This year, the healthcare industry in the Asia-Pacific region is expected to grow at 11.1%, according to a report by Frost & Sullivan which makes it one of the fastest growing regions for healthcare in the world. On average, the global healthcare economy has an annual growth rate of 4.8%, the report added.

This progressive growth is powered by a larger adoption of technology, innovative healthcare access programmes and delivery of care in and out of the hospital. Frost & Sullivan projects the Asia Pacific healthcare market to grow to US$517 billion in 2018.

The report also mentioned that despite political concerns and pressure to decrease the costs of healthcare, “…the industry will register globally a stable growth rate of 4.82% during this year.” Some trends that the region will see, include an ongoing digital transformation and the emergence of ‘Smart Hospitals’.

"The role of healthcare consumers is changing dramatically in Asia-Pacific. Digital technology enables access to information and care; hence consumers are able to choose where, how, and by whom they would like to be treated. This is changing every business model in the region", noted Rhenu Bhuller, Partner, Frost & Sullivan.

ASEAN healthcare harmonisation

Cross-border provision of healthcare services in the ASEAN region has flourished during the last few years with the emergence of medical tourism, particularly in Malaysia, Singapore and Thailand. The positive economic growth experienced in the region has allowed more people to seek medical services elsewhere for the best treatment possible.

In order to harmonise the healthcare sector to ensure that projected growth takes places in the region, the Association of Southeast Asian Nations (ASEAN) has come up with the ASEAN Economic Community (AEC) Blueprint 2025 that touches on healthcare co-operation.

The Blueprint was created to meet the expectations and demands of ASEAN citizens who are now placing more importance on healthcare. ASEAN member states have agreed to lay out strategic measures to ensure that the development and integration of this sector is systematically implemented.

According to the AEC Blueprint 2025 Analysis report, “The average spending per capita in ASEAN is very low compared to that in advanced countries. For example, the average healthcare expenditure in OECD countries was US$4,471 in 2014, while the figure for ASEAN was only US$643, suggesting a large potential for growth in the region.”

Plans under the AEC 2025 Blueprint

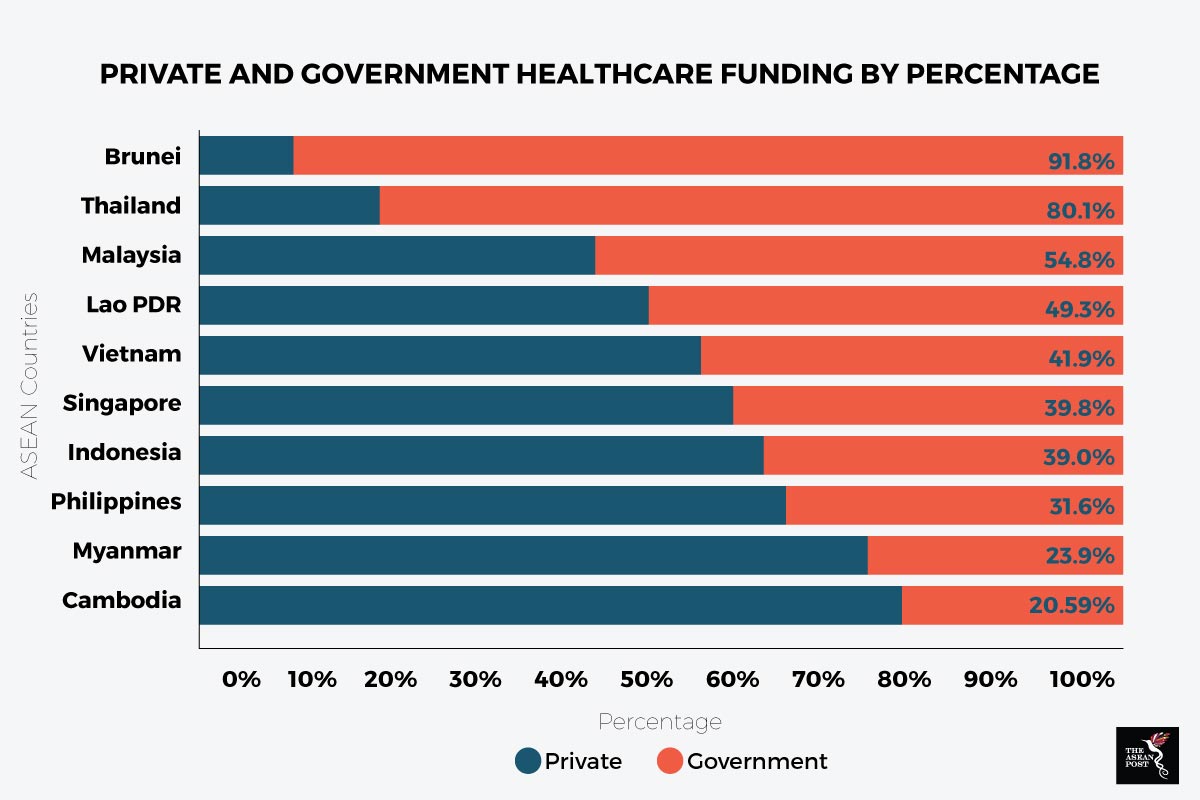

The AEC 2025 Blueprint for co-operation in the healthcare sector aims to increase public-private investments for better healthcare coverage in ASEAN and to harmonise standards in healthcare amongst others. These plans aim to promote the development of a stronger healthcare industry that will further advance healthcare facilities, products and services to meet the perpetually growing demand for affordable, quality healthcare in the region.

Currently, ASEAN is tackling these issues with aid from all the respective governments and other stakeholders. To increase public-private investments for better healthcare coverage, several member states have taken some important steps. For example, Singapore is in the process of adding 3,700 more beds and recruiting 20,000 more workers under its Healthcare 2020 Masterplan.

In the context of harmonising standards and conformance in healthcare services, ASEAN has issued the ASEAN Medical Device Directive (AMDD) to support trade in the region by harmonising the standards of medical equipment. With this directive, the registration process for manufacturers is made easier among ASEAN countries.

The promotion of other sectors such as health tourism and e-healthcare services are constantly being developed. According to Patients Beyond Borders - a US-based organisation that compiles statistics of global medical tourism – it is estimated that almost one-third of global medical tourism consumers travel to Southeast Asia just for treatments.

As mentioned above, Malaysia, Singapore and Thailand continue to be the main three destinations for medical tourists, with most of their consumers coming from within the ASEAN region itself.

Challenges for ASEAN

While this Blueprint helps to chart better integration for healthcare in the region, ASEAN still faces many challenges along the way. Most of the challenges in employing the blueprint affect smaller countries in the region such as the CLMV nations who are not moving as fast as Singapore, Malaysia and Thailand in this sector.

Governments need to find a balance between public and private investments to ensure that the whole population can have access to better medical treatment and facilities. As integration in the health sector could help promote greater health coverage throughout the ASEAN region, discussions and cooperation between health and finance authorities must take place for better healthcare to happen.

Recommended stories: