There are many sectors within ASEAN that have propelled the region to greater heights in terms of economic development and general prosperity. One of the sectors that Southeast Asia takes great pride in is its automotive industry, which has seen an increase in interest from investors, specifically from the Asian giant that is China.

Based on a report by Frost & Sullivan, no ASEAN country is in the Top 10 for global automotive sales as of Q1 2018. However, taking the region as a whole into account, ASEAN is projected to become the eighth largest automotive market this year, with estimated sales expected to reach 3.63 million units. This is indicative of the tremendous potential that the region has in terms of its automotive initiatives.

According to BMI Research forecasts, automotive sales in the Asia Pacific region will rise 4.7 percent, ahead of the projected global sales growth rate of 3.6 percent. Southeast Asia is anticipated to account for a significant portion of this figure, with the Philippines, Thailand, and Vietnam emerging as key markets.

With a projected growth output of 300 percent from 2016 to 2021, the Philippines has emerged as one of the fastest growing automotive hubs in the region. Based on another study by Frost & Sullivan, the number of new car sales in the country is expected to grow 11.5 percent to 576,959 units this year alone.

According to recent data from the ASEAN Automotive Federation, Thailand’s new vehicle market strengthened considerably in 2017, with sales rising by 12.2 percent to 210,894 units. Meanwhile, sales in the first nine months of 2017 were 11.6 percent higher at 620,870 units, compared to 556,525 units in 2016.

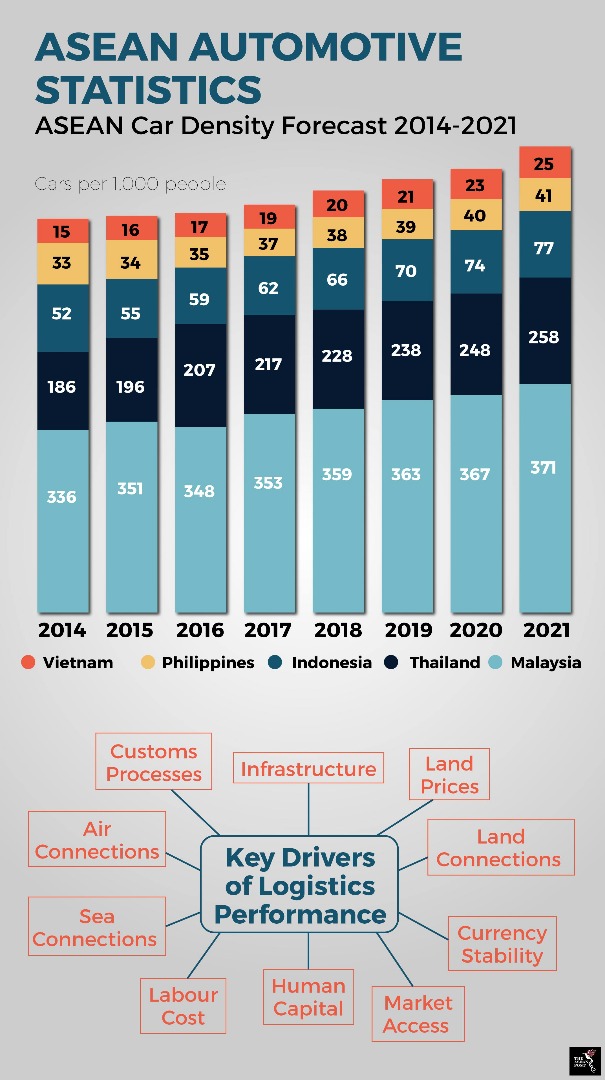

Source: ASEAN Secretariat

ASEAN’s automotive sector boom

There are numerous factors that have led to the region’s impressive progress in the automotive sector, with quite a few being specific to a particular nation. However, as a whole, healthy competition between ASEAN member states is the main pillar driving developments in the sector.

In Thailand, low interest rates for the purchase of vehicles can be seen as a strong factor that has contributed to the increase in car sales for that country. Sales there have been further strengthened by the launch of new passenger vehicle models. The expiration of the lock-in period (September 2017) for tax rebates for vehicle buyers under the government’s first-time buyer scheme introduced over five years ago has also contributed to improved sales figures.

According to Malaysia’s International Trade and Industry Ministry, sales of new vehicles in the country are expected to improve by a modest 1.9 percent to 591,000 units this year, slightly up from 580,000 units projected for 2017. Production volumes are also expected to grow by 3.9 percent to 535,000 units in 2018, as opposed to an estimate of 515,000 units last year.

Despite this growth, Malaysia’s automotive sector has to brace itself and be prepared for potential competition from other exporting nations as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) comes to the fore.

In Vietnam, the gradual elimination of tariffs for imported passenger cars through free trade agreements (FTA) has created a positive impact on car sales in the country. Manufacturers are of the opinion that the tariff cut to zero percent introduced this year will make the automotive market more competitive and will prove to be a major challenge for domestic manufacturers.

As of 2018, exports are predicted to increase by 30 to 40 percent. Demand for commercial vehicles is also expected to rise due to infrastructure development projects focused on road traffic in Hanoi.

ASEAN’s automotive sector is on the right track. Moving forward, the healthy competition among manufacturers within the region must be used as a catalyst to spur further technological, design and innovation advancements if ASEAN car manufacturers hope to become leaders in the global automotive market.