New technologies are helping Indonesia tap into its huge potential in aquaculture and cement its position as one of the world’s top aquaculture nations.

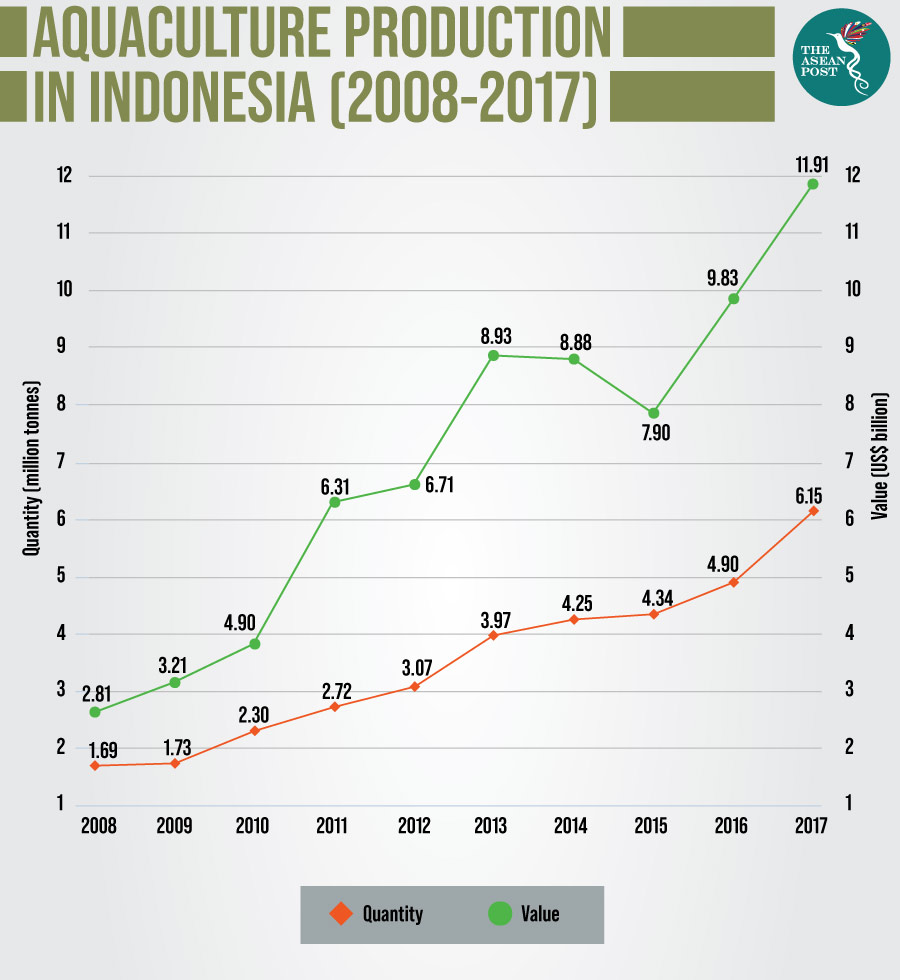

Indonesia’s aquaculture sector has enjoyed strong growth over the past decade and the country’s 6.2 million metric tonnes in 2017 placed it behind only China and India in terms of output.

While marine capture fisheries production grew around 34 percent from 2008 to 2017, growth in Indonesia’s aquaculture sector exploded by 264 percent during the same period according to data from the United Nations Food and Agriculture Organisation (FAO).

Increase productivity

Around 3.3 million people are directly employed in Indonesia’s aquaculture industry, but 80 percent of all fish producers and 70 percent of all shrimp producers are smallholders who use manual methods, highlighting the sector’s massive promise.

Aquaculture is expected to provide close to two-thirds of global food fish consumption by 2030, and ensuring that effective technology tools such as data analytics and the Internet of Things (IoT) are in place will help maintain the industry’s sustainability and continued growth.

Although Indonesia has about 26 million hectares of coastal land which is suitable for aquaculture expansion, much of it includes ecologically sensitive mangrove and coral reef habitats.

Apart from having high biodiversity value and playing a vital role in climate change resilience, these coastal lands provide critical ecosystem services that are the foundation of economic sectors such as fisheries and tourism. The greatest economic returns are likely to be achieved through the implementation of more productive processes on existing farms as opposed to launching new ones.

Smart feeding system

Start-ups such as eFishery, which markets itself as the first ‘fishtech’ start-up in Indonesia, are helping to provide farmers with the right tools they need to get the most out of their fish farms. Founded in 2013, eFishery provides an IoT automatic feeding system which allows farmers to monitor and schedule feeding times.

The feeding system’s in-water vibration-based sensor, combined with machine learning, detects and determines the appetite of the fish to avoid overfeeding or underfeeding and releases the optimal amount of feed.

Fish feeding accounts for 60 to 90 percent of total production costs in commercial aquaculture and is primarily done using hand-feeding methods. These methods often result in underfeeding or overfeeding – which then leads to malnourishment, feed wastage and negative environmental impact.

“eFishery’s Smart Feeder has shortened our harvest cycles and improved our water quality. Our feeds are always in great nutritious condition since they are on top of the water for a much shorter period of time before being eaten,” said Rio Albab, a shrimp farmer from Karawang, West Java.

“My pond’s feed conversion ratio has improved significantly (and) the shrimp sizes have evened out because the Smart Feeder distributes the feeds more evenly,” he added.

Rio is just one of the over 1,300 fish and shrimp farmers in the country who are using eFishery’s solution across 3,000 ponds. On average, these farmers have reported an increase in profits of over 20 percent.

Another start-up, Jala, provides IoT devices that monitor the quality of pond water in shrimp ponds. This data can be accessed online in real-time, and reliable analysis on water parameters is then provided for farmers to effectively manage and treat their ponds – thus minimising the risk of harvest failure.

Investors prioritising technology

Start-ups such as Aruna serve as an e-commerce platform for farmers and allows them to sell their produce directly to wholesale buyers, while online fundraising sites and peer-to-peer (P2P) lending platforms such as Growpal and IWAK are also increasingly gaining prominence as viable ways to attract investors.

Investors, meanwhile, are increasingly looking at farms which adopt farm data management tools to reduce risk – and if records exist – for investors to assess the risk level of a business more accurately.

In a report released last year titled ‘Investment Guideline for Sustainable Aquaculture in Indonesia’, Indonesian non-government organisation (NGO) Yayasan Inisiatif Dagang Hijau advised potential investors to prioritise businesses which adopt water quality sensors to increase their control over water quality and automatic (preferably IT-based) feeding units as a way to reduce overfeeding and to calculate the break-even point.

Imaging-based assessments on the size and characteristics of the stock are also other crucial elements investors have been told to prioritise when deciding which companies to invest in.

Global fish stock is on the decline thanks to overfishing, and the world’s fisheries haul plunged by two million tonnes from 2015 to 2016 alone.

With its strong track record as a major exporter to global markets, the digitalisation of Indonesian aquaculture will have a vital role to play in satisfying the seafood needs of ASEAN and beyond.

Related articles:

Vietnam’s shrimp exports at risk