From the bustling streets of Jakarta to the crowded roads of Hanoi, Southeast Asia as a whole is no stranger to traffic congestion. With a population spurt and rapid urbanisation, it is no surprise that such a situation can be seen on a daily basis. The introduction of electric vehicles (EVs) into the region has definitely caught the attention of many. The potential for a significant reduction in dangerous gases into the atmosphere from fossil fuel powered vehicles is a plus point that has to be taken into serious consideration. The progress of the EV industry will surely complement ASEAN’s regional target to achieve its mark of 23% renewables in the energy mix by 2025.

It must be said that the increase in EVs on ASEAN roads has led to a need for the construction of more charging stations, which is a niche market by itself. According to a report by Grand View Research (a US based market research and consulting company), the global electric vehicle charging infrastructure market is expected to reach US$45.59 billion by 2025. Also, this particular market is expected to grow at a compound annual growth rate (CAGR) of 46.8% from 2017 to 2025. In addition, Bloomberg Energy Finance sees the electric vehicle (EV) market progressing in the coming years, predicting that 54% of new cars sold in 2040 will be of this type, which by then will account for 33% of the global car fleet. What this implies for Southeast Asia nations is that they need to dig deep and catch up with the rest of the global market if ASEAN wants to remain competitive in the EV sector in the coming years.

An example of a country in the region that is making waves in terms of its EV charging market is Thailand. Energy Absolute, a Thai company that specialises in this field, looks to establish and operate 1,000 EV charging stations in the country by the end of 2018, with a projected US$18 million pumped into the industry.

The International Energy Agency (IEA) through its Global EV Outlook 2017 report, projected that EV’s will still be economical even without subsidies on the total-cost-of-ownership basis among mass market vehicles in the period of 2025 to 2030.

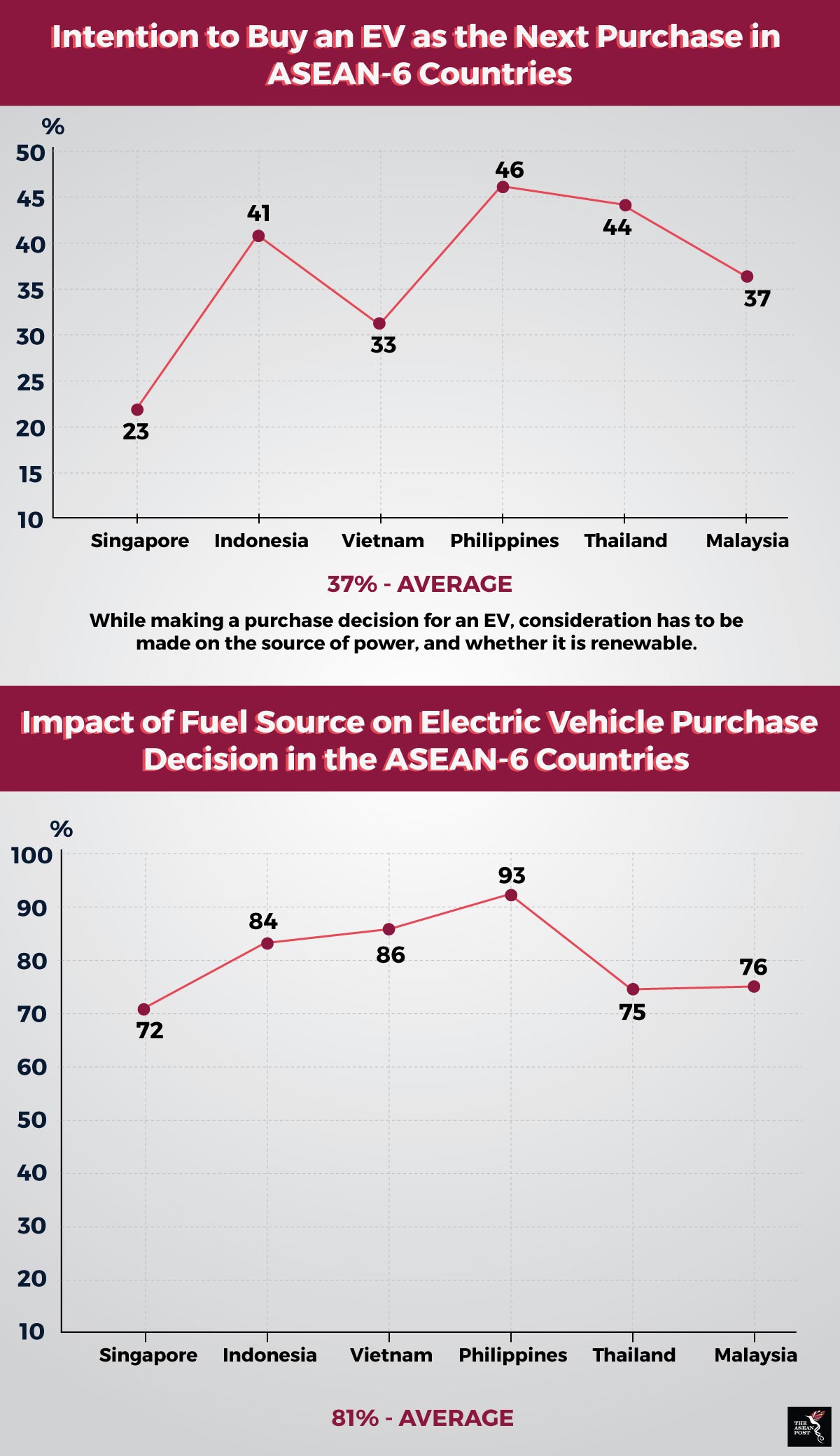

Source: Frost & Sullivan, Future of Electric Vehicles in Southeast Asia (2018)

Challenges for the EV charging market in ASEAN

There are a number of challenges that arise with regards to the EV charging market in Southeast Asia. One of the problems relates to congestion and the space needed to build charging stations. Even though these stations are not as big as a typical petrol station, substantial space will have to be allocated due to the number of stations required. To install a charging station, service providers will have to attain the approval of local governments and utility providers. If the station is to be built on a private lot, service providers will have to obtain permission from business owners. The plan to implement charging stations for EVs will also need to take into account the general scepticism that exists among members of the public, given that they might not be too familiar with the technology.

Another litmus test for the EV charging market is the storing of electricity in the stations. The electricity storage system enables the charging service provider to purchase extra electricity from the wholesale market when the price is low and store the unsold electricity for future use when the wholesale price is high. In such a context, the ‘buy low and sell high’ method may change as energy storage costs increases. This suggests that the service provider will become more conservative when purchasing electricity as storage costs increase. The struggle to strike a balance between the supply and demand for electricity for EVs (running on lithium-ion or nickel-metal hybrid batteries) could potentially be a hindrance to a normally receptive ASEAN citizenry.

On the whole, these challenges have to be dealt with so as to create a regional EV market that is sustainable in both, the short and long run. Governments of ASEAN member states should be more proactive in promoting the use of EV’s in the region as such a shift will only do more good than harm to the environment. A more thorough engagement between ASEAN governments and EV charging companies needs to be carried out. This is to do away with any possible discrepancies that might arise between intention and action on both ends of the spectrum.