In recent years, there has been an increasing demand and interest for digital assets in Southeast Asia.

“In the past, investors still understood that digital assets were digital currencies well known as Cryptocurrency,” stated the Siam Commercial Bank (SCB). “But in fact, digital assets are not limited to digital currency.” The SCB then named digital coins (Crypto tokens), also known as digital tokens, as well as other digital products and services – as examples.

While there are few countries around the region that actually accept digital currencies as a payment method, it was reported by digital assets technology company Atato, that Thailand has been open to cryptocurrency trading counting with over five regulated exchanges present in the country. It was reported that crypto trading volume in the kingdom has grown from US$630 million in December 2020 to US$2.17 billion in January this year.

Whereas in neighbouring Malaysia, the ASEAN member state is one of the first countries to come up with a regulatory framework on cryptocurrency courtesy of Securities Commission Malaysia’s digital asset framework. While cryptocurrencies have yet to gain traction as a means of payment in the country, there are already a number of local merchants and businesses who have opted to accept digital currencies.

“There are calls from local crypto enthusiasts calling for more merchants to accept bitcoins and we decided to answer their call,” Vincent Chin, founder of fish store Sarawak Harvest, told local media.

Cryptocurrencies like Bitcoin are viewed as a direct challenge to banks’ control of currency. Nevertheless, despite an initial reluctance and hostility towards cryptocurrencies, “central banks are starting to recognise and embrace blockchain – the highly innovative technological backbone behind bitcoin,” according to the East Asia Forum in an article titled, ‘Digital Currencies of the Future in Asia’.

“The future of money is here and governments need to embrace it,” it noted.

‘Base On Credit Token’

Blockchain assets are a type of digital asset or cryptocurrency. Some could represent stakes in a particular organisation while others are intended to be currencies such as Bitcoin and Ethereum.

Despite a growing number of organisations having expressed their desire to enter the blockchain field – there are still a number of barriers to blockchain adoption. For example, blockchain faces a number of implementation challenges that are connected to its still immature technology, as noted by Finextra Research in an article titled, ‘Remaining Challenges of Blockchain Adoption and Possible Solutions’.

They include a lack of scalability, lack of standardisation, lack of blockchain developers and due to their complexity and their encrypted, distributed nature – blockchain can be slow and cumbersome.

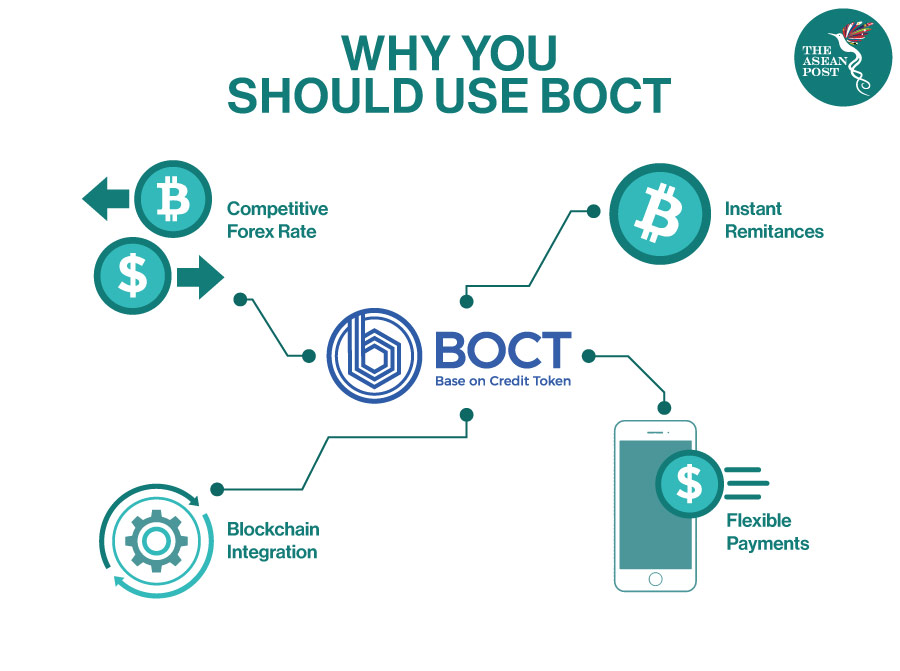

One of the possible solutions to the current barrier of blockchain assets adoption in the market is a stable fiat-pegged blockchain asset – and this is what Creditz Base Group Limited (CBGL) does.

CBGL is a Malaysia-based financial services firm, approved by the Labuan Financial Services Authority (LFSA) to carry out a credit token business that provides blockchain technology enabling and applications services via its proprietary Base-On-Credit-Token (BOCT) platform.

The key factor that CBGL is addressing is the inability to do blockchain assets settlement quickly and safely due to market risks such as high volatility in pricing and unstable liquidity.

Its BOCT platform is the first private blockchain-based digital money platform for cross border payments to a designated destination of choice.

BOCT works hand-in-hand with RMBex Limited, a company that provides a licensed digital asset brokering platform for cross-selling and trading of cryptocurrency approved by the LFSA. Therefore, the application of BOCT in the new millennial era is integrated into a unique and reliable trading platform which offers more versatile access to crypto-financial services.

The BOCT platform is expected to be a trendsetter that creates operational efficiencies, in the form of faster validation of settlements for many merchants and is set to redefine cost-savings strategies in the new digital consumer era.

BOXTradEx And BOCT Strategic Partnership

BOXTradEx, a digital assets exchange combined with strategic trading tools (bots), and BOCT have reached a strategic partnership to cooperate in cross-currency settlement via token and/or digital assets. This partnership has the potential to create great value-added benefits to BOXTradEx users, especially with the option for fiat-to-crypto currency transaction settlement; subject to rates.

Furthermore, BOXTradEx has established a Fiat On-Ramp platform that enables users in Southeast Asian countries, like Vietnam and Indonesia, to deposit fiat money from their bank accounts in return for digital assets, such as BOCT, Bitcoin (BTC), Ethereum and Tether (USDT), among others.

BOXTradEx and BOCT’s partnership provides users with access to the digital assets ecosystem where users in Southeast Asia can deposit fiat money in return for selected digital assets. The Fiat On-Ramp platform will support exchange for several digital assets, like BTC, USDT, and Ripple (XRP), among others.

In general, the spending of digital assets remains a key issue in the digital assets ecosystem as it is not easily accessible and reliable; where merchants also do not regard them as part of mainstream payment settlement options.

The issue here is mainly due to the inconvenience and lack of reliable access for fiat-digital assets conversion. This partnership together with BOCT, will allow for more reliable access and convenience for BOXTradEx’s users in the hope of providing more options for them to expand in the digital assets ecosystem.

BOXTradEx focuses on building valuable and user-friendly trading bots for digital assets-investors in Southeast Asia. Together, their commitment is towards a vision that provides one of the most stable liquidity and secure trading environments that differs from their competitors.