We often associate cryptocurrencies with the realm of the intangible, existing in the perplexing world of coding and data. This thought process will now be a thing of the past as physical bitcoin notes have been launched in Singapore. Tangem, a crypto start-up which positions itself as the developer of “the first smart banknote for digital assets,” has just introduced the pilot sale of “Tangem notes” in the island nation. Perhaps unsurprising due to its technological prowess, Singapore is the first ASEAN country to introduce such notes.

Each banknote is designed to carry a chip, with that particular chip designating the note’s value. During the pilot launch phase, the value of each note is locked at 0.01 BTC and 0.05 BTC.

Unlike physical fiat currency, the Tangem note is not made of paper. Instead, it is made up of a semiconductor chip, specifically the Samsung Semiconductor S3D350A. This specific chip technology has been used and refined for decades in deployments ranging from military to government applications. However, it was only last year that a breakthrough in tech allowed for the creation of a chip that was both, secure and had advanced cryptography support.

“We are the first real physical bitcoin – the first tangible bitcoin. With these banknotes, you can conduct physical crypto transactions by just handing them over or receiving them,” said Tangem co-founder, Andrew Pantyukhin during a recent interview.

“They are truly decentralised, meaning it will never be restricted by technological limitations,” he added.

Singapore’s status as the financial and commercial hub of Southeast Asia definitely played a part in Tangem’s decision to launch its first pilot sale in the republic, particularly given the Monetary Authority of Singapore’s advancement of blockchain-based software prototypes for decentralised interbank payments and settlements.

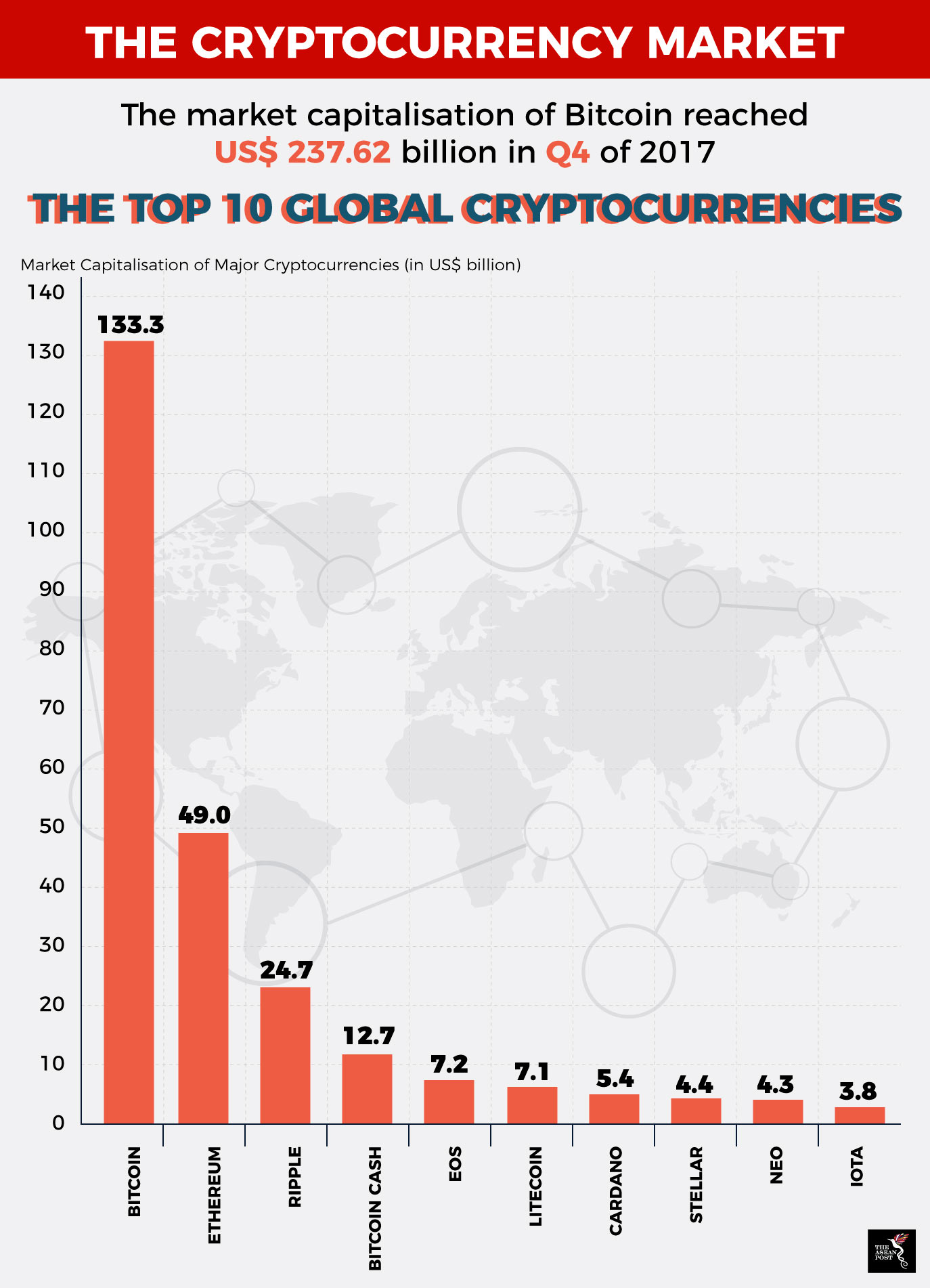

Source: Statista

Limitations in the ASEAN bitcoin market

Some would contend that the question of whether ASEAN is ready for physical cryptocurrencies or otherwise is premature. Considering the fact that many countries in the region are still finding their feet with the use of non-tangible bitcoins, it is perhaps safe to say that widespread physical cryptocurrency uptake for ASEAN as a whole is still some time away. However, the intent of such a statement is not to paint a bleak picture, but to spur the governments of ASEAN member states to be more aware of the value and potential of the digital market so as to “keep up with the times”, as it were.

With the use of cryptocurrencies, it is almost impossible to reverse payment once it is made. If one were to mistakenly pay another individual by this method, then there is no way to get a refund of the amount paid. One would then have to depend on the goodwill of the payee to return the funds.

Next, the problem of uncertainty and volatility in the cryptocurrency market has to be addressed. The aforesaid market is relatively new, which implies that it is unpredictable. Such volatility is one of the main reasons that mass adoption of the system is taking longer than it should. Many established corporations are not willing to deal with a medium of transaction prone to large and inconsistent swings in value.

An example of this sentiment can be seen when Bank Indonesia (BI) declared that cryptocurrencies were not recognised as a legal medium of exchange.

“There is a huge risk of losses to the public, besides the incipient threat to the stability of the financial system, regardless if the cryptocurrency in use is tangible or otherwise … [and] there is no underlying asset to be the basis for the price,” a BI spokesperson pointed out earlier this year.

As of now, the ASEAN region still needs time to adapt to the sweeping changes driven by the Fourth Industrial Revolution. In a highly competitive world, ASEAN member states have to up their ante and be more proactive so as to create a community that is not only tech savvy, but also able to comprehend the complexities of a new form of trade.