Sustainable investing is going mainstream in ASEAN with more than half of the private equity deals in the region now backing business models that contribute to environmental and social progress.

Sustainable investing – also known as responsible investing or impact investing – is catching on globally as companies increasingly realise that they do not have to sacrifice long-term competitive financial returns if they want to generate positive societal impact by incorporating environmental, social and corporate governance (ESG) guidelines.

In a report released yesterday, global consultancy firm Bain & Company pointed out that public concern about climate change, pollution, deforestation and social inequality has resulted in 56 percent of all private equity deals in Southeast Asia in the first half of 2019 meeting the company’s sustainability criteria for developing countries – up from 30 percent in 2017.

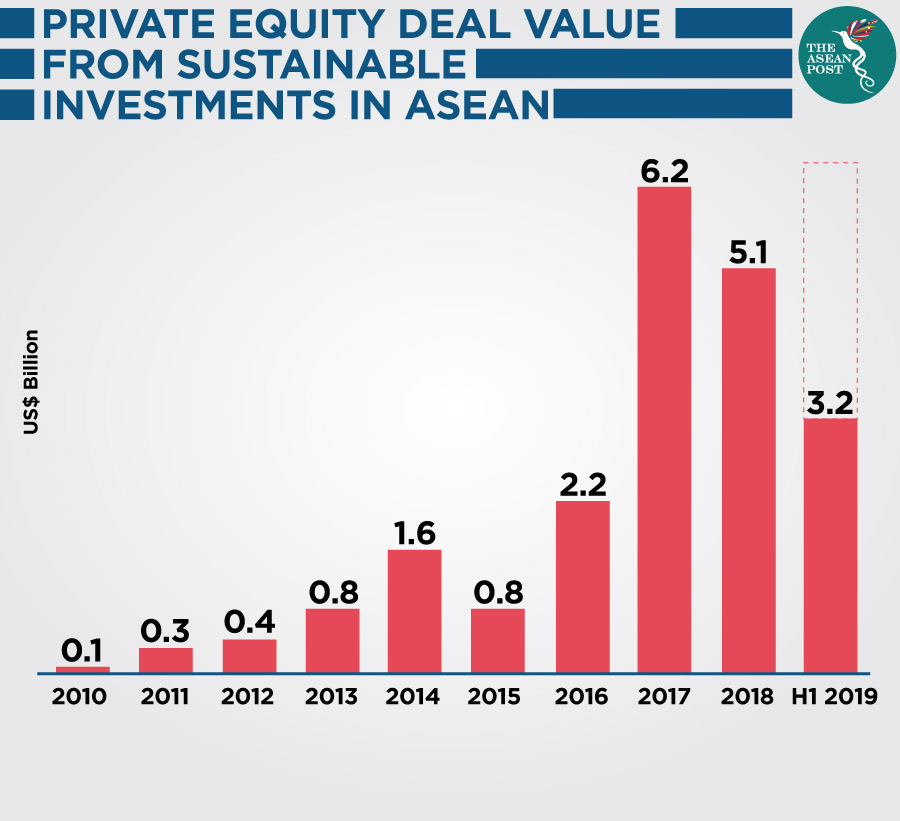

The total deal value of sustainable investments in Southeast Asia for the first half of 2019 amounted to US$3.2 billion, a 60 percent rise compared to the same period a year earlier – and on track to surpass last year’s total of US$5.1 billion.

In addition, private equity funds invested more than US$6 billion in sustainability assets in Southeast Asia last year, making up 41 percent of deal value. By comparison, private equity funds in ASEAN invested just one percent in sustainability assets in 2010.

“Consumers and shareholders are increasingly demanding that companies expose ethical issues linked to their investments,” said Suvir Varma, a senior advisor with Bain & Company’s Global Private Equity practice and the report’s co-author. “That concern sparked the first wave of sustainability investing a decade or more ago as funds sought to mitigate financial and reputational risks.”

Power to change futures

Bain & Company’s criteria for sustainable investing is that it must first and foremost fuel growth.

It must also either improve the environment by investing in sectors such as clean energy, water purification, pollution controls, waste reduction, low-carbon transportation, sustainable fisheries and energy from waste.

The two other criteria include increasing access to basic resources or services and providing microbusinesses access to finance and markets so as to help reduce poverty; and promote upward economic mobility of business owners.

As global accountancy firm KPMG noted, investors have the power to change futures by deciding where to allocate resources. And with today’s growing awareness of the social impact of financing decisions and in the context of climate change and resource scarcity, this idea has begun to shape the investment landscape.

A sure sign that sustainable investing has landed in ASEAN came last month in the region’s financial hub of Singapore when the Singapore Venture Capital and Private Equity Association (SVCA) organised its first conference on ESG and impact investing since being formed in 1992. Lim Boon Heng, chairman of state investment firm Temasek Holdings – which holds a portfolio worth US$230 billion – was the key speaker.

Higher returns

More proof that sustainable investing is here to stay can be found in the number of fund managers who have signed the United Nations (UN)-supported Principles for Responsible Investment (PRI), which has grown to more than 2,660 from 1,200 in 2013. Crucially, the US$82 trillion in assets under management by these signatories – 41 of which are from Southeast Asia – increased by a compound annual rate of 19 percent from 2013 to 2019.

A report by Bank of America Merrill Lynch in September fund that companies that have higher compliance with ESG principles showed a higher median forward one-year return on equity, at about 17 percent, compared with about 13 percent for companies with lower ESG compliance.

A lot has changed over the past decade, and the Bain & Company report stressed that many large investors in the region have shifted away from primary industries such as oil and gas, mining and agricultural commodities to business models that address environmental and social needs such as renewable energy and for-profit hospital networks that offer underserved populations better access to healthcare.

Take for example Northstar Group, a Singapore headquartered private equity firm whose sustainable investments in Indonesia include a teak plantation and a solar micro-grid project which aims to bring electricity to 2.5 million people across 3,000 villages.

The Ignite Impact Fund, meanwhile, has set out to “invest in growing businesses from any country that can eradicate poverty in the Philippines”. Targeting 2033 as the year in which the Philippines’ eight million people living below US$1.90/day will be lifted out of extreme poverty, they have invested in coffee farmers whose beans have won international accolades.

In Vietnam, renewable energy has been ranked as the third most attractive sector for private equity investment according to a report released by accounting firm Grant Thornton in May. It is significant to note that a year earlier, renewable energy was 10th on the list.

As Ismitz Matthew de Alwis, Executive Director and Chief Executive Officer of Malaysia’s Kenanga Investors noted, current trends point towards sustainable investing as a way to reach new demographics of investors while addressing changing investor preferences.

“Studies show that women and younger investors care most about sustainability. As these demographic segments gain greater control of wealth, demand for ESG-minded investments is likely to grow,” pointed out de Alwis, who is also the President of the Financial Planning Association of Malaysia (FPAM), in an article he wrote.

With increased awareness about its potential to create balanced economic development and realise stronger returns, Southeast Asia can expect to see a growing number of firms incorporate sustainable investing practices into their strategies.

Related articles:

Moving faster towards net-zero emissions