Cryptocurrency is a decentralised virtual currency that is deemed to be more efficient than traditional currencies because it is regulated by a community of users.

As of 2019, the top 100 cryptocurrencies had a market value of about US$200 billion with bitcoin accounting for more than half of that amount.

Bitcoin mining, the backbone of the network, refers to the production of bitcoin or digital coin through solving complex algorithms with specialised computers. “Miners” process and confirm bitcoin transactions to be entered into the digital currency’s shared public ledger, known as a blockchain. Miners also provide security to the network. New coins are awarded to miners who complete the calculations first along with transaction fees for their services.

Specialised Industry

In December 2017, the price of bitcoin hit US$17,000 per coin and the bitcoin mining industry became ever more competitive. In 2019, the value of bitcoin surged again above US$11,000 after Facebook unveiled its global cryptocurrency, Libra. It was reported recently that the virtual currency is now valued at above US$33,000 –an all-time high.

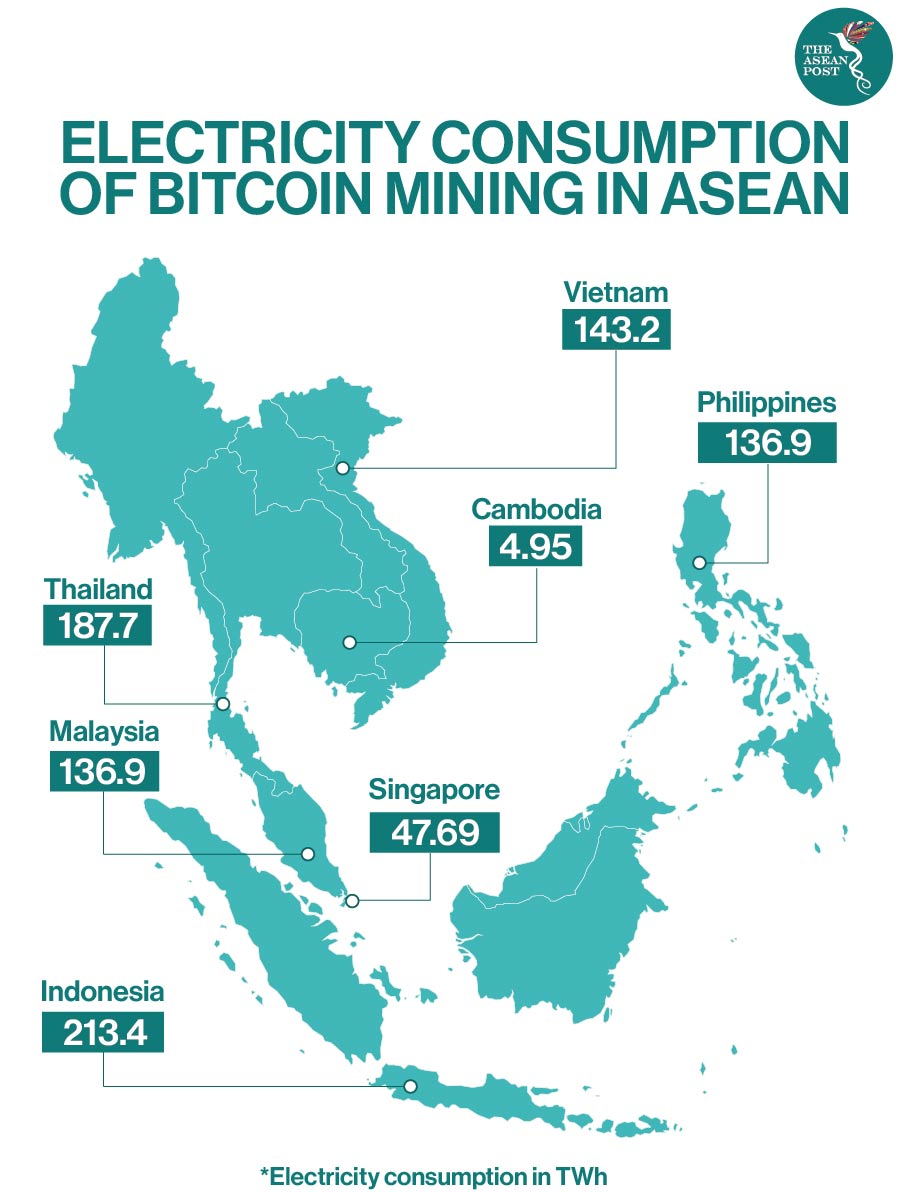

Bitcoin mining has already picked up in Southeast Asia, with Cambodia increasingly becoming a hub for cryptocurrency trading and mining perhaps due to its cheaper rent and electricity rates and loose regulations. Cambodia launched its first digital currency exchange called LockCoin in 2018.

Mining for Bitcoins is a highly specialised industry. Usually called server farms, mining digital coins require large warehouses with large numbers of linked computer units. It takes an entire server farm to mine cryptocurrency as well as massive amounts of energy to generate one coin or digital fund.

Computing power is necessary for generating new Bitcoins and carries with it an environmental cost that is rarely taken into account.

“We now have an entirely new industry that is consuming more energy per year than many countries,” said Max Krause, a researcher at the Oak Ridge Institute for Science and Education and lead author who co-wrote a study titled, “Quantification of energy and carbon costs for mining cryptocurrencies”, which was published in the 2018 Nature Sustainability journal.

In search of the internet equivalent of precious metals, people are willing to run energy-consuming farms in order to mine these coins. The total energy consumption of the Bitcoin network has grown and now consumes more energy than some countries, based on data from an online tool launched in July 2019 by the Cambridge Centre for Alternative Finance.

The tool – Cambridge Bitcoin Electricity Consumption Index (CBECI) – estimates how much energy is needed to maintain the Bitcoin network in real-time. The CBECI found that Bitcoin mining consumes more energy than the entire nation of Singapore. Based on current data from the CBECI, the global Bitcoin network is estimated to consume around 11 gigawatts (GW) of electricity.

“We wanted to spread awareness about the potential environmental costs for mining cryptocurrencies,” Krause said. “Just because you are creating a digital product, that doesn’t mean it does not consume a large amount of energy to make it.”

More Carbon Emissions

There are an unknown number of server farms around the world and the high energy consumption of Bitcoin mining comes with a significant carbon footprint. According to the Joule journal published in June 2019, the annual emission of carbon dioxide (CO2) from digital coin mining is estimated to be between 22 and 22.9 megatons.

“We do not question the efficiency gains that blockchain technology could, in certain cases, provide. However, the current debate is focused on anticipated benefits, and more attention needs to be given to costs,” warns Christian Stoll, a researcher at the University of Munich and MIT.

Stoll adds that the biggest problem is the fact that most mining facilities are located in China, which relies heavily on coal-based power, either directly or for load balancing.

Fuelling mining farms with renewable energy sources will lessen the dependency on fossil fuels thus reducing the industry’s carbon footprint. Another method to reduce carbon emission is the development of more energy-efficient algorithms, like ‘proof-of-work’ or ‘proof-of-stake’. In proof-of-stake, coin owners create blocks rather than miners, eliminating both miners and their power-hungry machines in the process.

Bitcoin and the rest of the digital currency space will inevitably grow. It is however important for developers, miners and users to recognise the environmental implications of the technology.

Related Articles: