On the first anniversary of the Muhyiddin Yassin administration, the stage is set for the next lap of Malaysia’s economic development which would include a continuing reliance on foreign direct investment (FDI).

Prime Minister Muhyiddin Yassin has said that Malaysia continues to attract foreign direct investment (FDI), including Fortune 500 companies. This is due, not least, to the incentives that the government is offering with emphasis on the high technology and digital sectors.

For example, under the National Economic Recovery Plan (PENJANA) last year, in an effort to boost investment activities, business-friendly initiatives were crafted such as a 10 to 15-year tax exemption for new FDI in the manufacturing sector with capital investment of RM300 million (US$72.8 million) or more.

Other pro-FDI policies include the setting up of the Project Acceleration and Coordination Unit (PACU) – under the Malaysian Investment Development Authority (MIDA) which in turn comes under the purview of the Ministry of International Trade & Industry (MITI) – last year to provide end-to-end facilitation for all projects approved by the National Committee of Investment (NCI) and, therefore, ensures acceleration of the process from approvals of the projects to implementation.

In his first anniversary address, the Prime Minister also publicised that the manufacturing sector attracted most of the approved investments for the first three quarters of 2020 – which account for more than half of investments worth at 59.5 percent of RM65.3 billion (US$15.8 billion), followed by services and other primary sectors. During the period, 2,935 projects were involved with 64,701 jobs created.

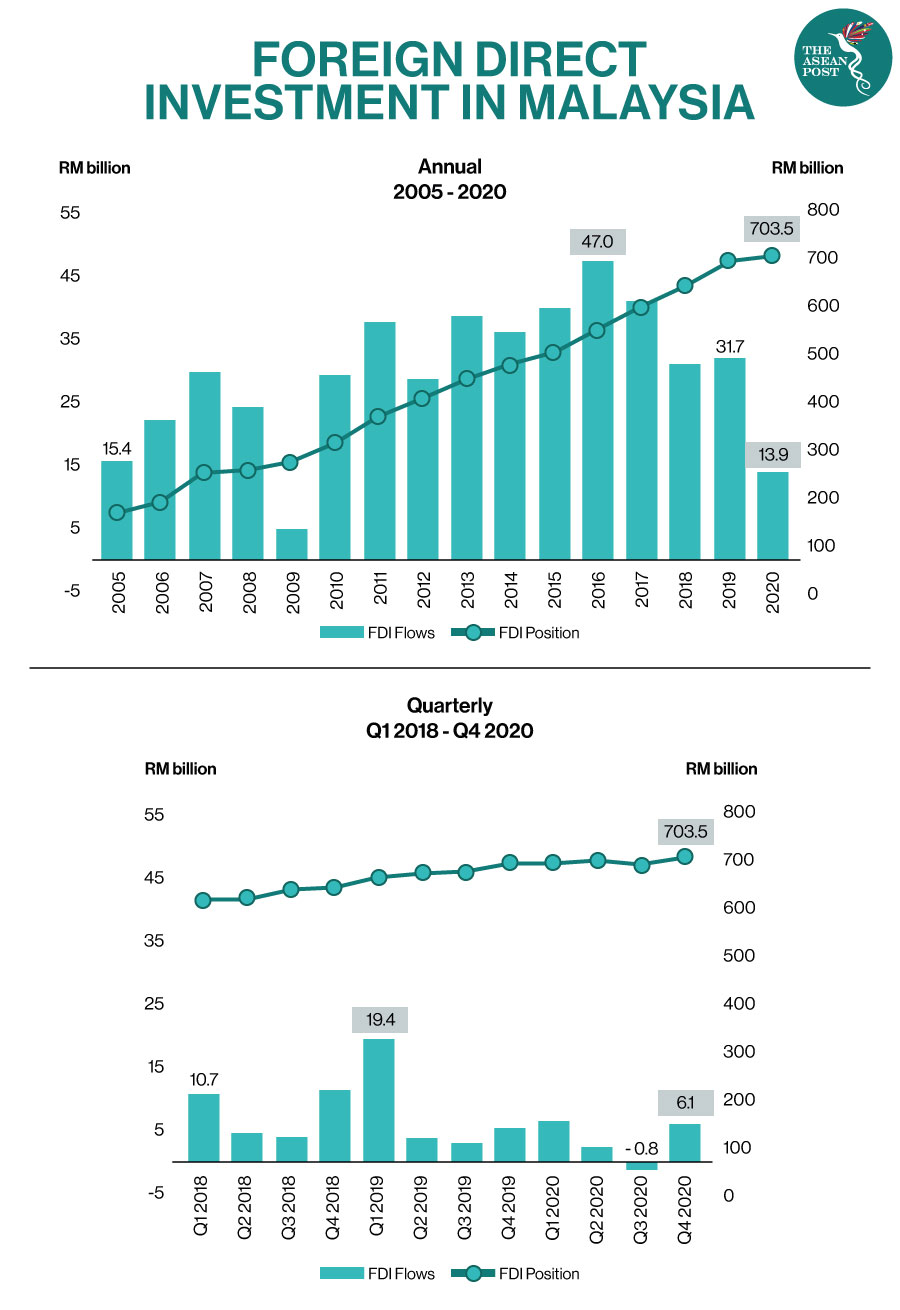

In commenting and clarifying on the state of FDI in Malaysia under the onset of COVID-19, i.e., for the year 2020, MIDA in its Malaysian Investment Performance Report (2020) referenced the total gross FDI inflow figures for the year from the Department of Statistics Malaysia (DOSM) as valued at RM139.9 billion (US$33.9 billion) compared to RM138.8 billion (US$33.7 billion) in 2019 – an increase of 0.8 percent.

As the Report notes, this is despite the “movement control order (MCO) and recovery movement control order (RMCO) in the second and third quarters of last year, respectively”.

Furthermore, “[t]he decline in net FDI flows mirrors the situation Malaysia experienced in 2009 after the subprime crisis in the United States (US). [Multinational corporations] in Malaysia were repatriating higher amounts of their profits for loan repayments and retaining earnings to help their [headquarters] and affiliates faced with financial difficulties”.

The country’s FDI-oriented policies are aligned with the MyDigital initiative via the Malaysia Digital Economy Blueprint launched on 19 February by the Prime Minister – which aspires to enable Malaysia to be a “high-value-added economy and a net exporter of home-grown technologies and digital solutions”.

The Malaysia Digital Economy Blueprint: MyDigital sets out the strategic roadmap that will be implemented in three phases until 2030. The initiative complements the 12th Malaysia Plan (12MP) and the Shared Prosperity Vision/SPV (2030).

Towards that end, in providing the requisite and conducive ecosystem in its capacity as enabler and catalyser, the government is committed to:

a) Investing RM21 billion (US$5.1 billion) through the National Digital Network (JENDELA) over the next five years;

b) Investing RM15 billion (US$3.6 billion) to roll out 5G nationwide over a period of 10 years;

c) Paving the way for a RM1.65 billion (US$400.7 million) FDI and domestic direct investment (DDI) by telecommunications companies to strengthen connectivity to the international submarine cable network until 2023; as well as

d) Providing the necessary support so that between RM12 billion (US$2.9 billion) and RM15 billion (US$3.6 billion) will be invested by cloud service provider (CSP) companies over the next five years.

As reported in local media, the digital economy is expected to make up 22.6 percent of Malaysia’s gross domestic product (GDP) and create 500,000 jobs by 2025.

Pro-active direct State intervention in the economy in the form of investment and fiscal measures on the one hand and increasing DDI on the other bodes well for a climate of continuing flows of FDI into Malaysia.

Going forward, Malaysia needs to reconceptualise and reframe its FDI in a slightly fresh direction that preserves both “quality” and “quantity” of the inflows.

Firstly, the country needs to leverage on its competitive advantage in so-called “non-economic” investments such as aerospace. This requires close strategic cooperation, collaboration and coordination between the federal and state governments – as the state of Selangor is a leading regional hub for the aircraft maintenance, repair and overhaul (MRO) as well as the manufacturing and engineering and design sub-sectors.

Last year, the Selangor Darul Ehsan Aerospace Industry Coordination Office or S-DAICO which is also the secretariat for the Selangor Aerospace Council chaired by the Menteri Besar (Chief Minister) was formed with the view of executing the Selangor Aerospace Action Plan 2020-2030, among others.

At the federal level, the National Aerospace Industry Coordinating Office (NAICO) was established in August 2015 under MITI to primarily oversee the implementation of the strategies and initiatives in the Malaysia Aerospace Industry Blueprint (2030).

In this regard, traditional investors such as the US continue to play a pivotal and key role. For example, as mentioned in a 2011 scholarly article by Khadijah Md Khalid in the Asian Survey journal titled, “Malaysia’s Foreign Policy under Najib: A Comparison with Mahathir”, Composites Technology Research Malaysia (CTRM) and US-based Goodrich Corporation entered into a strategic partnership in 2009 which “enables the former to manufacture nacelle components (the enclosed part of an airplane) in the next two decades.

The contracts were valued at US$135 million for the next five years. The period of the contracts is the lifespan of the aircraft, and CTRM project contracts are valued at US$1.5 billion over 20 years”.

The Prime Minister in his first anniversary speech also noted that aerospace will be a key driver of growth even as we are shifting towards a green economy at the same time. With green technology and the Fourth industrial Revolution (4IR) in full swing, both aerospace and the green economy can converge and coalesce in the future.

Secondly, Malaysia needs to leverage on its position within ASEAN (Association of Southeast Asian Nations) to be an important gateway and “first-stop” destination for FDI to the rest of the region. And not least the wider Regional Comprehensive Economic Partnership (RCEP) trade agreement involving ASEAN plus Five, i.e., Australia, China, Japan, Korea and New Zealand which is to be ratified by Malaysia this year.

The country’s historical ties with the United Kingdom (UK) fresh from Brexit, and keen to foster and forge new strategic and economic ties with Commonwealth countries augurs well for Malaysia. The UK is looking to renew foreign economic diplomacy that was affected during the Mahathir-Thatcher era.

Elizabeth Truss, UK’s Secretary of State for International Trade has expressed the country’s commitment to supporting ASEAN’s economic ambitions embodied in the signing of the UK-ASEAN economic and digital partnership last November. It’s vital, hence, for Malaysia to play its part in stepping up the implementation of the ASEAN Comprehensive Investment Agreement (2012) to ensure that relocation of FDI in one member-country will benefit the original host country via production network linkages and integrated supply chains.

The ASEAN Comprehensive Recovery Framework (ACRF) which aims to “maximise the potential of the intra-ASEAN market and intensify broader economic integration” recognises the 2012 Agreement as a core instrument and mechanism.

Towards that end, Malaysia could honour the memory of former prime minister, the late Abdul Razak Hussein in his export-oriented industrialisation and pro-FDI policies at the national level, and the former Chief Minister of Penang, the late Lim Chong Eu at the state level by re-imagining free industrial/trade zones as harbingers of regional integration where ASEAN is both, an export as well as production market.

This requires re-conceptualisation of the sub-regional growth areas such as SIJORI (Singapore-Johor-Riau), IMT-GT (Indonesia-Malaysia-Thailand Growth Triangle) and the BMPGA (Brunei-Malaysia-Philippines Growth Area) as integrated free industrial/trade zones and mega-agglomeration/mega-clusters for intra-regional as well as global exports.

Malaysia’s FDI has always been built on strong and viable foundations. The ASEAN member state can be confident that for the next lap, it’ll continue to be so.

Related Articles: