In the not so distant future, cross border transfer of money can be done with a few taps on your smartphone. Cash stored in virtual wallets and accessible via a secure smartphone application would make physical currency obsolete, while paving the way for digital cryptocurrencies. Such advancements fall under the wider web of financial technology or fintech for short.

The fintech sector in Southeast Asia is currently facing a boom. A myriad of applications that aim to ease payments, money transfers and banking services are now readily available, with many more ideas still in the works.

However, with this boom, comes the issue of regulation. As the fintech wave continues to revolutionise the way we live, governments are now looking to ensure that fintech startups and financial institutions have a space to experiment and err on the side of caution.

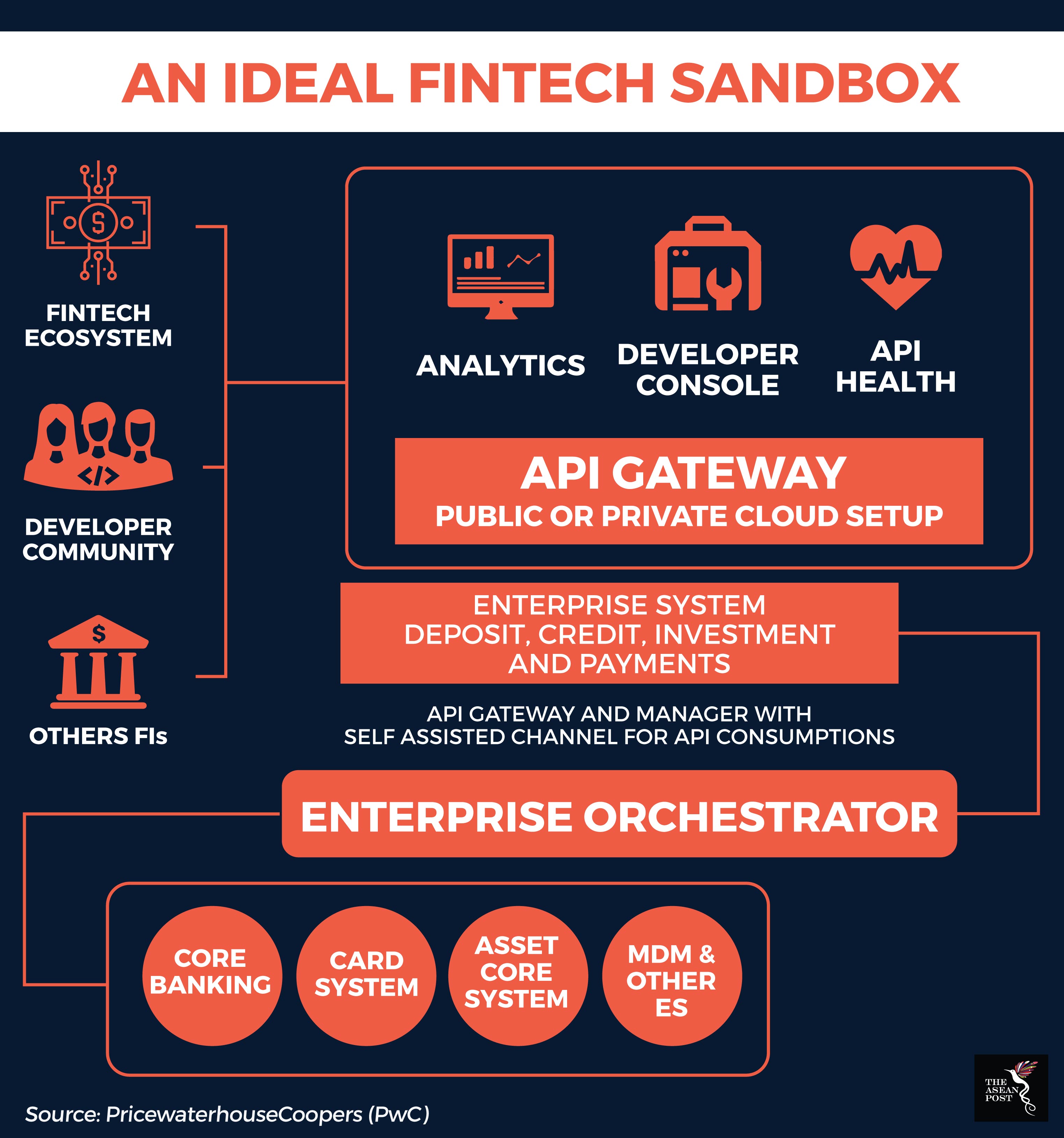

This playground to test their fintech innovations is called a fintech sandbox.

Leading the way

Singapore, Malaysia and Thailand have been the three most advanced nations in terms of fintech regulatory sandboxes in this region.

The Lion City launched its sandbox in June 2016. Specific legal and regulatory laws are relaxed for sandbox entities for the duration of their sandbox experimentation. Besides that, the technologies developed are also expected to be deployable in a broader scale within Singapore.

According to the official website of the Monetary Authority of Singapore (MAS), it currently has three active sandbox entities. They are, Kristal Advisors – an artificial intelligence (AI) driven fund management platform, Thin Margin – an online money changing service and FriendTransfer – a digital remittance service provider. So far, one insurance technology (insurtech) startup, PolicyPal – an insurance mobile application to help manage and purchase insurance policies – has since graduated from the sandbox.

To oversee innovations in fintech, the Malaysian central bank created the Financial Technology Enabler Group (FTEG), which also manages the fintech regulatory sandbox. The sandbox allows fintech companies – even those without a presence in Malaysia – to participate in it for a testing period of not more than 12 months.

According to Aznan Abdul Aziz, Chairman of FTEG, the sandbox serves as “…an important regulatory tool for the bank to spur innovation in the financial sector.”

“It signifies the bank’s commitment to improving the quality, efficiency and accessibility of financial services in Malaysia through a progressive and responsive regulatory approach that unlocks the value of technological developments,” he added.

Thus far, the sandbox has six approved participants involved in various sub sectors within the finance industry including remittance services, e-payment, insurtech and financial advisory. The latest to join the sandbox was Jirnexu, Asia’s only full stack fintech solutions provider, delivering end-to-end digital acquisition tools and solutions for its clients from around the continent.

Thailand launched its fintech sandbox in December 2016. The Thai central bank approved four fintech companies to operate within the sandbox. These companies are driving innovation in the field of blockchain and biometrics identification.

The rise of insurtech has also prompted the Thai Office of the Insurance Committee (OIC) to develop an industry specific sandbox. The insurtech sandbox was launched in June 2017, to further develop digital insurance solutions in the country.

Fresh to the game

In late 2017, the Indonesian central bank introduced its fintech sandbox which will allow fintech players to test their services for six months under the regulatory eyes of the central bank. According to KPMG, Indonesia is home to more than 300,000 active users of e-wallets, prompting the central bank to better regulate fintech services for fear that it may cause systemic risks to the prevailing financial system.

Brunei is also looking to break into the fintech scene, in particular, Islamic fintech. Developments in Islamic finance there has drawn international recognition. Hence, Brunei is better placed to fully utilise its potential in Islamic finance disruption. It is already in talks with South Korean cyber-security company KTB Solution for tentative areas of collaboration.

Fintech is set to take the world by storm, hence governments must be better prepared to synergise this disruption with the prevailing financial system. Regulatory sandboxes are an excellent way of doing so, and Southeast Asian governments should be quick to design and operate sandboxes or risk losing out in the long term.

Recommended stories: