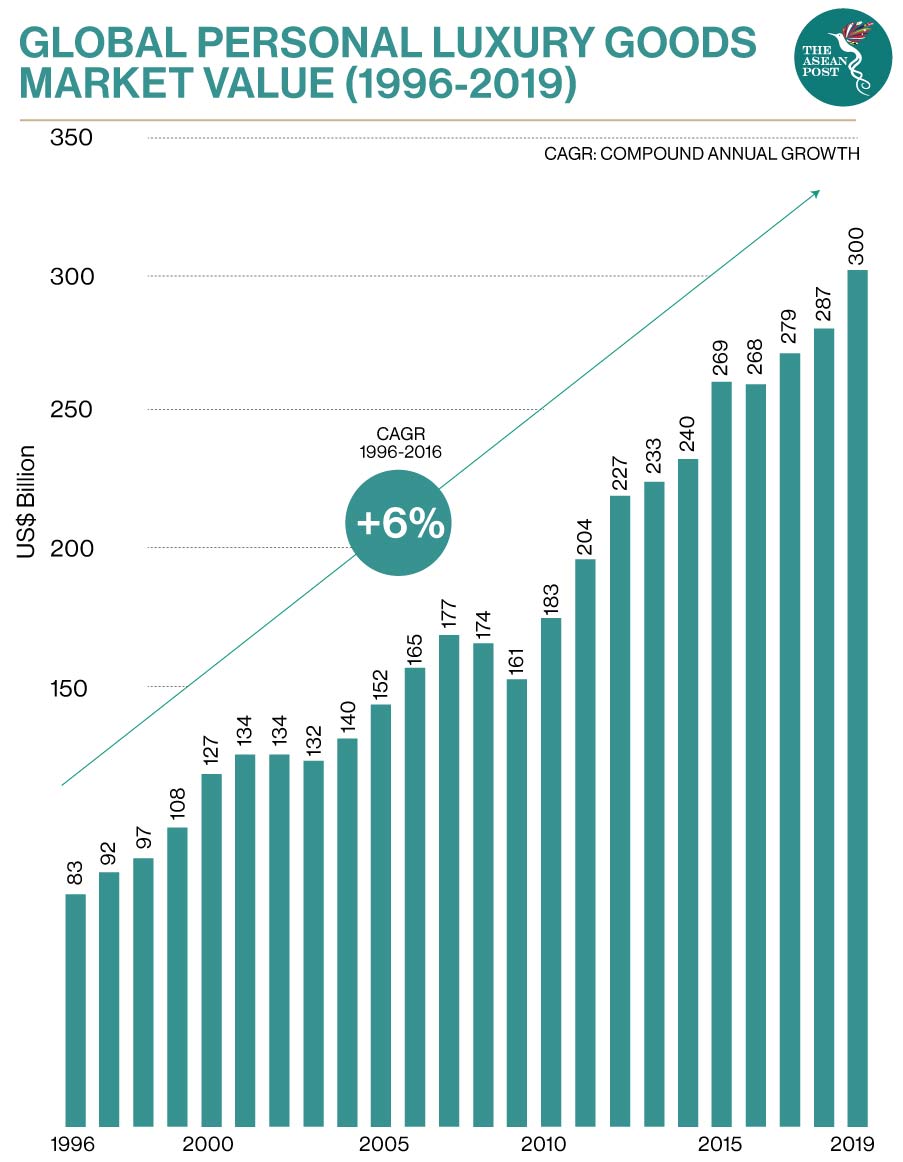

Global demand for personal luxury goods has been steadily increasing for decades, resulting in an industry worth US$308 billion in 2019.

However, the insatiable desire for consumers to own nice things was suddenly interrupted by the coming of the COVID-19 pandemic, and experts are predicting a brutal contraction of up to one-third of the current luxury goods market size this year.

Will the industry bounce back? Or will it return as something noticeably different?

A Once Promising Trajectory

The global luxury goods market – which includes beauty, apparel, and accessories – has compounded at a six percent pace since the 1990s.

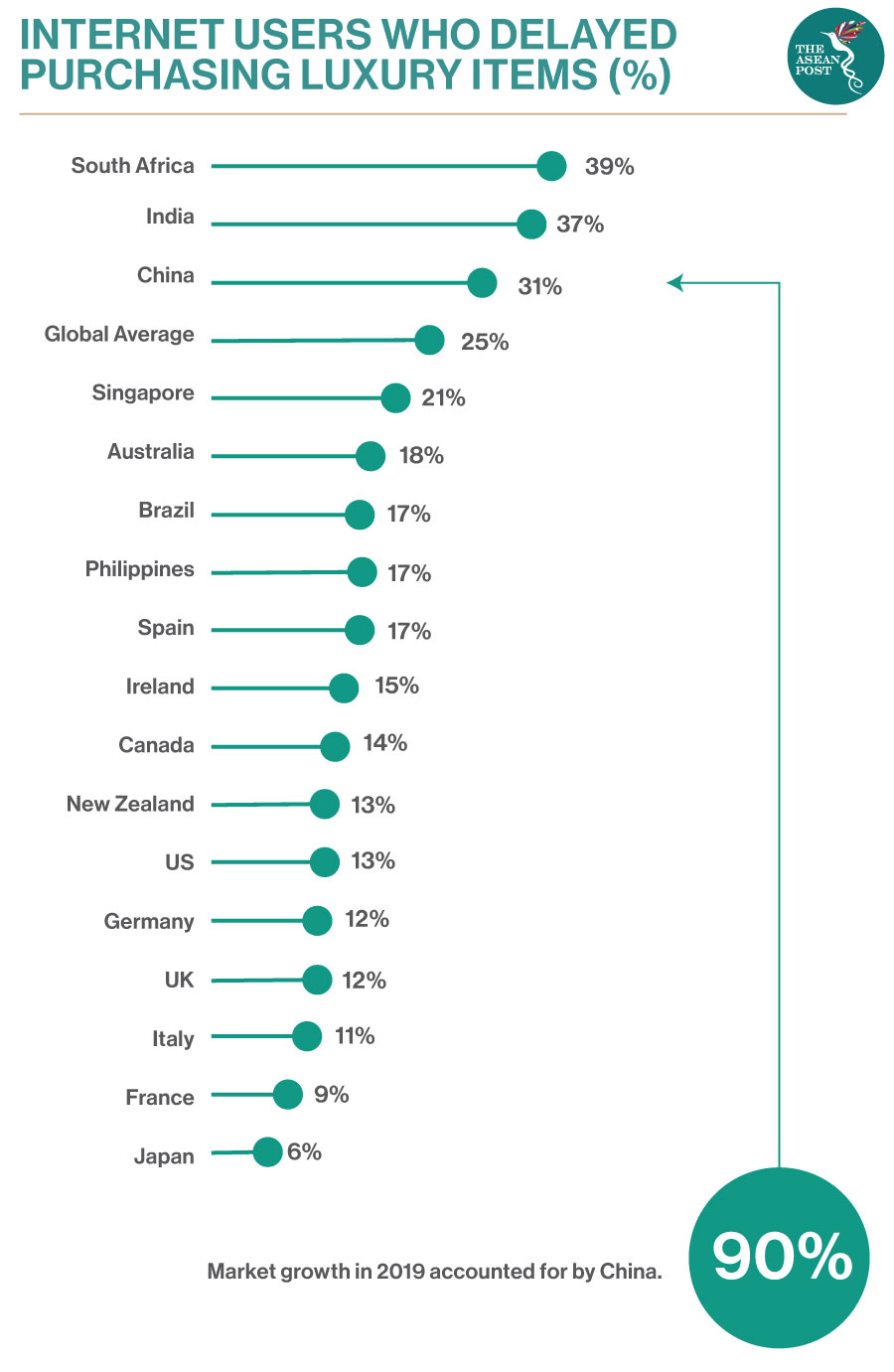

Recent years of growth in the personal luxury goods market can be mostly attributed to Chinese consumers. This geographic market accounted for 90 percent of total sales growth in 2019, followed by Europe and the Americas.

Analysts suggest that China’s younger luxury goods consumers in particular have significant spending power, with an average spend of US$6,000 per person in pre-COVID times.

An Industry Now In Distress

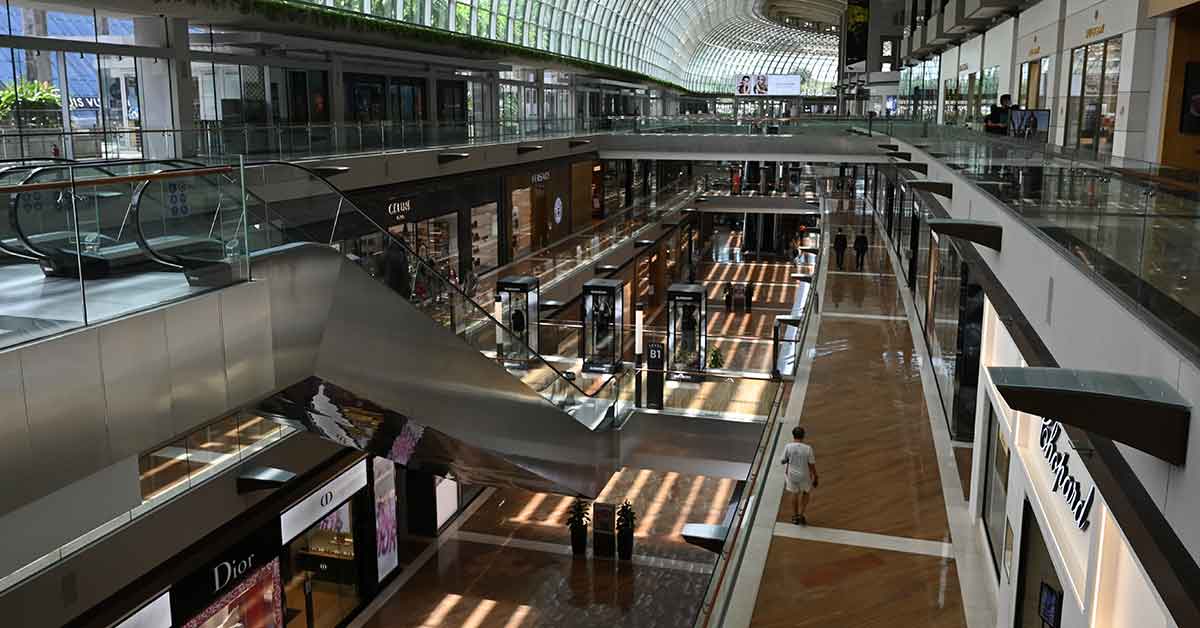

The lethal combination of reduced foot traffic and decreased consumer spending in the first quarter of 2020 has brought the retail industry to its knees.

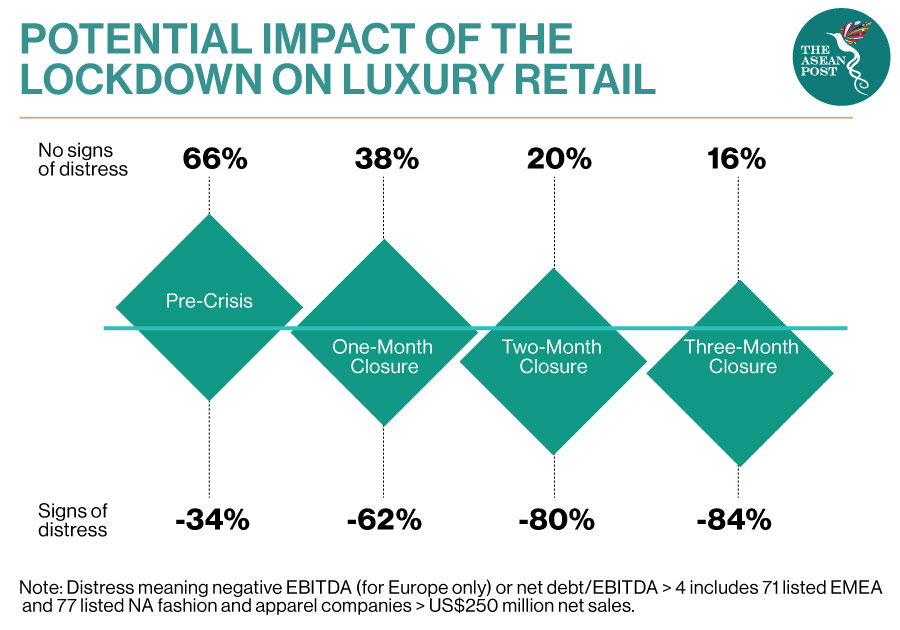

In fact, more than 80 percent of fashion and luxury players will experience financial distress as a result of extended store closures.

With iconic luxury retailers such as Neiman Marcus filing for bankruptcy, the pressure on the luxury industry is clear. It should be noted however, that companies who were already experiencing distress before the COVID-19 outbreak will be the hardest hit.

Predicting The Collapse

In a recent report, Bain & Company estimated a 25 percent to 30 percent global luxury market contraction for the first quarter of 2020 based on several economic variables. They have also modelled three scenarios to predict the performance for the remainder of 2020.

Optimistic scenario: A limited market contraction of 15 percent to 18 percent, assuming increased consumer demand for the second and third quarter of the year, roughly equating to a sales decline of US$46 billion to US$56 billion.

Intermediate scenario: A moderate market contraction of between 22 percent and 25 percent, or US$68 billion to US$77 billion.

Worst-case scenario: A steep contraction of between 30 percent and 35 percent, equating to US$92 billion to US$108 billion. This assumes a longer period of sales decline.

Although there are signs of recovery in China, the industry is not expected to fully return to 2019 levels until 2022 at the earliest. By that stage, the industry could have transformed entirely.

Changing Consumer Mindsets

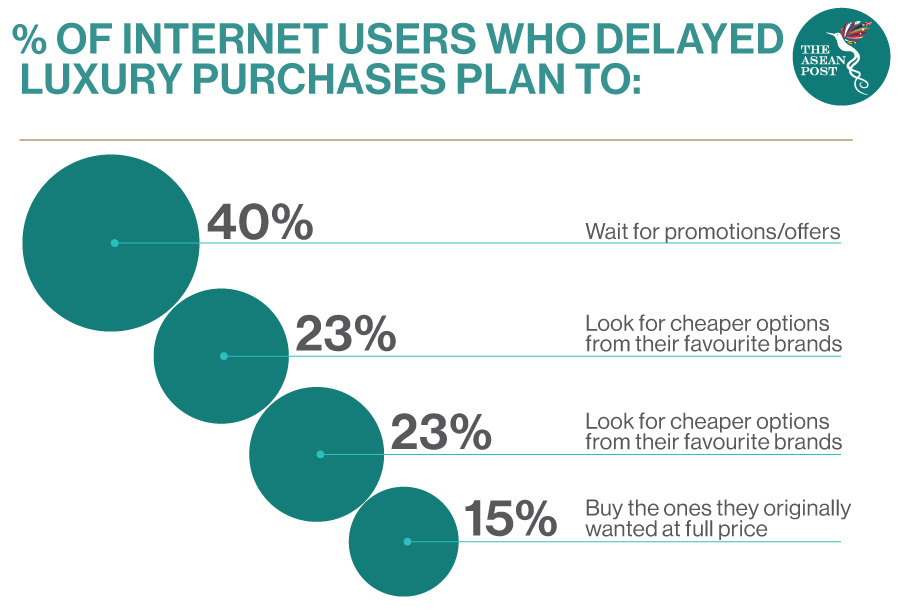

Since the beginning of the pandemic, one-quarter of consumers have delayed purchasing luxury items. In fact, a portion of those who have delayed purchasing luxury goods are now considering entirely new avenues, such as seeking out cheaper alternatives.

However, most people surveyed claim that they will postpone buying luxury items until they can get a better deal on the price.

This frugal mindset could spark an interesting behavioural shift, and set the stage for a new category to emerge from the ashes – the second-hand luxury market.

Numerous sources claim that pre-owned luxury could in fact overtake the traditional luxury market, and the pandemic economy could very well be a tipping point.

The Future Of Luxury

Medium-term market growth could be driven by a number of factors, from a global growing middle class and their demand for luxury products, as well as retailers’ sudden shift to e-commerce. While analysts can only rely on predictions to determine the future of personal luxury, it is clear that the industry is at a crossroads.

This article was first published on 26 May, 2020 on Visual Capitalist.

Related Articles: