The chandeliered halls of Vienna’s Hofburg palace will be the venue for the meeting between leaders of the Organization of the Petroleum Exporting Countries (OPEC) as they decide on output policy amid calls by the major oil consuming economies of the United States (US), China and India to increase crude oil production and cool down oil prices. OPEC, which has been infamous for backing-out of agreed upon oil output targets has been over delivering on an agreement to slash oil production which has been in place since January last year – cutting approximately 1.5 times the promised output.

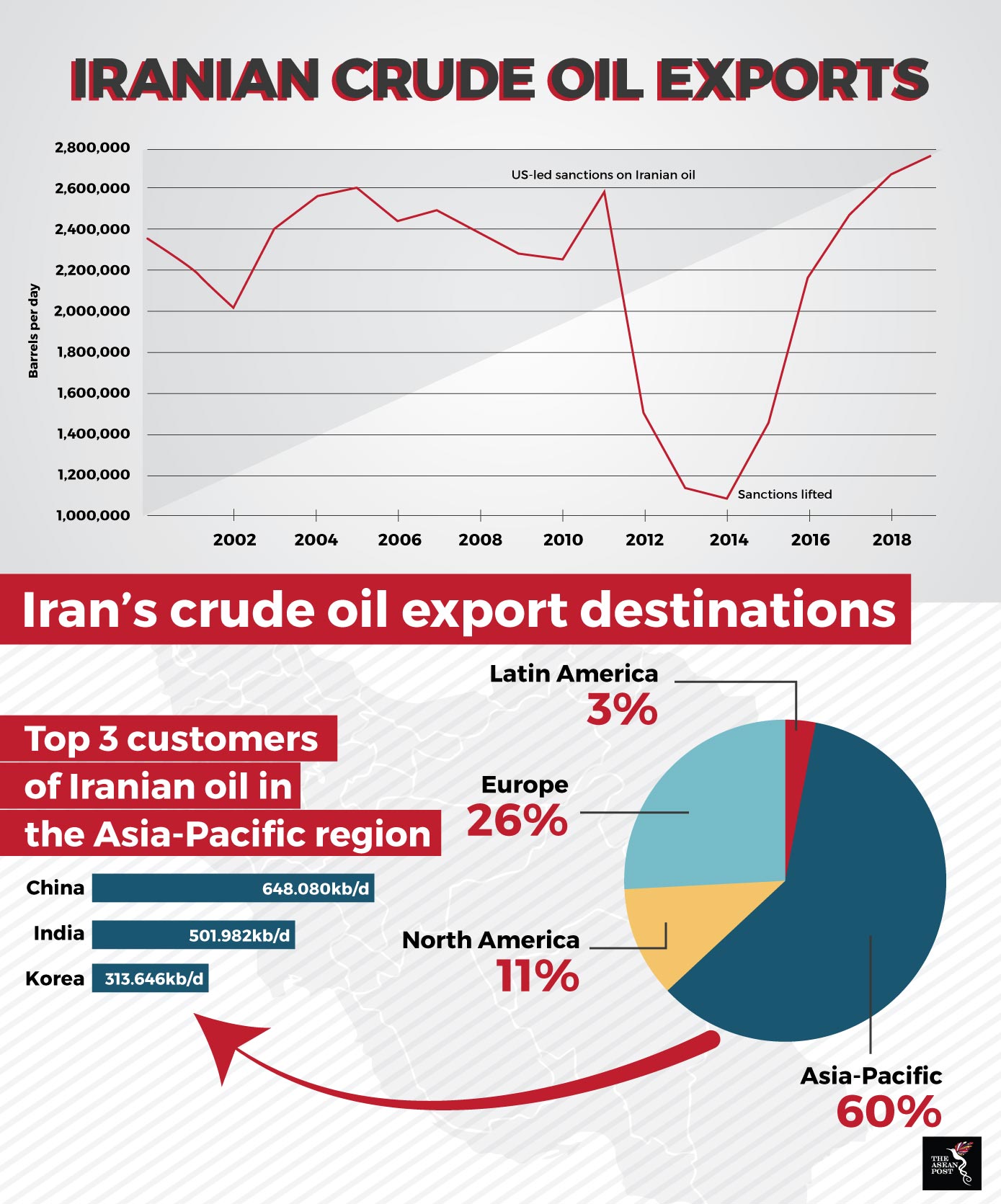

Now, Russia – a non-OPEC country – and Saudi Arabia – OPEC’s de facto leader and largest crude oil producer in the world – are lobbying for an output raise much to the chagrin of Iran which has threatened to veto any such proposal as the OPEC functions on the principle of unanimity. Iran which has been recently hit by sanctions after US President Donald Trump withdrew from the Iran nuclear deal says that members of the cartel whom have over-delivered should then return to the agreed quotas.

The US has been pressuring Saudi Arabia – one of its key allies in the Gulf – to engineer a supply boost in order to lower oil prices. Iranian Oil Minister Bijan Zangeneh, in a firm retort said that it was Trump’s actions of pulling out of the nuclear deal and imposing sanctions on Iran that has created difficulties in the oil market. He then castigated Trump for thinking he can control OPEC by expecting its member countries to address the consequent supply shortfall.

OPEC sees an urgent need to return oil supply to the market due to outages from Iran and a decline in Venezuelan output. However, its members are now squabbling over how much oil needs to be pumped back into the market. After a tense meeting on Wednesday, Saudi Energy Minister, Khalid al-Falih said that he was convinced that OPEC members would “do the right thing” and that “reason would prevail” at the upcoming meet on Friday.

Source: Various sources

How will this impact Southeast Asia?

For Southeast Asia’s economic boom to continue, it would have to meet its energy demands which have seen a significant rise in recent years. According to the International Energy Agency (IEA), oil demand in the region is following an upward trajectory from current levels of 4.7 million barrels per day (bpd) to 6.6 million bpd by 2040.

Niharika Tagotra, a PhD researcher in international politics at Jawaharlal Nehru University expects relatively little impact on Southeast Asia per se but sanctions on Iran would have considerable impact on global oil prices.

“Southeast Asian markets have had a limited exposure to Iranian oil supplies. The trade between ASEAN and Iran has only recently seen some growth. The impending Iran sanctions will have some degree of impact on global oil supplies which is expected to push up oil prices,” she said

“However, in the event that the OPEC countries decide to ease production cuts (as is being pushed at the OPEC meet by Russia and Saudi Arabia), prices may stabilize. In my view, the Iran sanctions, for this time around may have very limited impact on its oil trade with other countries,” Tagotra concluded.

On the possible outcome of the OPEC meeting on Friday, Tagotra expects production cuts to proceed, if only partially.

“The OPEC meeting should see some easing out on the production cuts. Russia and Saudi Arabia are pushing hard for it. Both producer and consumer countries vie for a stable oil market. Extremely high or low oil prices are in favour of neither,” she explained.

Han Phoumin, an energy economist with the Economic Research Institute for ASEAN and East Asia (ERIA) told The ASEAN Post that he sees this issue as more politically fuelled.

“Basically, the world has enough flow of oil and reserve capacity, but the political sentiment could shock the market more than expected, not about the real supply and demand itself,” he said, adding that, “the oil price is pretty much affected by sentiment of political instability in the middle east and also the collapsing of production in Venezuela.”

“However, the shortfall of Venezuela combined with Iran's production could be easily off-set by the combined action of the OPEC producers and Russia who have the ability to quickly produce about 1.5 million bpd. US production also adds around nearly one million b/days to the market, resulting in the slumped price seen these past few days,” he added.

Hence, the outcome of the OPEC meeting would have very minimal direct impact on Southeast Asia. Nevertheless, the region should keep one eye on developments as major Iranian oil importers like China and India could be affected by the outcome of the meeting. This in turn may result in indirect repercussions for Southeast Asia.