-term, which will give a boost to its economy in order to emerge from a three-year recession. Government revenue from Brunei's oil and gas sectors amounted to US$2.84 billion in 2017, compared to US$921.5 million from non-oil and gas sources. Analysts expect Brunei’s oil reserves to run out in the next two decades, and it is only now that the country is looking to develop new sectors as well as look into better management of existing ones.

Out of the existing ones, agriculture remains key for Brunei to maintain national food security for the long term.

“We need to be independent and become self-sufficient in rice production. Work on this until we see results,” said Sultan Hassanal Bolkiah in a recent parliamentary address at Brunei’s Legislative Council.

After signing a memorandum of understanding with China in 2017 to increase agriculture cooperation, Brunei is said to be employing new Chinese hybrid plant varieties to increase crop production. By using the new varieties, crop production is expected to increase from 2,000 tons in 2015 to 7,700 tons in 2020. The nation also hopes to achieve up to 20% of self-sufficiency for rice production by 2020, from just 6% in 2015.

Brunei is also likely to ramp up its tourism sector, for which it is expecting around 278,000 tourist arrivals in 2018 which equals to US$141 million in revenue, according to estimates by its Tourism Development Department. Chinese tourists made up 47,714 visitors out of Brunei’s 238,150 tourist arrivals in 2017. Efforts are underway to increase the number of inbound Chinese tourists, such as procuring more Chinese tour guides and increasing China-Brunei flight routes.

“The spending power of Chinese tourists can help contribute to the economy and businesses in the country,” noted Salinah bin Salleh, acting director of the Tourism Development Department.

Still, although China has already lent much help to Brunei’s economy, this is not likely to turn into a status quo for the long term.

“Brunei would be happy to take investment from Japan, other Southeast Asian states, the United States, or Europe. However, at the moment, only Chinese entrepreneurs are looking at the opportunities,” explained Bill Hayton.

Brunei could establish wider regional ties with other ASEAN countries in order to hedge the risk of China’s interests taking over too much, too soon. Being part of the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and Regional Comprehensive Economic Partnership (RCEP) is a start towards expanding these ties, but fuller results are only likely to materialise later on. For now, China is Brunei’s most willing bet, and the latter is more than happy to comply.