Perhaps one of the most widely discussed challenges that comes with a growing global e-commerce sector is the challenge of taxing that industry. Simon Woodside of the Organisation for Economic Co-operation and Development’s (OECD) Fiscal Affairs division noted that there were technical issues regarding taxing online businesses including the right of a state to tax the profits of an enterprise of another state, how international transactions should be treated, and how to collect tax on a product that is delivered online.

For ASEAN and particularly Indonesia, these challenges will present serious repercussions – not to mention a serious blow to revenue collected from tax - if left undealt with. Research has indicated that the e-commerce market will continue to grow by leaps and bounds in the region.

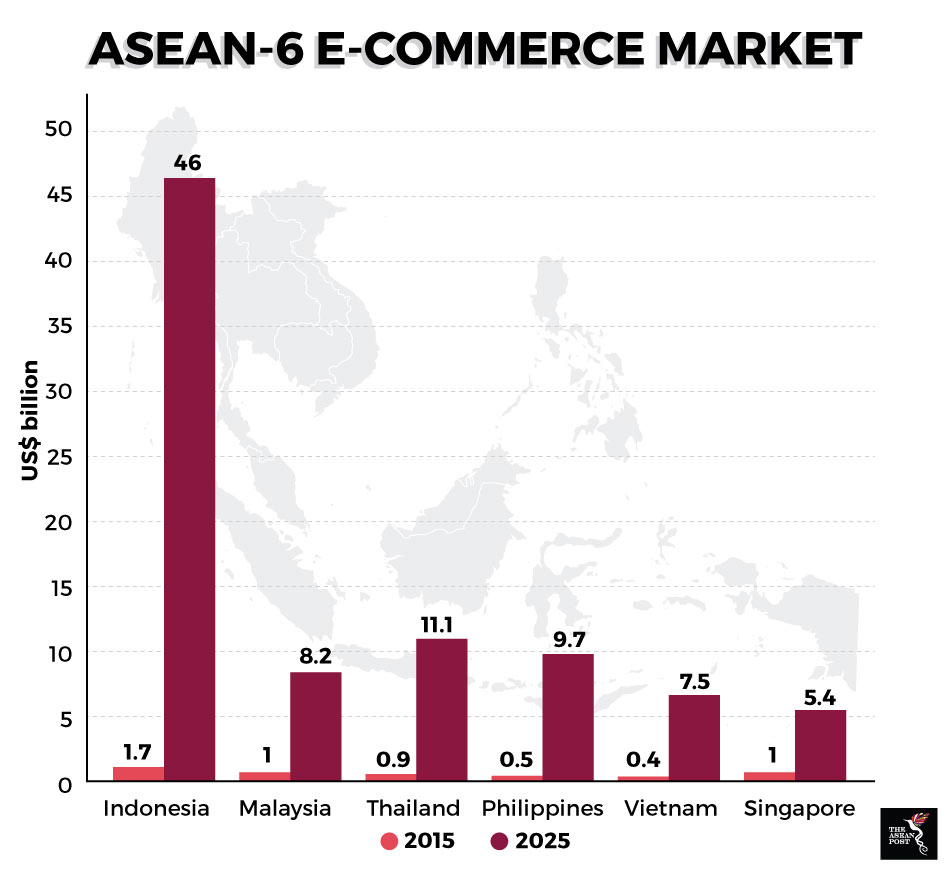

According to a 2016 report by Google and Temasek, Indonesia’s e-commerce market will grow to US$46 billion in 2025, followed by Thailand at US$11.1 billion, the Philippines at US$9.7 billion, Malaysia at US$8.2 billion, Vietnam at US$7.5 billion and Singapore at US$5.4 billion.

A more recent report by McKinsey and Co estimates an even bigger share for Indonesia with online commerce sales in the country growing by as much as US$65 billion in 2022 from US$8 billion in 2017.

Source: Google and Temasek

Tax evasion

In September, Indonesia and Singapore began exchanging financial data on taxpayers with the intention to crack down on tax evasion. Towards that same end, Indonesia joined the global treaty on the Automatic Exchange of Information (AEOI) on tax matters. This enables tax auditors to check with tax authorities in 101 jurisdictions including Singapore, Hong Kong, and Belgium to find out whether Indonesian taxpayers are paying their income tax.

The move is integral as Indonesia’s Finance Ministry suspects that many high-net worth Indonesians have not come forward and that they still have a large amount of assets overseas. Consulting company McKinsey, for example, estimated that the real amount of assets parked overseas by rich Indonesians to be valued at US$250 billion.

The Center for Indonesia Taxation Analysis (CITA) has estimated that last year’s tax audit coverage was a mere 0.39 percent of the 1.9 million registered individual taxpayers, excluding employees whose income taxes are withheld by their employers. This ratio is far below the three to five percent the International Monetary Fund (IMF) has set as the minimum tax audit coverage necessary to enhance voluntary tax compliance and discourage tax evasion.

Indonesia’s solution

In order to address taxation issues involving e-commerce, Indonesia has plans to require online merchants to own tax identification numbers beginning this year. The country hopes that this will boost revenue as well as improve compliance in the fast-growing e-commerce industry.

Among Indonesian e-commerce companies which will begin asking sellers for identification numbers are PT Tokopedia and PT Bukalapak.com. This will be the condition they set for sellers who wish to operate on their platforms. Indonesia’s Finance Ministry director general of taxes, Robert Pakpahan said these platforms will submit a monthly report of transactions to the government.

“We want to improve tax enforcement but we don’t want to scare start-ups. Instead of the start-ups collecting taxes, their merchants will perform self-assessment on the arrears,” he said.

Although the government will be clamping down hard on tax evasion, Pakpahan’s assertion that it does not want to scare away start-ups rings true as starting July, the government lowered the final income tax for micro, small and medium enterprises to 0.5 percent from one percent, and gave a transition period of as long as seven years before imposing normal rates. Proving that the country is indeed going after the big guns.

Tax evasion may have grown with globalisation and the boom of online businesses but Indonesia seems to be taking the correct approach in clamping down on tax evasion while providing enough leeway to not chase away smaller businesses and those interested in entrepreneurship. As ASEAN becomes increasingly digitised, the key for governments seems to be a good balance between enforcement and encouragement.

Related articles:

Indonesia’s e-commerce success story

Are e-commerce taxes materialising on the Southeast Asian horizon?