2018 was the year e-commerce established itself as one of the region’s fastest growing sectors.

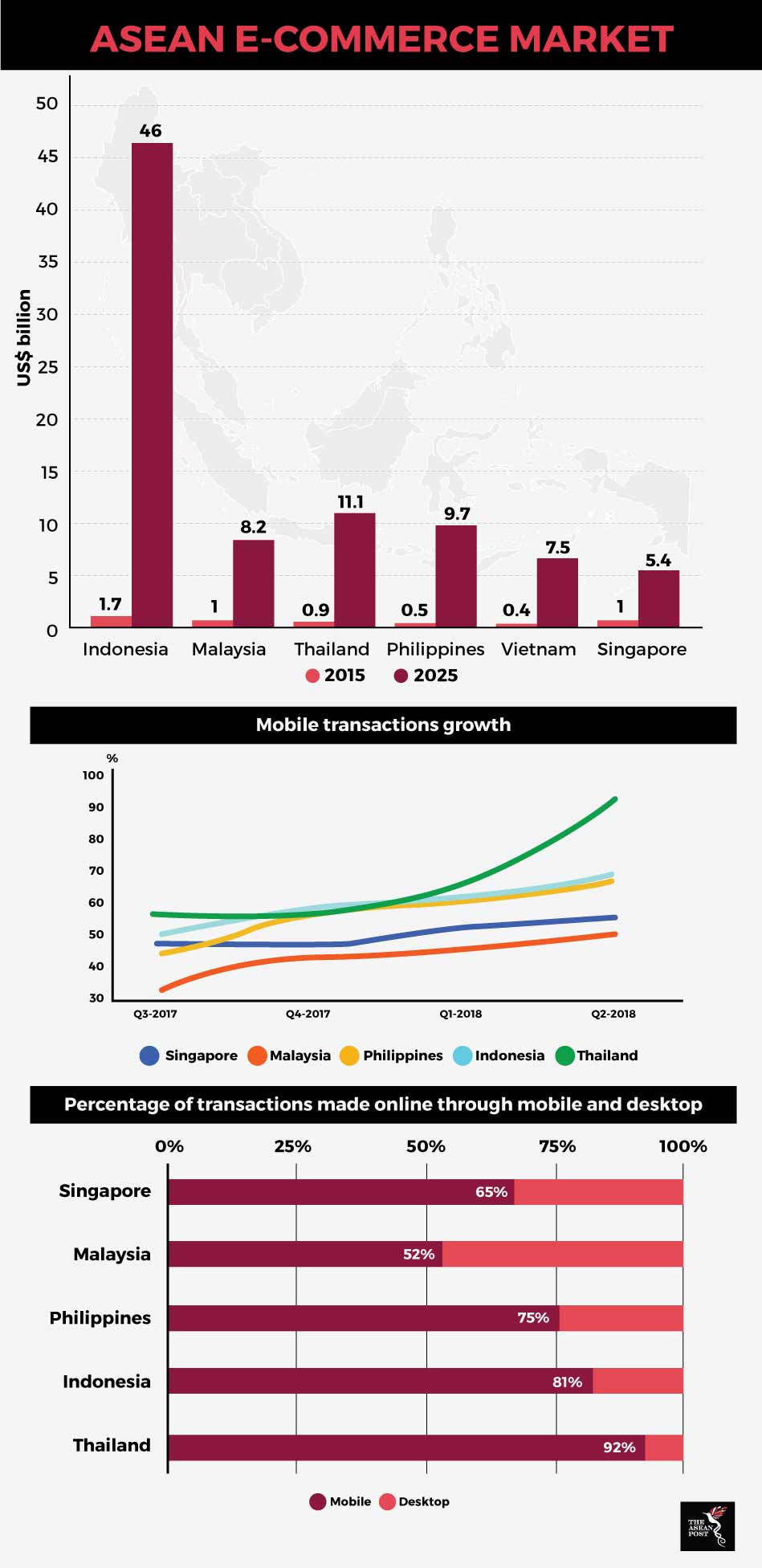

Over the past three years, it has been the most dynamic sector of the digital economy accounting for close to US$11 billion in gross merchandise value (GMV) in 2017, exceeding US$23 billion in 2018. By comparison, in 2015, the sector’s size was only US$5.5 billion and the quadrupling since then represents a 62 percent compound annual growth rate (CAGR) over the period.

Among the main drivers of the rise in the e-commerce sector for the region is the presence of shopping portals like Alibaba-owned Lazada, Shopee and Tokopedia. Collectively, they have grown more than seven times in size since 2015, well eclipsing other players in the sector.

The sheer power these websites have over users is exemplified in Lazada’s 11.11 Singles Day Sale held in all six countries it operates in: Singapore, Malaysia, Thailand, Indonesia, the Philippines and Vietnam last year. According to Lazada, more than 20 million consumers browsed and shopped on Singles Day. Lazada Malaysia reported that it surpassed its 2017 sales record in under just nine hours. Lazada Malaysia also said that over 3,000 transactions per minute were carried out on the website.

It has been said that one of the biggest reasons online shopping has been so popular in the region is because of the growing middle class. A growing middle class means more disposable income which results in an increase in consumer spending. Coupled with a young population and an ever-increasing internet penetration rate, it is no wonder e-commerce sales are going through the roof in Southeast Asia.

Source: Various

Source: Various

E-commerce in 2019

With e-commerce continuously reaping record profits, the sector will play a valuable role in the region’s digital economy. In a joint study by Google and Temasek, Southeast Asia’s internet economy is slated to be worth more than US$240 billion by 2025, US$40 billion more than what was first projected in 2018. By 2025, e-commerce is predicted to be worth US$102 billion – making up more than 40 percent of the total worth of the region’s internet economy,

As e-commerce continues to grow, it is expected that governments in Southeast Asia will want a slice of the pie. Several governments have already mulled the idea of taxing e-commerce transactions in 2018 and it will not be surprising if it comes to fruition this year.

Thailand has already done it last year by charging a value added tax on e-commerce purchases. In Indonesia, the government requires online merchants to own tax identification numbers. Surprisingly, Singapore has yet to announce a digital tax or a tax on e-commerce but some observers believe that it is only a matter of when and not if. There was speculation that a tax on e-commerce would be announced in the island state’s budget last year but that did not materialise.

Some may argue that a digital tax or a tax on e-commerce could harm the sector, saying that it could scare off new e-commerce start-ups or entrepreneurs that want to sell their items online.

Competition between the big e-commerce companies is also expected to heat up in the coming year. Players such as Lazada, Shopee and others will vie for leadership in all the markets in the region.

As such, we will also see expansion from metro cities to second-tier cities and rural regions where e-commerce penetration is low for now. These places provide the highest growth prospects in terms of expanding e-commerce consumer bases.

With established companies continuing to dominate the e-commerce market, some analysts are concerned that it could lead to a monopoly ala Amazon in the United States. Companies such as Lazada and Shopee are giants in the game and have large sums of capital to spend on capturing different markets compared to fledgling local start-ups. This could discourage local start-ups from entering the e-commerce marketplace which could then lead to a stagnating sector.

Related articles: