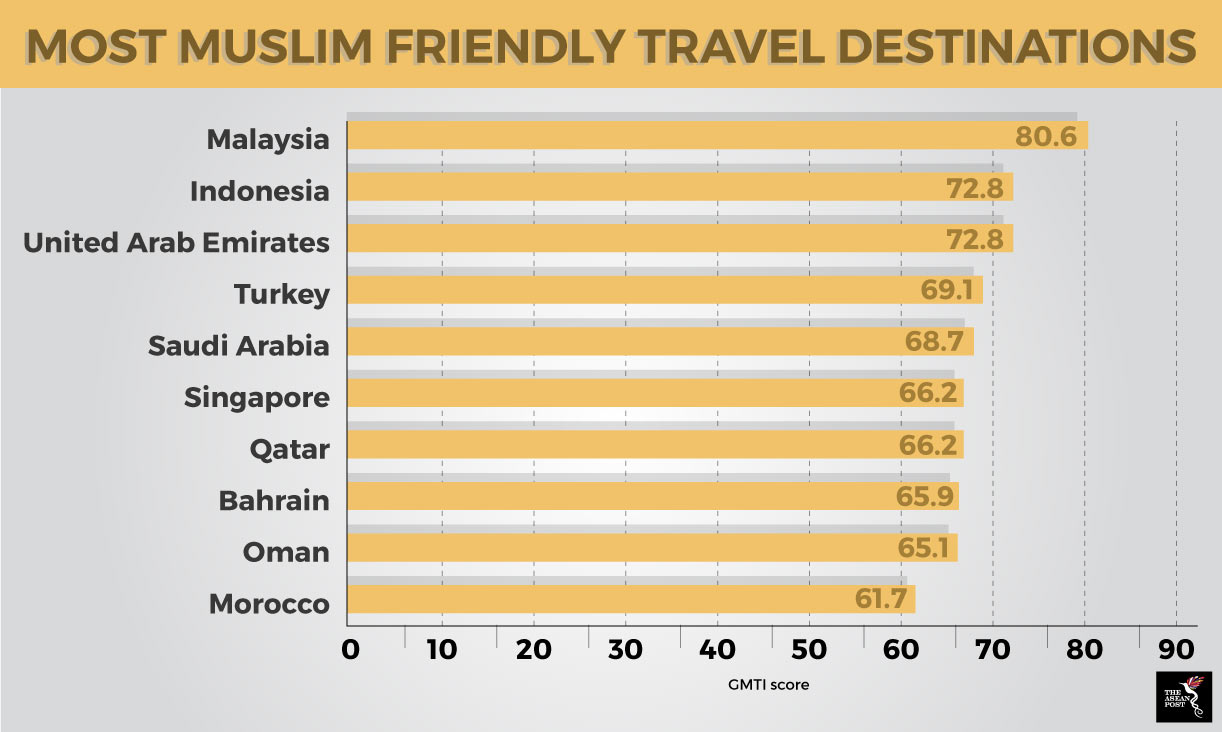

Three ASEAN countries finished in the top-10 of last year’s Mastercard-CrescentRating Global Muslim Travel Index (GMTI) 2018 in a strong acknowledgement of the region’s reputation as an Islamic tourism hub.

Malaysia topped the index for the eighth straight year, finishing ahead of Indonesia and the United Arab Emirates and cementing its position in the global Islamic tourism market. As in 2017, Singapore remains the most popular non-Organisation of Islamic Cooperation (OIC) destination, finishing joint-sixth in 2018 in the survey which featured 130 destinations.

The GMTI index takes into account four criteria; access, communications, environment and services.

Source: Mastercard-CrescentRating Global Muslim Travel Index (GMTI) 2018

Source: Mastercard-CrescentRating Global Muslim Travel Index (GMTI) 2018

Booming global Muslim tourism

With a steady rise in the number of global visitor arrivals, the relatively untapped niche Islamic tourism market is one of the fastest growing segments in the tourism sector.

There were an estimated 25 million Muslim tourists globally in 2000, with the number rising to 98 million in 2010. The number of Muslim tourists globally was estimated at 117 million in 2015, 121 million in 2016 and 131 million in 2017. The number is expected to reach 156 million by 2020, representing 10 percent of the global tourism industry.

In terms of spending, the global Muslim-travel segment is currently worth an estimated US$180 billion, with the value forecast to reach US$220 billion by 2020 and US$300 billion by 2026, respectively.

In ASEAN, it is estimated that the region will attract over 18 million Muslim arrivals by 2020, which is nearly 15 percent of all tourist arrivals to the 10-member bloc.

“The importance of Islamic tourism is appreciated by many national tourism organisations around the world,” said Joan Henderson, Associate Professor of Marketing and International Business at Nanyang Business School in Singapore.

According to Henderson, who specialises in tourism and is a fellow at the Institute on Asian Consumer Insight at Nanyang Business School, promotional websites such as those of Japan, South Korea and Hong Kong offer guides to halal (permissible or lawful in traditional Islamic law) dining and the Tourism Authority of Thailand has launched an app to cater to Muslim tourists.

Though Islamic tourism has traditionally meant religious travel for Hajj and Umrah pilgrimages, the term has now grown to include the increasing number of Muslims who travel for business and leisure too.

The GMTI report identified several key factors pushing the growth of Muslim tourism, the biggest being the growing Muslim population.

Muslims are the world’s fastest-growing religious group where approximately one in four people worldwide is a Muslim. By 2050, this will increase to 2.8 billion, or approximately one in three people worldwide - with the majority located in the Asia Pacific region.

Other drivers include a growing middle class with disposable income, a young population and increasing access to travel information.

Government initiatives

According to a report released by Salam Standard titled Global Economic Impact of Muslim Tourism and Future Growth Projection: 2017-2020, Muslim travel in Malaysia is forecast to have a gross domestic product (GDP) impact of US$3.6 billion by 2020, up from US$2.8 billion in 2017 – when it attracted 5.3 million Muslims out of a total of 26 million tourist arrivals.

Apart from robust Islamic financial institutions and a vibrant halal industry, Malaysia’s Islamic tourism sector also benefits from good infrastructure and government backed policies and incentives.

Recognising the need to preserve the integrity of tourism products which claim to be Muslim-friendly, Malaysia rolled out its – Muslim Friendly Hospitality Services (MFHS) Standard in 2015 – setting guidelines for three critical components of the Islamic tourism supply chain; accommodation, tour packages and tourist guides.

In Indonesia, the world’s most populous Muslim country, the head of the Tourism Ministry’s halal tourism acceleration team believes Indonesia can attract 50 percent more tourists if it tops the 2019 GMTI.

“We saw this when Lombok was ranked the World’s Best Halal Honeymoon Destination and World’s Best Halal Tourism Destination in 2015 and 2016, respectively. The number of tourists increased up to 50 percent, especially from the Middle East and Malaysia,” said Riyanto Sofyan.

With Muslim visitors to the country in 2017 standing at 2.8 million, Indonesia targeted 3.8 million Muslim tourists in 2018 and will hold a series of sales missions to Jeddah, London, Mumbai, Singapore and Sydney to achieve its target of five million Muslim tourists this year.

Increasing numbers like these only further outline Islamic tourism’s growth potential globally. With ASEAN at the forefront of capitalising on this exciting new niche market, we can once again expect to see Malaysia or Indonesia featuring strongly in the GMTI this year.

“This isn’t an overnight change, it is a story still waiting to happen.” said Mikhail Goh, co-founder of the Singapore-based website Have Halal Will Travel. “This is just the beginning.”

Related articles:

Could Islamic tourism be Brunei’s answer?

Tourism could boost Indonesia’s economy

Enhancing the tourism industry in ASEAN