The e-commerce market in Southeast Asia is expected to be worth US$200 billion by 2025, according to a 2017 report jointly produced by Google and Temasek Holdings.

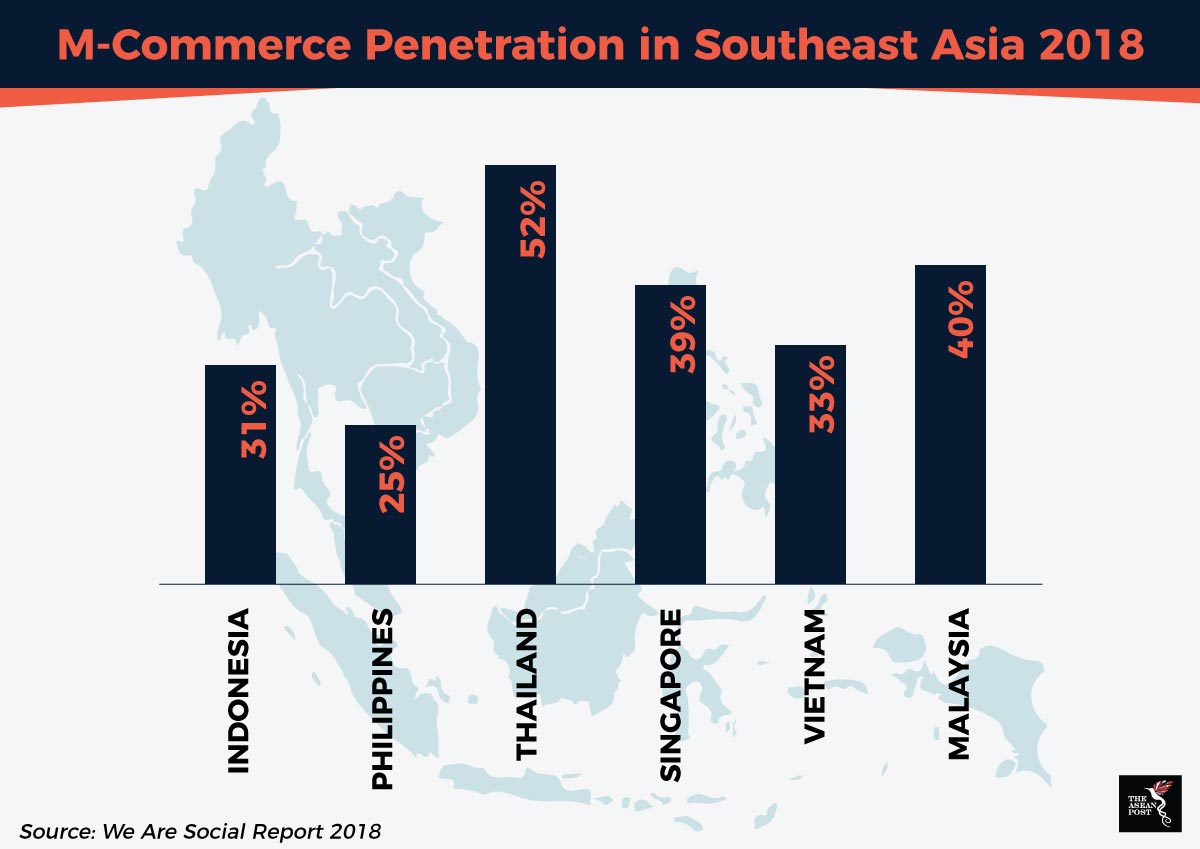

Meanwhile mobile commerce is expected to ride on e-commerce growth as smartphone users account for more than 90% of Southeast Asian internet users, according to the same report. Mobile commerce penetration was at 58% in Thailand, 40% in Malaysia, 39% in Singapore, 33% in Vietnam, 31% in Indonesia, and 25% in Philippines as of January, 2018.

Mobile commerce, or m-commerce refers to the buying and selling of goods and services over the internet using mobile phones, according to the Financial Times’ Lexicon.

The Google-Temasek report also states that the highest growth in mobile commerce was seen in ride-hailing services, with gross merchandise volume expected to grow to US$20.1 billion by 2025.

Leveraging on their market share, ride-hailing providers have also expanded into other market segments such as digital payments and food delivery. Malaysia’s Grab, for instance, now has GrabFood and GrabPay, while Indonesia’s Go-Jek recently received an undisclosed investment from Google to further expand its digital payments system. Go-Jek acquired three fintech firms – Kartuku, Mapan and Midtrans - in 2017 to include third party services into its payments system.

Market demand for digital payments jumped by 161 times in 2017, while demand for food delivery services increased 22 times that same year, according to the Google-Temasek report.

Smartphone transactions comprised 73% of m-commerce transactions in 2016, compared to just 27% for tablets.

Southeast Asians spend an average of 3.9 hours on their smartphones per day, compared to 2.2 hours per day for people in the United States and 1.3 hours per day in Japan, according to the We Are Social Report 2018. Thailand’s smartphone usage is the highest, at 4.9 hours per day followed by Indonesia, with 4.3 hours per day.

Indonesian smartphone use is expected to grow 48.4% between 2016 and 2018, while the Philippines is expected to see a growth of 34% for smartphone growth by the end of 2018, according to market research conducted by JWT Intelligence in 2016.

Tech start-ups in the region have seen this growth as an opportunity to provide many of their services via mobile applications. These days, customers can hail a ride, order food, buy groceries and get almost everything done remotely.

Mobile commerce has also grown in tandem with the growth of digital payments platforms and better internet connectivity in Southeast Asia.

Digital payments providers are now designing their applications with better security features to help their customers overcome payment concerns. About 64.4% out of 1,067 Malaysians surveyed in 2017 by the Malaysian Communications & Multimedia Commission (MCMC) reported that they did not shop online because of concerns over the security of their data.

Malaysia was already seeing an increase in mobile online transactions from 2 million transactions in January 2017 to 3.5 million transactions in December 2017, according to Chan Kok Leong, executive director of Malaysian digital payments provider, iPay88.

According to him, more creative payment applications have also been designed to enhance the mobile user experience. These creative applications employ a combination of retail customer intelligence, social media, and location services, to better improve the payment experience.

Worldpay’s Global Payments Report in 2017 recommends that m-commerce platforms offer seamless checkout processes and loyalty benefits to grow m-commerce trade. It predicts 33% growth in Singapore mobile commerce markets over the next five years.

In terms of mobile internet connectivity, Singapore scored 83.42 out of 100 points as of 2018 against the GSMA Mobile Connectivity Index, which factors infrastructure, affordability, content and internet user skills in its formula.

Meanwhile Malaysia scored 69.85, Thailand 68.05, Vietnam 59.65, Indonesia 52.71 and the Philippines 59.97 on the index. The country with the highest mobile connectivity index score in the world is Australia, with an index score of 87.29.

Mobile commerce is set to keep growing at a phenomenal rate as smartphone ownership in the region increases. However, mobile commerce players in this space need to ensure that they have an eye on what their customers really want. In order to grow consumer confidence and for long term success, they have to ensure that essential things like watertight security for online payments, an engaging user experience and localised services and content are put in place first.

Recommended stories: